Author: Zhang Yu and Li Xingyu from Huachuang Securities

Abstract

(I) How to view the development of the stablecoin market?

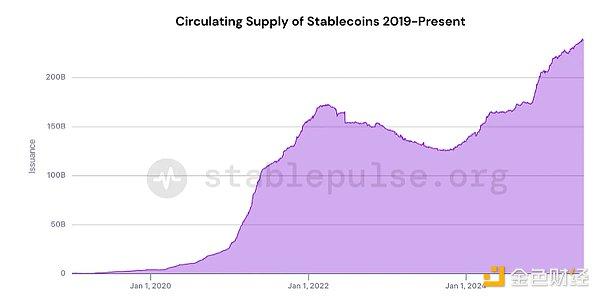

Stablecoins are digital assets designed to maintain price stability by pegging their value to reserve assets (such as the US dollar). The stability inherent in their design makes them a key tool for payment settlement and value storage in the on-chain ecosystem. Driven by rekindled institutional interest, the evolution of global regulatory frameworks, and the development of broader on-chain application scenarios, the stablecoin market is experiencing rapid transformation. According to TBAC's analysis, the stablecoin market has experienced three major events in the past 4 years: the Terra (UST) collapse in May 2022, the regional bank crisis and USDC de-pegging event in March 2023, and the gradual market recovery from 2024 to date, synchronized with the overall development of digital assets.

[The rest of the translation follows the same professional and precise approach, maintaining the original structure and technical terminology]2. The "Possibility Boundaries" of Stablecoins

Financial institutions can participate in the stablecoin market through multiple potential paths, which are highly inspiring but require internal approval and compliance with applicable legal and regulatory frameworks. Stablecoins can help unlock new business models and generate diverse business optimization and internal efficiency improvement use cases.

3. Comparison of Stablecoin Regulatory Regulations

By comparing the key features of proposed/effective stablecoin regulations in the United States, Singapore, the European Union, and Hong Kong, key regulatory conflict points can be found mainly in three aspects: 1) Liquidity of anchored assets, with the US mandating US Treasury bonds within 93 days, potentially causing short-term interest rate distortions, while Hong Kong accepts high-quality commercial paper but requires "real-time full redemption" capability; 2) Regulatory vacuum for decentralized stablecoins, with none of the four regions including algorithmic stablecoins in the first round of regulation (Hong Kong explicitly excludes them), and the US GENIUS bill directly prohibiting algorithmic models; 3) Competitive positioning of central bank digital currencies (CBDC), with the EU promoting the digital euro to hedge private stablecoins, while Hong Kong allows "digital Hong Kong dollars" to coexist with private stablecoins.

4. Development Trajectory of the Stablecoin Market

Driven by rekindled institutional interest, the evolution of global regulatory frameworks, and the development of broader on-chain application scenarios, the stablecoin market is experiencing rapid evolution. According to TBAC's analysis, the stablecoin market has experienced three major events in the past 4 years:

1) In May 2022, the Terra (UST) collapse, where algorithmic stablecoins depegged, triggered a widespread loss of confidence in the stablecoin sector;

2) In March 2023, the regional bank crisis and USDC depeg event, where Circle (USDC issuer) held approximately $3.3 billion in reserves at Silicon Valley Bank (SVB), causing a brief depeg and temporarily reducing USDC supply and usage, with USDT subsequently occupying a larger market share;

3) From 2024 to now, market activity has gradually recovered, synchronized with the overall digital asset development. 2024 is the inaugural year for US-listed cryptocurrency spot ETFs, providing investors with channels to allocate BTC and ETH through institutional-level tools. The Trump administration's policy shift has significantly reshaped market perception and acceptance of crypto opportunities and digital assets.

5. Stablecoins and Tokenized MMF

Currently, the rise of tokenized government securities is noteworthy. Tokenization refers to the process of creating a digital representation of underlying assets using blockchain technology. The rapid emergence of tokenized government securities (including money market funds MMFs) quickly validates its product-market fit—allowing investors to retain benefits from traditional securities while staying within the digital asset ecosystem.

It's worth noting that the rise of tokenized government securities is driven by three factors: 1) Exploration of DeFi and stablecoin applications in the digital asset ecosystem during low-yield cycles; 2) Participation of mature financial service providers, accelerating the development and launch of tokenized government securities and other fixed-income products; 3) Product solutions precisely matching investors' yield requirements in the digital asset ecosystem and optimizing their capital costs through instant settlement.

Although tokenized money market funds and stablecoins have similar use cases, the key difference is that under the current GENIUS bill, stablecoins are not allowed to have interest-bearing functions.

6. Outlook for Stablecoin Market Scale

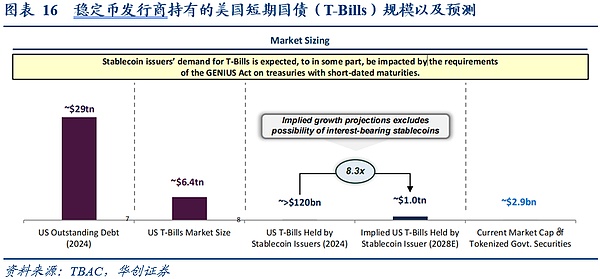

According to TBAC's prediction, with continuously evolving market dynamics, structural design, and incentive mechanisms, stablecoin growth can be accelerated, potentially reaching a market value of approximately $2 trillion by 2028.

