The recent interest rate cut signal released by the Federal Reserve has further increased market expectations for loose liquidity, and has pushed some funds into the crypto market in advance. As an emerging asset class, its narrative of hedging traditional risks and storing value continues to attract institutional interest.

At a time when global economic recovery is intertwined with uncertainty, every move of the Federal Reserve's monetary policy has always captured investors' attention.

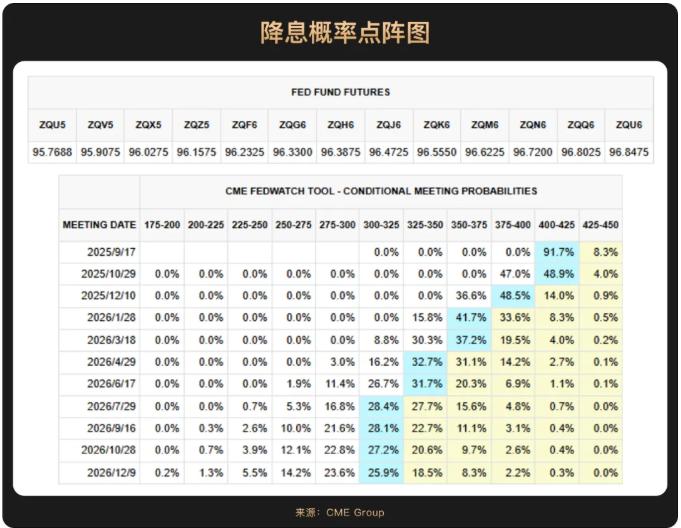

At the end of August, Federal Reserve Chairman Powell sent a clear signal to the market about a shift in monetary policy. He not only reversed his hawkish stance in July, which prioritized inflation risk over employment risk, but also warned of downside risks to employment leading to a "sharp increase in layoffs and higher unemployment." These comments caused market expectations for a September rate cut to surge from 75% to over 90%, signaling a shift in the Fed's policy balance toward boosting employment .

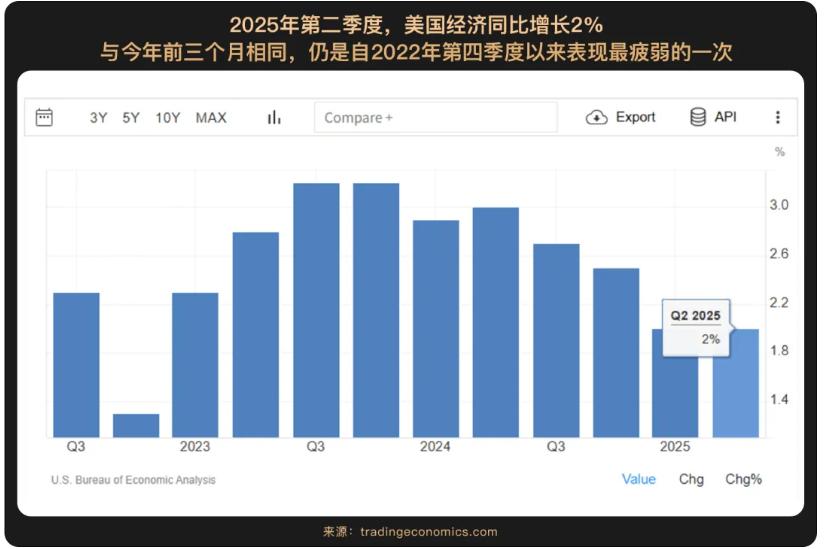

Powell's shift isn't groundless; it stems from the reality of a significant slowdown in US economic momentum . US GDP growth is projected to average 1.2% annualized in the first half of 2025, significantly lower than the 2.5% growth rate for the same period in 2024. More crucially, while the unemployment rate appears stable at 4.2%, underlying fatigue is evident in the labor market: US nonfarm payrolls plummeted to 73,000 in July, significantly below the expected 104,000 and the smallest increase since October of last year. Furthermore, nonfarm payrolls for May and June were revised downward by a cumulative 258,000. This suggests that the momentum of the economic expansion has weakened significantly.

