Bitcoin sends the first correction signal after weeks of increase, but the upward trend remains steady due to buying pressure during price drops and important support levels.

Bitcoin sends the first price drop signal on the daily chart since early May when BTC formed a clear price decline signal on the daily chart, for the first time since early May. The candlestick pattern that appeared is a Shooting Star, which typically suggests the possibility of a reversal or weakening of the upward momentum. This signal appeared after BTC increased by 19% in 21 days, indicating that the upward momentum might be slowing down as the market shows signs of exhaustion.

According to data from CryptoQuant, the Miner Position Index (MPI) has risen to 2.78 – the highest level since November 2024. MPI measures the amount of Bitcoin that miners transfer to exchanges compared to the annual average. When this index is high, it usually signals a potential increase in selling activity from miners. Although this may create short-term selling pressure, the current MPI has not yet exceeded the threshold typically seen when the market reaches a price peak. Therefore, the long-term trend has not been significantly affected.

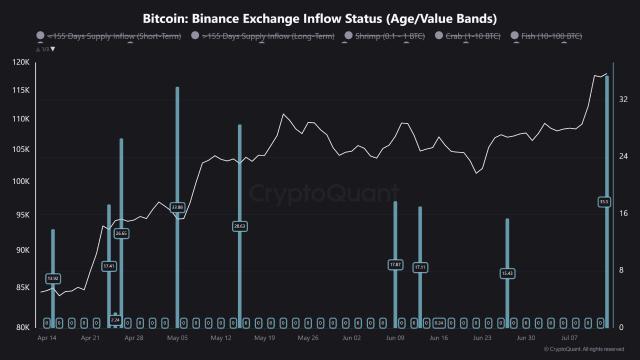

In addition to the high MPI, on-chain data shows that the profit and loss (P&L) from BTC deposits to centralized exchanges has reached an All-Time-High of $9.29 billion, reflecting strong profit-taking activities from investors.

Cryptocurrency analyst Crazzyblockk notes that these numbers are signaling a high-risk area, where short-term volatility may increase, although Bitcoin's overall upward trend remains intact. At the same time, Hyblock Capital warns that Bitcoin's open interest is approaching "saturation" levels, suggesting the market may be about to enter a correction or leverage rebalancing phase.

"Historical evidence shows that when this occurs and F&G is in the 'Extreme Greed' zone – We will see local peaks and correction waves. The bright red marks are when both conditions occur. Typically, these happen over a longer period, so don't rush to make trades immediately."

Bitcoin's recent price drop triggered a panic sell-off, with nearly 50,000 BTC sold at a loss within 24 hours, according to research by Bitcoin expert Axel Adler Jr. This strong reaction shows investors' anxiety and fear immediately after BTC dropped from recent highs.

Despite the recent drop triggering sell-offs, data shows significant buying interest from investors. Bitcoin's base cost distribution map reveals that investors have accumulated over 196,600 BTC, equivalent to more than $23 billion, in the price range from $116,000 to $118,000. This indicates that despite short-term selling reactions due to concerns, strong buying pressure has demonstrated confidence and determination in maintaining the long-term prospects of the Bitcoin market.

Technically, Bitcoin remains in a long-term upward price structure as long as the price maintains above the critical support level of $112,000. After experiencing a 19% increase, a period of sideways movement or slight correction is normal and healthy.

Although the recent candlestick pattern may signal short-term exhaustion or potential reversal, it has not eliminated the overall upward trend. As long as the main support levels around $112,000 are maintained, the possibility of Bitcoin continuing to grow remains very high.

This article does not contain investment advice or suggestions. All investment and trading activities carry risks, and readers should conduct their own research when making decisions.