Title: Beyond Stablecoins: The Case for Ethereum

Source: Electric Capital, Translated by: AIMan@Jinse Finance

Key Points

Global demand for the US dollar is not declining, but rather experiencing explosive growth. Despite news headlines focusing on "de-dollarization", a more important trend is emerging: over 4 billion people and millions of businesses are actively seeking to access dollars through stablecoins, representing the largest expansion of the US dollar network effect in decades.

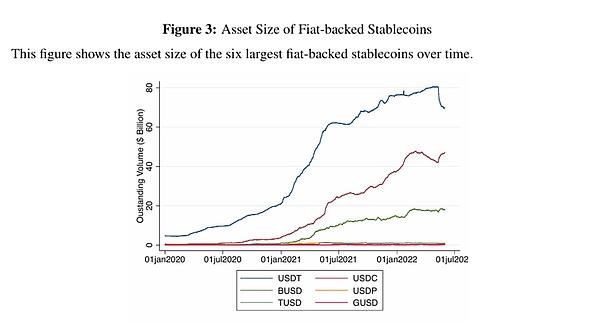

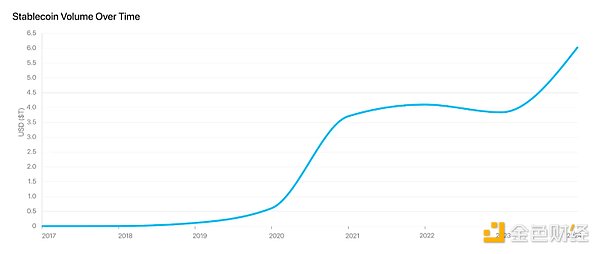

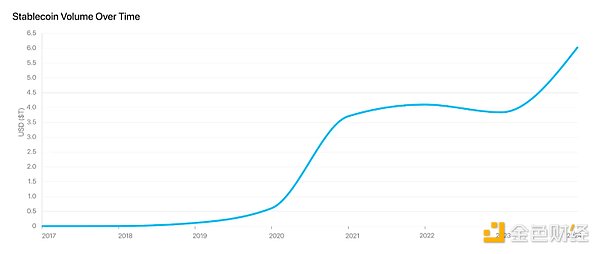

This creates an unprecedented opportunity for Ethereum. Stablecoins provide a channel for global individuals to access US dollars—growing 60 times since 2020, exceeding $200 billion—and the millions of new dollar holders need more than just digital cash. They need returns, investment opportunities, and financial services. Due to regulatory and infrastructure limitations, traditional finance cannot serve this massive new market.

Ethereum has unique advantages to provide global financial infrastructure for this new digital dollar economy, and ETH will directly benefit from this growth.

1, Millions of New Dollar Holders Enter the Dollar Market through Stablecoins

Global individuals and businesses have enormous potential demand for US dollars.

People worldwide want to use dollars for security:

Over 4 billion people face significant monetary risks due to political instability, poor monetary policies, and structural inflation.

An estimated 21% of the global population lives in countries with annual inflation rates exceeding 6%, rapidly eroding savings and purchasing power.

For these populations, holding dollars means financial safety. Dollars are viewed as a store of value, a means of cross-border transactions, and a hedge against local currency fluctuations.

Businesses Need Dollars for Transactions:

The US dollar remains the dominant currency in global trade, with 88% of forex transactions involving the dollar on at least one side.

Enterprises in emerging markets rely on dollar liquidity for international payments, imports, and supply chains, where local banks and forex markets are often limited or unstable.

Small and medium enterprises and freelancers increasingly need digital dollars to receive payment and avoid currency mismatch risks.

For the First Time in History, Anyone in the World Can Hold Dollars through Stablecoins:

Anyone with internet access can hold and trade dollars—without banks, without government permission, available globally 24/7.

As a result, stablecoin market cap has grown 60 times since 2020.

Major adoption is concentrated in emerging markets previously excluded from dollar-denominated finance. Nigeria has become the world's second-largest crypto market, and in China, underground cryptocurrency usage continues despite prohibitions.

[Rest of the translation continues in the same professional manner, maintaining the specified translations for specific terms]

* Bitcoin may become more programmable in the future, provided that the Bitcoin community agrees to modify opcodes to enable this functionality.

4. As ETH becomes the reserve asset of the new digital dollar economy, its demand may increase

What is a reserve asset?

In any financial system, a reserve asset is the trusted foundational layer that underpins everything. It is the collateral, savings, or liquidity asset held by institutions, protocols, and users for value storage, loan collateralization, and transaction settlement.

In traditional systems, the US dollar, US Treasury bonds, and gold are examples of reserve assets because they are trustworthy, highly liquid, and widely accepted.

Why ETH naturally plays this role

As billions of dollars flow through stablecoins on Ethereum, participants need a safe, permissionless, and efficient asset to support borrowing, staking, and yield generation. ETH has unique advantages in this regard because:

- Scarce and trustworthy: ETH's supply is predictable, with low inflation and no central control.

