Author: TechFlow

Recently, there's an obvious trend of people starting to be bullish on Ethereum again.

From shouting "Ethereum is the oil of the digital age" to the slogan "ETH will rise to 10,000" at EthCC... What else could revive ETH?

The answer to this question might not be on the chain, but in the US stock market.

As "Bitcoin reserves" have become a new trend among US-listed companies, Ethereum reserves have become the new darling of the US stock market.

For example, last week, SharpLink announced purchasing another 7,689 ETH, making it the listed company with the most ETH reserves; its stock price (SBET) also rose nearly 30% yesterday;

BitMine (BMNR), a mining company focused on Bitcoin, recently announced a $250 million ETH asset reserve plan, intending to emulate MicroStrategy. The company's stock price has risen 16-fold in one month, with its short-term wealth effect even surpassing some meme coins.

Additionally, another US-listed Bitcoin mining company, Blockchain Technology Consensus Solutions (BTCS), followed a similar path, announcing on Tuesday a plan to raise $100 million to purchase ETH.

Upon the news, the company's stock price soared 110%.

Even more aggressive is Bit Digital, whose main business is Bitcoin mining and Ethereum staking, directly announcing a full pivot to Ethereum and selling Bitcoin, with its stock BTBT rising about 20% intraday yesterday.

These 4 enterprises are a microcosm of the US stock market's recent active embrace of the Ethereum narrative and are stars at the capital market's cutting edge.

Speculative funds have limited attention, and the market often can't remember too many latecomers, so you can see them rushing to make official announcements, seeking a clear stance and mental positioning.

We'll also analyze the similarities and differences in these companies' businesses and behind-the-scenes resources to provide some reference for players focusing on crypto-stock interactions.

"The strategy is simple: incorporate ETH into the balance sheet and then sell ETH to Wall Street... Ethereum itself has many narrative highlights, and ETH only needs someone vibrant enough to excite Wall Street".

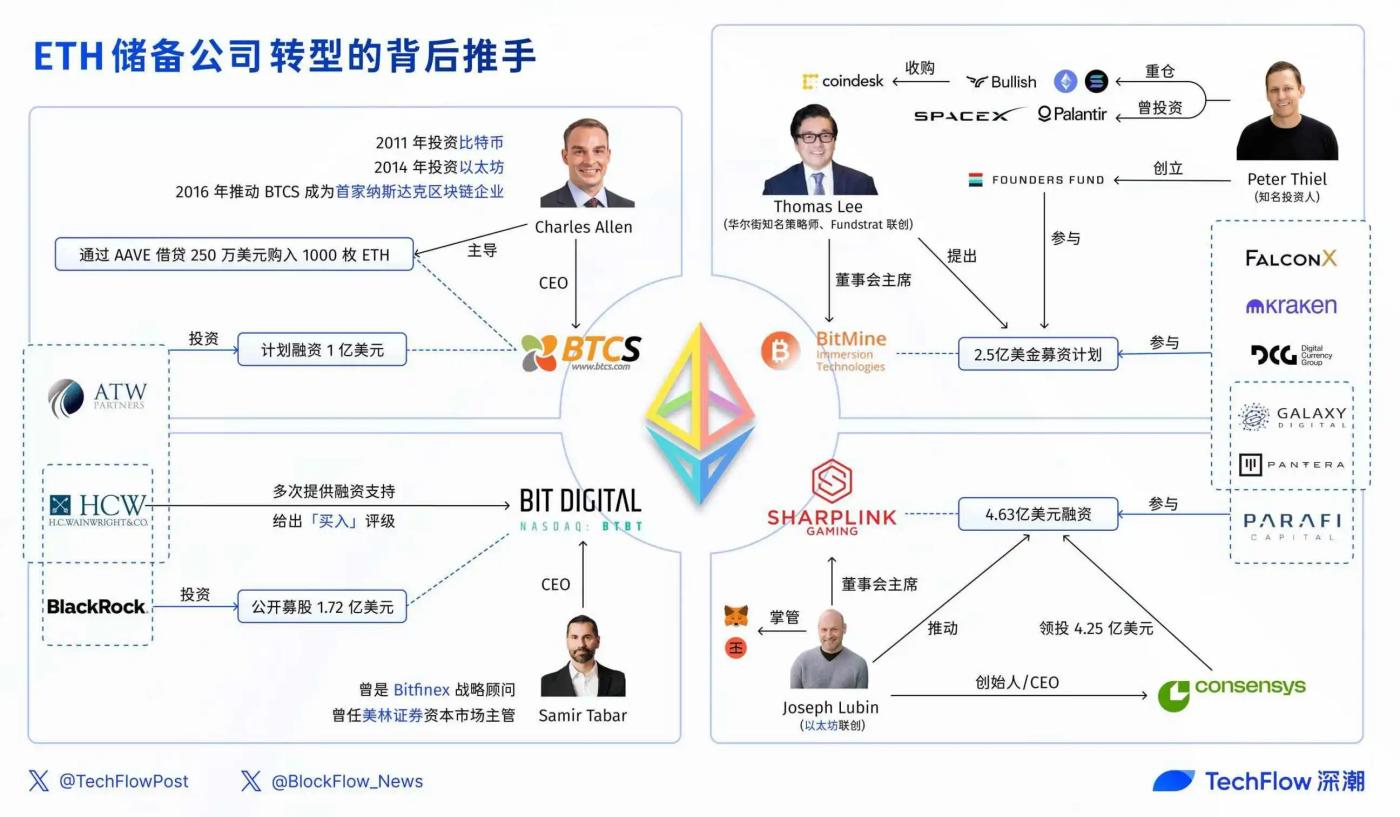

Connections and resources are linking crypto narratives into traditional capital markets. From crypto giants to investment banking behemoths, these 4 companies have different key figures behind them.