However, the path to rate cuts is not smooth sailing, as inflation remains a variable the Fed cannot ignore . While Powell believes the price impact of tariffs is more likely a "one-time shock" than sustained inflation, and that the final estimate for the five- to ten-year inflation rate fell to 3.5% in August (below the expected 3.9%), the August CPI data (unreleased at press time) will be the final deciding factor in whether a rate cut will be made in September . If August inflation figures show a sharper-than-expected increase (e.g., a month-over-month CPI increase exceeding 0.5%), the Fed could still be forced to reassess its decision.

Furthermore, the US economy is shrouded in the shadow of quasi-stagflation. On the one hand, economic growth is slowing; on the other, inflationary pressures persist under the influence of tariffs and tightened immigration policies. This complex situation of "slowing growth and coexisting price pressures" suggests that Powell's dovish shift lacks confidence , and his rhetoric is more cautious.

The Fed's future policy path will be highly data-dependent, especially if inflation and employment objectives conflict. If inflation risks subsequently outweigh employment risks, Powell could also halt rate cuts. Therefore, while we embrace the short-term asset price euphoria brought about by the expectation of rate cuts, we must remain vigilant regarding the complexity of economic fundamentals and the volatile nature of monetary policy.

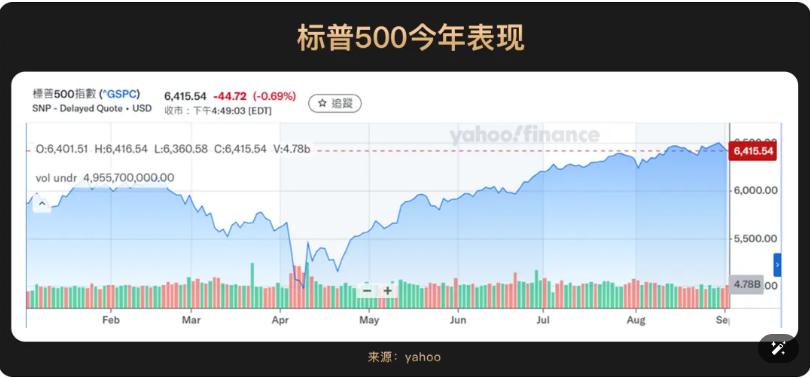

So far this year, US stocks have performed strongly, driven by the AI revolution and expectations of policy shifts. They have reached new highs several times in the first half of the year, with technology and growth stocks leading the gains. As of the end of August, the S&P 500 index had risen nearly 10% year-to-date , breaking several historical records and even breaking the 6,500 point mark during intraday trading.

Financial reports show that corporate profits are a key factor supporting market capitalization, with AI-related companies performing particularly well . US stocks reported strong Q2 2025 financial reports, and AI has become a key driver of the current market rally. Nvidia (NVDA), a bellwether in the AI field, reported a significant 56% year-over-year revenue increase in its Q2 earnings report. While data center revenue fell slightly short of expectations, the overall performance confirmed the sustainability of the AI boom, boosting market confidence. Other chip stocks also performed well, with Broadcom (AVGO) and Micron Technology (MU) rising 3%. AI-focused stock Snowflake (SNOW) saw its share price surge by approximately 21% after its earnings exceeded expectations.

HSBC analysis indicates that AI has a significant impact on businesses, with 44 S&P 500 companies leveraging AI to achieve 1.5% operating cost savings and an average 24% efficiency improvement , which has partially offset the pressure from tariffs. The Federal Reserve's monetary policy outlook also provided significant support to the market, with the high probability of a September interest rate cut boosting the performance of risky assets such as US stocks.

However, despite the strong performance of the US stock market, its valuation is already at a historically high level. As of August, the S&P 500's expected price-to-earnings ratio was approximately 22.5 times, which is lower than its historical peak but still well above the average level of 16.8 times since 2000.