- Yield-generating: Unlike gold or static dollars, ETH generates yield through staking - similar to earning income from real estate or government bonds.

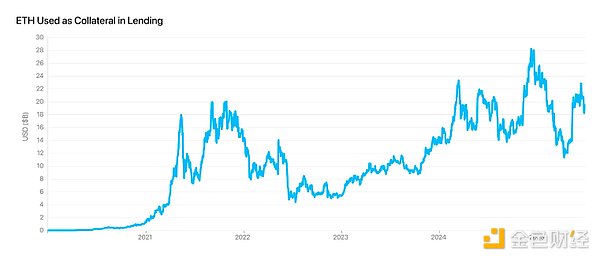

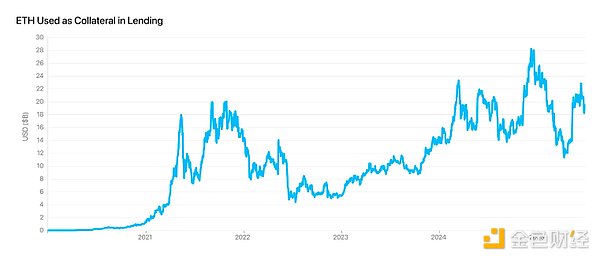

- Collateral utility: ETH is already the largest on-chain collateral asset in the Ethereum ecosystem, supporting $19 billion in lending protocols. Institutions hold it because they need it to enter the DeFi market.

- Seizure and censorship resistance: ETH cannot be frozen or seized by governments, making it more resilient than centralized issued assets.

- Programmable and highly liquid: ETH is deeply integrated into the entire on-chain financial system, with unparalleled liquidity for large transactions.

Why this makes ETH valuable

As more users hold stablecoins and need financial services, they require a reserve asset to support these activities. ETH can earn yields, secure the network, and underpin DeFi lending - therefore, demand for ETH will naturally grow as the system develops.

Simply put: More stablecoin adoption → More on-chain activity → More demand for ETH as collateral → More ETH held by institutions and users.

L2s expand demand for ETH

The growth of Ethereum Layer-2 solutions further stimulates demand for ETH. By reducing transaction costs, accelerating transaction speeds, and enabling new use cases, Layer-2 opens up more areas where ETH can be used as collateral. This expands ETH's coverage and reinforces its position as a reserve asset in the digital dollar economy.

5. As demand for ETH increases, it is also expected to become a global value storage method

The growing demand for ETH also gives it a significant share of the traditional value storage market.

- Like Bitcoin, Ethereum has superior value storage (SoV) characteristics compared to traditional assets like gold.

- ETH and BTC are not competing but may capture a portion of the $500 trillion traditional SoV asset market (gold, government bonds, stocks, real estate) in the coming years.

- In addition to Bitcoin's SoV properties, ETH provides yields for holders.

- Yield generation is a significant advantage, as investors generally prefer yield-generating assets. US households hold about $32 trillion in dividend-paying stocks, compared to less than $1 trillion in gold.

ETH has superior characteristics to traditional SoV assets and can provide yields:

6. Conclusion: Holding ETH may be the best way to participate in the growing stablecoin economy

The growth of the stablecoin economy establishes a powerful flywheel for Ethereum and ETH.

As more stablecoins are deployed on Ethereum, demand for ETH strengthens. Higher ETH value and a more secure network attract more institutions and services, further driving stablecoin adoption.

Alternatives face significant challenges in replicating this flywheel:

- Traditional finance cannot serve billions of people excluded by geographical and regulatory barriers.

- Government-controlled systems remain politically influenced and jurisdictionally limited.

- Bitcoin lacks programmability for complex financial services.

- Other blockchains lack the security, reliability, and customizability institutions require, as well as decentralization resistant to government intervention.

Result: Holding ETH may be the simplest and most effective way to access the growing stablecoin economy.

- You can also choose to invest in specific DeFi protocols benefiting from stablecoin expansion, but this is riskier and requires expertise.

- For most retail and institutional participants, ETH provides the simplest opportunity to engage with the entire digital dollar ecosystem.

Appendix: Risks to Watch

Like any emerging global system, Ethereum faces significant risks. Despite many risks, three major risks most threaten the argument that "Ethereum will build a permissionless, dollar-based financial system with ETH as a reserve asset".

1. US dollar becomes the reserve asset, not ETH

If stablecoins like USDC or USDT dominate and are used for borrowing, collateralization, and settlement, the US dollar might replace ETH as the system's reserve asset. In this scenario, ETH could be viewed primarily as "gas money" rather than a core value storage method. However, given ETH's 44% share of on-chain lending collateral on Ethereum mainnet and Layer-2, and generating 3-5% staking yield, replacing ETH seems challenging. More importantly, ETH is the only truly decentralized asset on Ethereum - stablecoins like USDC and USDT are centralized and can be frozen or seized, fundamentally preventing them from serving as censorship-resistant collateral. More likely, ETH and the US dollar will play complementary roles - the dollar focusing on stability and transaction optimization, while ETH provides decentralized, seizure-resistant value storage and network ownership.

