Crypto Asset Trading Expert Clinton Donnelly Warns Traders to Prepare for Form 1099-DA from 2026, Allowing IRS to Track Wallet Addresses Across Multiple Blockchains.

The crypto asset trading community is facing a revolution in tax oversight as the US Internal Revenue Service (IRS) prepares to implement Form 1099-DA from 2026. Clinton Donnelly, CEO of Crypto Tax Audit and a digital asset tax expert, warns that this is not just a new form but the beginning of a fundamental change in how the IRS taxes and monitors digital assets.

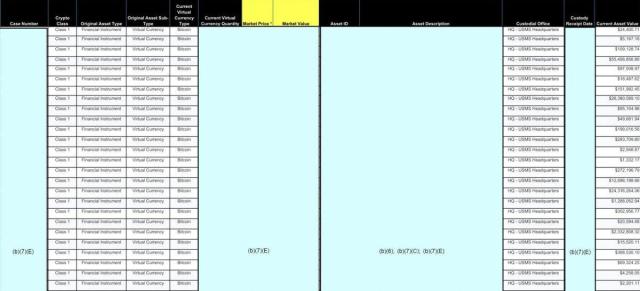

Form 1099-DA will be issued to record digital asset transactions, including crypto assets and Non-Fungible Tokens. "Brokers" such as exchanges, wallet providers, and payment processors will be required to report total revenue from sales or exchanges, capital, purchase/receipt dates, and detailed transaction details. More importantly, they will apply the FIFO accounting method on a per-wallet basis, creating an unprecedented comprehensive tracking system.

Donnelly emphasized in his post on 15/7 that "if you have sold or transferred crypto assets from a US-connected centralized exchange, you will receive Form 1099-DA". The concerning aspect is that even if assets are withdrawn from the exchange and transferred to Cold Storage, that wallet address will still be reported to the IRS, allowing the tax authority to "reconstruct your entire digital asset portfolio by linking wallets and analyzing activities across multiple blockchains".

Serious Consequences for Non-Compliance

The IRS enforcement mechanism is particularly strict. If users do not self-declare sales or transfers of crypto assets with capital, the IRS will default the entire proceeds as taxable profit and send an automatic CP2000 notice. This is a method where the IRS estimates taxes based on incomplete data, with only a 30-day response period.

The number of CP2000 notices related to crypto assets is rapidly increasing, signaling an imminent large-scale tax compliance crackdown. Donnelly warns that comprehensive declaration is "crucial", even if one disagrees with the regulations, to avoid being placed on the IRS watchlist for suspected underreporting.

Complexity will vary depending on the type of investor. Those using only one exchange like Coinbase and not transferring assets externally are in the most favorable position, as the exchange will track capital and report both transaction sides like traditional stock brokers with Form 1099-B.

However, traders using multiple platforms will face greater challenges. They need to proactively track the capital of each transaction and prepare for a much more complex tax filing process from 2026. Users may need to choose to participate in Safe Harbor to avoid retrospective recovery.