Overall, the US stock market in August 2025 will see a significant boost in risk appetite, driven by AI innovation, relatively robust economic fundamentals, and expectations of loose monetary policy. While elevated valuations warrant some caution, robust corporate earnings growth and the potential for an upcoming interest rate cut cycle make US stocks still considered attractive.

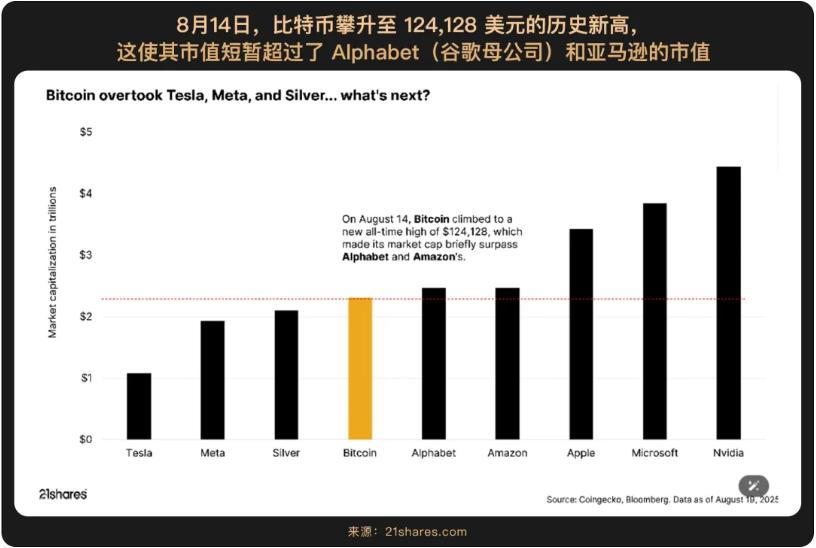

The Bitcoin market showed unprecedented maturity in August 2025.

On the one hand, according to JPMorgan Chase analysis, Bitcoin's six-month rolling volatility has plummeted from nearly 60% at the beginning of the year to approximately 30%, a record low. At the same time, the volatility ratio of Bitcoin to gold has also fallen to a record low, a change that has significantly increased Bitcoin's appeal to institutional investors.

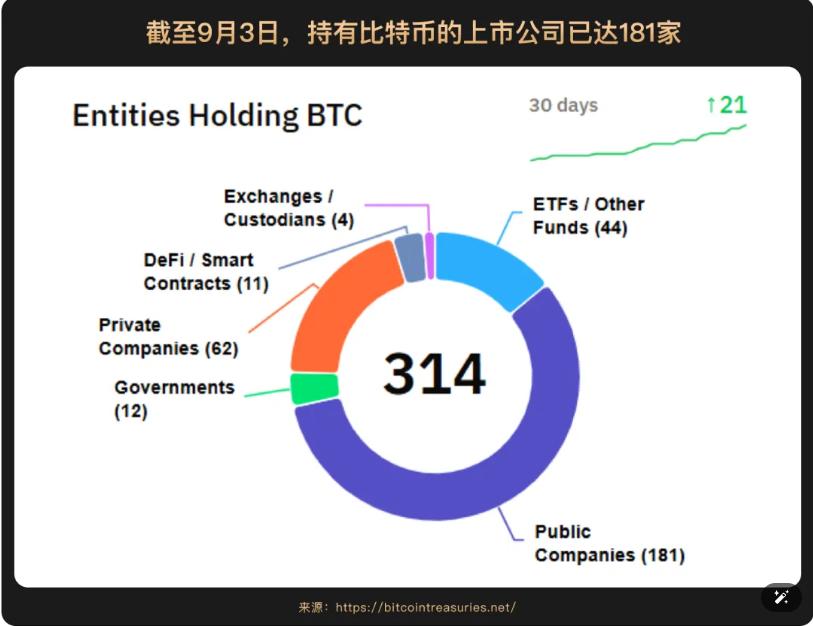

The reduction in volatility is mainly attributed to regulated investment tools such as the US spot Bitcoin ETF, which has attracted a large amount of institutional funds. Its holdings have accounted for more than 6% of the total supply of Bitcoin, and corporate treasuries continue to allocate Bitcoin (the DAT trend). These factors have jointly "locked" part of the circulating supply and reduced the floating chips in the market.

