BlackRock's capital inflow into crypto asset products surges 370%, reaching $14 billion in Q2, becoming a highlight amid declining overall capital flow.

According to the Q2 2024 financial report, BlackRock, the world's largest asset manager, witnessed a spectacular growth in digital assets, despite the market's downward trend. Specifically, the capital inflow into the company's crypto ETF funds increased significantly by 366%, from $3 billion in the previous quarter to $14 billion.

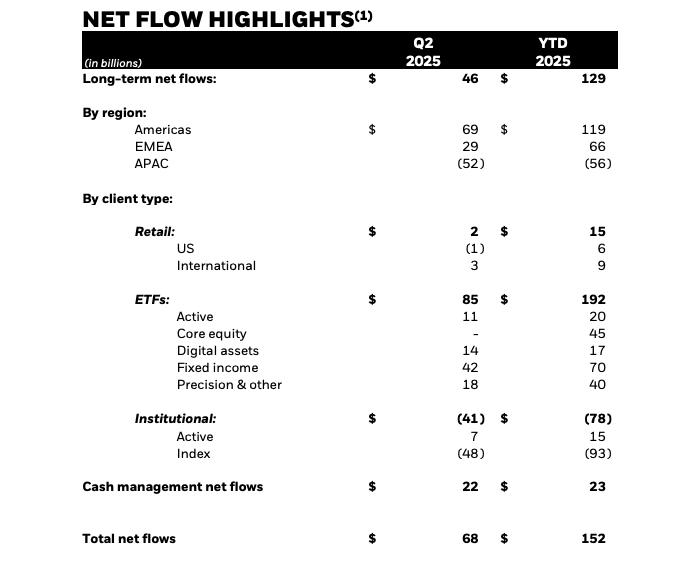

This growth has transformed digital assets from a small business segment into a primary growth driver. Crypto asset products in this quarter accounted for 16.5% of BlackRock's total $85 billion ETF capital flow, a significant increase from just 2.8% in Q1.

This is particularly impressive as BlackRock's global net Capital flow decreased by 19%, to $68 billion, due to a large $52 billion withdrawal from an institutional client.

Although the scale remains relatively small, the financial impact of digital asset products is becoming increasingly apparent. By the end of June, these products generated $40 million in base fees, accounting for about 1% of total long-term revenue but increasing by 18% from the previous quarter. "The rapid growth rate of this segment reflects the potential for larger future revenue contributions," the BlackRock report affirmed.

CEO Larry Fink emphasized that BlackRock is attracting a new, increasingly global generation of investors through products like digital asset funds. BlackRock's growth reflects the broader market trend, exemplified by the iShares Bitcoin Trust ETF (IBIT) becoming one of the fastest-successful ETFs in history.

Data from CoinShares shows that BlackRock's crypto asset product capital inflow accounts for 42% of the total $184 billion flow into global digital asset funds in the first half of 2024. The positive market environment, with Bitcoin rising 25% in Q2, created favorable conditions, further solidifying digital assets' increasingly strong position in institutional investor portfolios.