2. Competition from CBDCs, replacing US dollar stablecoin adoption

Central bank digital currency (CBDC) can provide similar round-the-clock digital dollar access and have full sovereign backing, which might squeeze out private stablecoins and limit the permissionless dollar system currently supported by Ethereum. CBDC is inherently national, typically lacks true cross-border interoperability, and may restrict open developer access due to compliance and identity requirements. In contrast, stablecoins have settled trillions of dollars annually, operate globally by default, and maintain higher flexibility in innovation, making it difficult for CBDC to replace them.

3. Competing Chains Surpassing Ethereum

A blockchain that is faster, cheaper, and initially less decentralized might attract users and developers who prioritize low fees and a streamlined user experience, creating strong liquidity and network effects early on. Over time, such a chain might mature its validator set to achieve "sufficient decentralization" and potentially undermine Ethereum's dominance. However, given Ethereum's level of decentralization and over a decade of proven security, replacing it is no easy task.

Additional Data

Annual stablecoin settlement volume exceeds $6 trillion (10 times growth from 2020):

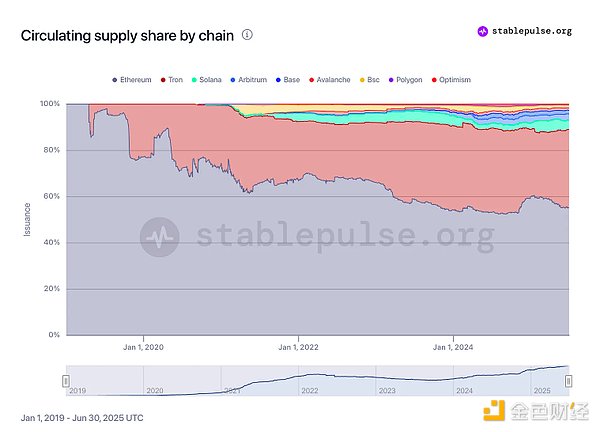

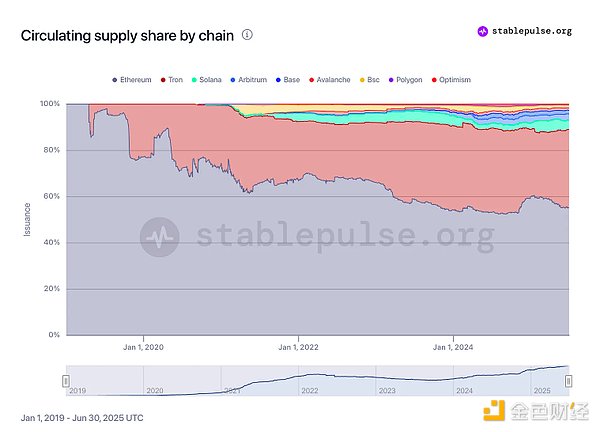

Ethereum holds over 55% of stablecoins:

Ethereum holds over 55% of stablecoins:

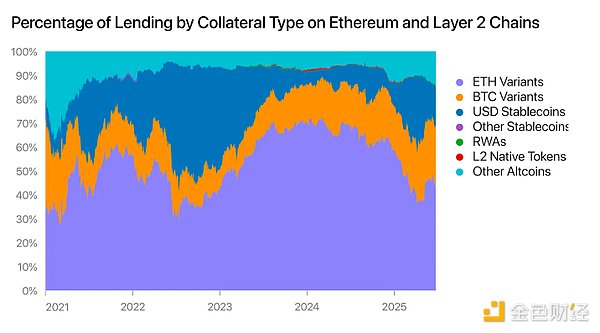

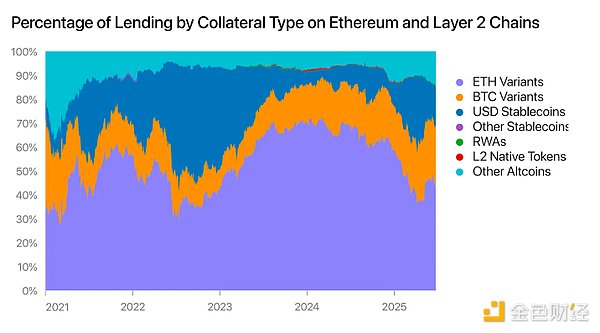

ETH could become a reserve asset for the new financial system. 44% of lending collateral in the Ethereum ecosystem is ETH, making it the largest collateral asset ($19 billion):

ETH could become a reserve asset for the new financial system. 44% of lending collateral in the Ethereum ecosystem is ETH, making it the largest collateral asset ($19 billion):

Ethereum holds over 55% of stablecoins:

Ethereum holds over 55% of stablecoins: ETH could become a reserve asset for the new financial system. 44% of lending collateral in the Ethereum ecosystem is ETH, making it the largest collateral asset ($19 billion):

ETH could become a reserve asset for the new financial system. 44% of lending collateral in the Ethereum ecosystem is ETH, making it the largest collateral asset ($19 billion):