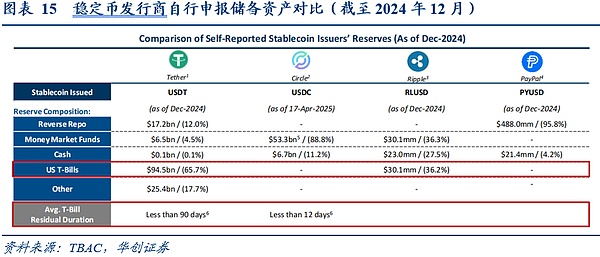

(The rest of the translation follows the same professional and precise approach)If stablecoins continue to expand exponentially, their demand for U.S. Treasury bonds will rise simultaneously, likely at the cost of bank deposit outflows - users converting fiat deposits to stablecoins, with issuers then allocating funds to U.S. Treasuries, forming a deposit transfer chain.

These market dynamic changes could be further intensified under two scenarios: a stablecoin trust crisis (such as redemption panic) triggering sell-offs; a stablecoin de-pegging event (like price deviation from 1:1 anchored exchange rate), forcing issuers to urgently sell U.S. Treasuries for redemption, triggering a spiral of risk "redemption → sell-off → yield surge → more redemption".

Given that stablecoins are expected to continue being backed by fiat assets, and tokenized money market funds (MMF) remain a preferred investment product for investors, the proportion of U.S. Treasuries (USTs) held by such issuers will likely grow positively with the overall tool scale.The demand for U.S. short-term Treasury bills (T-Bills) by stablecoin issuers is expected to be partially influenced by the policy requirements for short-term Treasury bill durations under the GENIUS Act.

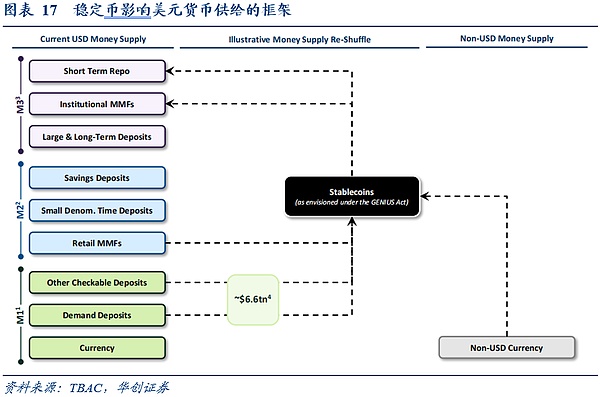

(V) How Do Stablecoins Affect Money Supply?

Stablecoin growth may lead to funds shifting from traditional bank deposits to stablecoins, especially when widely used for payments and value storage. While this may not have a net impact on total U.S. money supply, it will catalyze fund transfers from M1/M2 to stablecoins. Stablecoins may accelerate as a means of value storage and a channel for non-U.S. dollar holders to access U.S. dollars - thereby increasing global inflows of U.S. dollar money supply.

(VI) How Do Stablecoins Affect Market Structure?

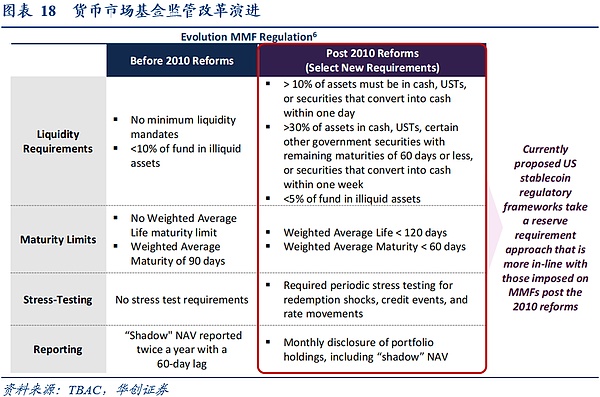

Multiple historical stablecoin de-pegging events have exposed redemption risks, indicating that stablecoin issuers may need more market access mechanisms (similar to banks). However, the strict reserve requirements proposed in current legislation (such as the GENIUS Act) actually draw from money market fund (MMF) regulatory reform logic - aimed at preventing "breaking the net value" crisis scenarios.

Historical Stablecoin De-pegging Events.Moody's defines "de-pegging" as a stablecoin price fluctuating more than 3% relative to its anchored fiat currency in a single day. De-pegging can be triggered by macroeconomic, currency-specific factors, or economic environments. In 2022, 2,347 de-pegging events occurred, and by November 2023, 1,914 events had already happened. These events reveal potential redemption risks for stablecoins and the volatility issuers must manage during stress periods. A typical case is the USDC de-pegging event in March 2023, which highlighted the close relationship between traditional banking systems and digital asset markets. Major de-pegging events can cause confidence collapse and trigger massive redemptions, thereby suppressing crypto market liquidity; triggering automatic liquidations (such as DeFi collateral falling below thresholds); weakening trading platform redemption capabilities; and producing broader transmission effects on the financial system.

Can Stablecoin Regulation Borrow from Money Market Fund Reform Experiences to Prevent Future De-pegging?The money market fund (MMF) reform implemented in 2010 focused on term limits, credit quality, and liquidity requirements, aimed at addressing the 2008 "breaking the net value" crisis. If the stablecoin regulatory framework can systematically absorb such reform experiences, it will effectively mitigate stablecoin de-pegging risks and provide more comprehensive market access mechanisms for issuers.