The latest FOIA response shows that the US Marshals Service only controls 28,988 BTC valued at $3.44 billion, which is much lower than the estimated 200,000 BTC.

A shocking revelation from the Freedom of Information Act response has raised questions about the actual size of the US government's bitcoin reserve. Independent journalist @L0laL33tz published on The Rage that the US Marshals Service (USMS) currently only controls 28,988 BTC, a modest number compared to the nearly 200,000 BTC previously reported by blockchain tracking tools like Arkham Intelligence.

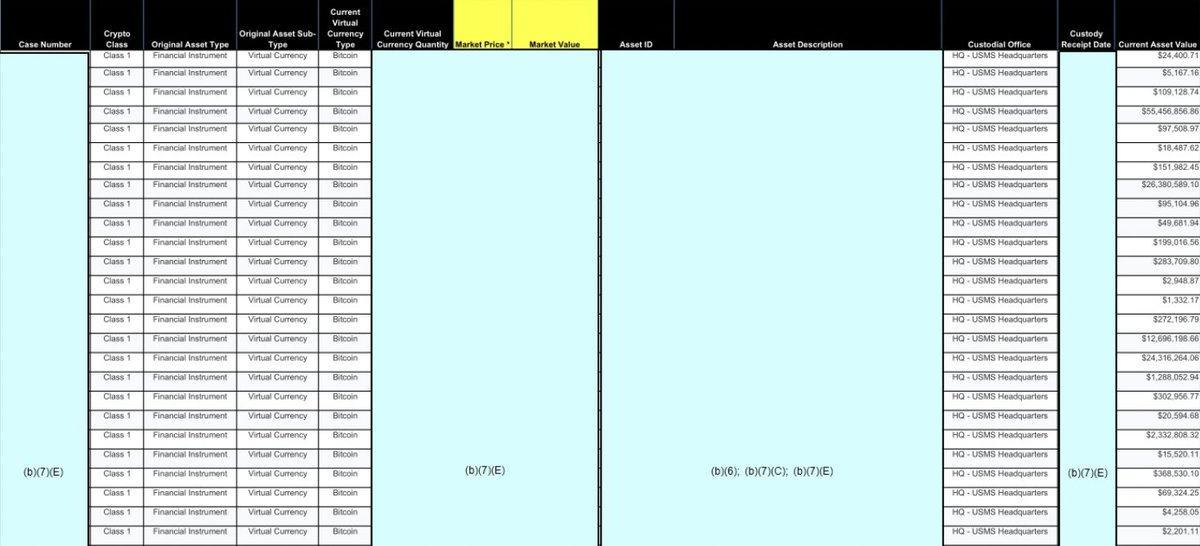

This FOIA response was submitted in March and recently released, including a list of specific bitcoin addresses held by USMS. This raises serious questions about the accuracy of previous reports and the actual location of the remaining 170,000 BTC. David Bailey, CEO of Bitcoin Magazine, who previously promised a $10,000 reward to the first journalist to get USMS to confirm the amount of crypto assets they hold, is now considering payment after requesting further verification.

Traditionally, USMS plays a central role in managing and auctioning seized crypto assets on behalf of federal agencies like the FBI, IRS, and Department of Justice. Major cases such as Silk Road, Bitfinex hack, and other cybercrime investigations have generated a significant amount of seized bitcoin. However, the figure of 29,000 BTC suggests that USMS may not be the only government repository.

Distributed System and Lack of Transparency

The reality is far more complex than the public imagines. Agencies like the FBI, IRS-Criminal Investigation, US Secret Service, and District Attorney's Office may seize bitcoin in criminal cases without necessarily transferring it immediately to USMS. Some assets may still be entangled in legal procedures or awaiting final forfeiture decisions.

More importantly, the US government has contracted third-party custodians to manage crypto assets. In 2021, Anchorage Digital was designated as the official custodian. By 2024, Coinbase had contracted with USMS to store large-cap digital assets. This means a significant portion of bitcoin may be held on these platforms rather than in USMS's direct wallet.

Bailey questioned the possibility of "internal transactions" at custodial platforms, making on-chain tracking inaccurate. He argued that tools like Arkham can only track transactions on the public blockchain and cannot detect internal movements within the custodial system.

The situation worsened when CoinDesk revealed in February that USMS cannot accurately determine the number of BTC it controls. According to Chip Borman, Vice President of Bidding Strategy at Addx Corporation, USMS is managing these assets using "manual Excel files". He warned that "just one bad day could result in billions of dollars in errors".