Bitcoin increases by 31.6% and ETF capital flow drives market capitalization up 28.2% to $3.460 trillion, despite spot trading decreasing 21.7% to $3.630 trillion due to macroeconomic instability.

The cryptocurrency market had an impressive Q2 2025 recovery after a strong correction in Q1, with total market capitalization reaching $3.460 trillion, increasing 28.2% from the previous quarter. The latest report from Token Insights on cryptocurrency exchanges shows the main momentum coming from capital inflows into ETFs and Bitcoin's spectacular breakthrough, despite macroeconomic concerns and geopolitical tensions still constraining broader participation.

Bitcoin demonstrated superior strength with a 31.6% increase in the quarter, rising from $83,000 to a peak of $111,900 and closing near $106,000. Favorable US labor data and expectations of Fed rate cuts supported positive market sentiment. However, slowing global growth and geopolitical tensions continue to hinder a comprehensive recovery.

Notably, there is a clear differentiation between trading types. Total trading volume at top centralized exchanges reached $21,600 billion, decreasing 6.2% from Q1, despite Bitcoin's significant price increase. Spot trading weakened considerably with an average daily volume of only $40 billion, dropping from $51 billion in the previous quarter, totaling $3,630 billion, a 21.7% decrease.

Derivatives dominate, exchanges expand market share

In contrast, derivative trading continued to show strength with a total volume of $20,200 billion, only slightly decreasing by 3.6%, with an average daily volume of $226 billion. In an uncertain environment, traders prioritize derivatives for risk hedging, explaining this dominance.

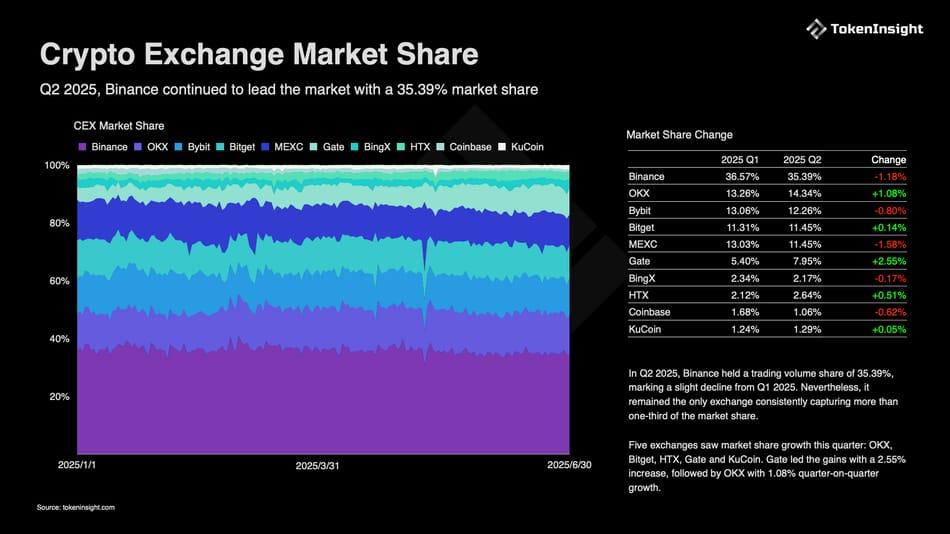

In terms of market share, Binance continues to lead with 35.4% of total trading volume, though slightly decreased from Q1. Exchanges like OKX, Bitget, HTX, Gate, and KuCoin all expanded their market share, with Gate showing the strongest increase of 2.55%. In the open derivatives contracts segment, Binance remains at the top with 23.8%, followed by growth at HTX, Bitget, and OKX.

Exchange tokens did not keep pace with Bitcoin's increase. While BTC rose 31.6%, BNB only increased 8.9%, and OKB, BGB, and KCS showed only slight increases. Other tokens even declined, reflecting the continued subdued altcoin activity as investors focus on Bitcoin.

Q3 2025 prospects suggest this trend may continue. Despite Bitcoin's clear strength, the concentration of trading volume persists. With macroeconomic instability not fully resolved, Q3 may see spot trading remain low or continue decreasing, with estimated total volume only reaching $3-3.5 trillion.

Conversely, derivatives are forecast to maintain their advantage due to their defensive role in a variable environment. Exchange token performance is likely to continue differentiating, reflecting selectively shifting capital flows between assets during an unstable market phase.