SharpLink: Ethereum Co-founder and His Crypto Gang

From near delisting to becoming the largest ETH holder, this is inseparable from Ethereum co-founder Joseph Lubin's operation.

As the founder and CEO of ConsenSys, Lubin manages critical infrastructure in the Ethereum ecosystem, such as MetaMask wallet and Infura (which handles over 50% of Ethereum transactions).

In May 2025, Lubin joined SBET's board of directors as chairman, personally driving $463 million in financing. This is also closely linked to crypto VCs who previously invested in various Ethereum ecosystem projects:

His own ConsenSys led SBET's $425 million private placement, jointly with ParaFi Capital (top DeFi VC, invested in Uniswap, Aave), Pantera Capital (early Ethereum investor, managing over $5 billion in assets), and Galaxy Digital (managing Ethereum ETF) and other institutions.

Despite community doubts about this being an Ethereum Foundation conspiracy, Lubin's connections and ConsenSys's resources undoubtedly give SBET the ability to become a pioneer in Ethereum's Wall Street transformation.

BitMine: Thomas Lee and Silicon Valley VC Collaboration

Thomas Lee, a well-known Wall Street strategist and Fundstrat co-founder famous for precise predictions, is the mastermind behind BitMine (BMNR)'s ETH reserve strategy.

Lee has been bullish on Bitcoin since 2017, predicted ETH would reach $5,000-6,000 in 2024, and announced becoming BMNR's board chairman in June 2025.

In an interview, he mentioned the reason for betting on Ethereum:

"Frankly, the real reason I chose Ethereum is the stablecoin explosion. Circle is one of the best IPOs in five years, with a 100x EBITDA multiple, bringing excellent performance to some funds... Stablecoins are the ChatGPT of the crypto world, already mainstream, evidence of Wall Street trying to 'tokenize' equity. Meanwhile, the crypto world is 'equitizing' tokens, such as tokenizing the US dollar."

He also stated on CNBC that BMNR would become the "MicroStrategy of Ethereum".

In Lee's $250 million fundraising plan for BitMine, we also see the famous Silicon Valley VC Founders Fund, founded by Peter Thiel, which has invested in SpaceX, Palantir, and started heavily investing in crypto since 2021, including Ethereum, Solana, and Bullish group, which also acquired CoinDesk.

Additionally, native crypto institutions like Pantera, FalconX, Kraken, Galaxy Digital, and DCG also participated.

Bit Digital: CEO Was Once Bitfinex Advisor

Samir Tabar is the helmsman of Bit Digital (BTBT)'s ETH reserve strategy, with a cross-industry experience from Wall Street to crypto.

Tabar was Merrill Lynch's capital markets head, served as Bitfinex's strategic advisor from 2017-2018, optimizing USDT's transaction flow on the Ethereum network, and joined Bit Digital in 2021.

Tabar called Ethereum a "blue-chip asset reshaping the financial system" on CNBC, emphasizing its huge potential in stablecoin and DeFi applications. His traditional financial background and crypto experience provide more credibility for Bit Digital's transformation, and his "blue-chip asset" rhetoric also caters to the narrative of reviving Ethereum.

In June 2025, Bit Digital raised $172 million through public offering (ATM issuance) to purchase ETH; main investors include BlackRock and investment bank underwriter H.C. Wainwright, which has repeatedly provided financing for Bit Digital and reaffirmed BTBT as a "buy" rating in 2025, with a target price of $5-7.

BTCS: Utilizing AAVE Lending to Purchase ETH

Compared to the previous three, BTCS's CEO Charles Allen is relatively low-key.

However, he is also a crypto industry veteran, with blockchain experience starting from Bitcoin investment in 2011, turning to Ethereum in 2014, and promoting BTCS to become the first Nasdaq blockchain enterprise in 2016.

In June 2025, he led BTCS's action of borrowing $2.5 million through AAVE to purchase 1,000 ETH, with plans to raise $100 million in July 2025. Investors include ATW Partners and H.C. Wainwright, with the former being a New York-based hybrid venture capital/private equity firm investing in both debt and equity.

From these 4 companies, we can see commonalities:

Each company has core figures related to the crypto world, and the fundraising targets of different companies also overlap.

Crypto funds and traditional funds that previously invested in Ethereum are also behind-the-scenes players in the ETH reserve trend; the Ethereum ecosystem's capital network has extensive reach, which might also be another proof of the network's robustness.

Money never sleeps. When ETH reserve companies become the new meme stocks of 2025, companies in transformation will inevitably create a wave of wealth. Currently, this crypto stock feast is far from over.