The DAT (Digital Asset Treasury) movement continued to intensify in August. Its core focus is on listed companies and institutions using cryptocurrencies like Bitcoin as strategic reserve assets. This is particularly true for listed companies, which are shifting their capital allocation from project investments to holding cryptocurrencies on their balance sheets. This means using their balance sheets to "backstop" cryptocurrencies. This not only provides sustained purchasing power to the market, making them one of the most powerful buyers, but also provides strong support for the price of the cryptocurrency. For companies, such as Strategy (MSTR), as long as their market capitalization is higher than the actual value of their Bitcoin holdings, they have the opportunity to raise funds from the market through private placements, convertible bonds, and preferred stock sales. These funds can then be used to purchase more Bitcoin, allowing the company to accumulate more coins at a lower cost. Statistics show that as of mid-August, DATs had raised over $15 billion in cumulative funding, significantly exceeding the total amount raised by crypto VCs during the same period. By 2025, leading institutions will view DATs as an alternative or supplement to ETFs, emphasizing their advantages in liquidity and flexibility. At this year's Bitcoin Asia 2025 (Hong Kong) event, the DAT trend also became a top topic in the industry.

Meanwhile, favorable policy support continues. As the only crypto asset officially included in sovereign reserves, Bitcoin's global regulatory framework is becoming increasingly clear. For example, the passage of the US CLARITY Act and the repeal of SAB 121 accounting guidance have paved the way for traditional financial institutions such as banks to directly hold Bitcoin. This has also prompted other countries, such as Norway and the Czech Republic, to consider adding Bitcoin to their foreign exchange reserves. In August, US President Trump officially signed an executive order allowing 401(k) retirement accounts to invest in Bitcoin and other digital assets, representing tens of billions of dollars of 1% of $12.5 trillion . This move opens the door to the crypto market for the US's massive pension system. Market analysts believe that even if only limited retirement funds are allocated, the potential for incremental demand in the market will be significant, and the long-term purchasing power it generates cannot be underestimated.

It's worth noting that August saw significant capital rotation within the crypto market. Bitcoin ETFs experienced significant outflows, with net outflows exceeding $2 billion and net inflows of approximately $4 billion and $164.6 million . Ethereum ETFs, on the other hand, attracted significant institutional capital. This reflects the shift in some investors to capitalize on the growth potential of ecosystems like Ethereum after Bitcoin reached a record high. However, this rotation was also rapid, with significant outflows from the Ethereum ETF at the end of August, indicating short-term volatility in market sentiment.

Despite short-term capital rotation, the continued entry of top financial institutions signifies the formal integration of cryptocurrencies into the traditional financial ecosystem . According to Bloomberg, BlackRock's Bitcoin Spot ETF attracted several top global financial institutions in the second quarter of 2025, ranging from hedge funds, market makers, to large banks, with holdings spanning both proprietary and client funds. JPMorgan Chase analysis indicates that based on risk-adjusted valuations, Bitcoin's "fair price" should be around [unclear context - possibly a literal translation error], indicating potential upside relative to gold.

In short, the significant decline in Bitcoin volatility, the evolution of institutional adoption patterns, and the acceleration of internal capital rotation in August all indicate that the crypto market is undergoing a profound structural shift. While short-term capital flows will continue to fluctuate, the institutional foundation and macroeconomic dynamics supporting the long-term value of cryptocurrencies are becoming increasingly solid.

In the long run, as the interest rate cut cycle boosts risk appetite and the crypto ecosystem continues to improve, the resilience of Bitcoin's core assets will continue to attract capital inflows. The short-term fluctuations brought about by market rotation will provide better layout opportunities for bullish funds.