One year ago, I told you that "disinflationary" or "non-recessionary" rate cuts were bullish for risk assets. If you listened to me, you printed money. Today, I'll be sharing my thoughts on the upcoming rate cut environment & what it means for investors, for free. Link in bio.

Caleb Franzen

@CalebFranzen

08-25

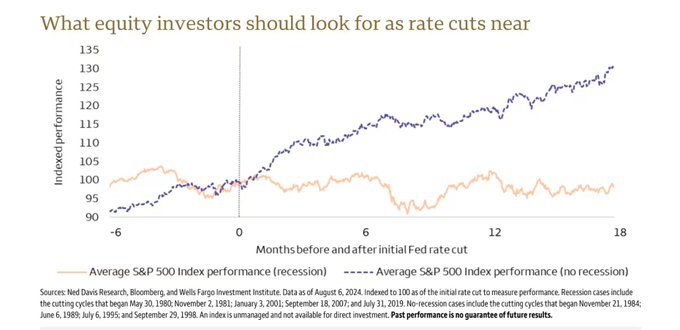

The Fed is not cutting because of weakness.

They are cutting to prevent material weakening.

That's why I've been referring to this upcoming rate cut cycle as "disinflationary" or "non-recessionary" rate cuts.

Factually, absent of a recession/crisis, these cuts are bullish.

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share