As competition in the decentralized exchange (DEX) space heats up, Hyperliquid has become one of the most watched platforms this year with its astonishing growth rate and expanding product portfolio.

Yesterday, the foundation announced it would launch its own USDH stablecoin through on-chain governance . This move not only signals Hyperliquid's desire to gradually transition away from its reliance on Circle's USDC , but is also being interpreted as a key step toward building a self-sustaining ecosystem and improving its closed-loop ecosystem.

Following the announcement, Hyperliquid's native token , HYPE , surged to $47.63. Although it subsequently retreated slightly, its price still maintained a 4% increase over the past 24 hours, according to Coingecko data.

From "Rookie" to "Dark Horse": The Rise of Hyperliquid

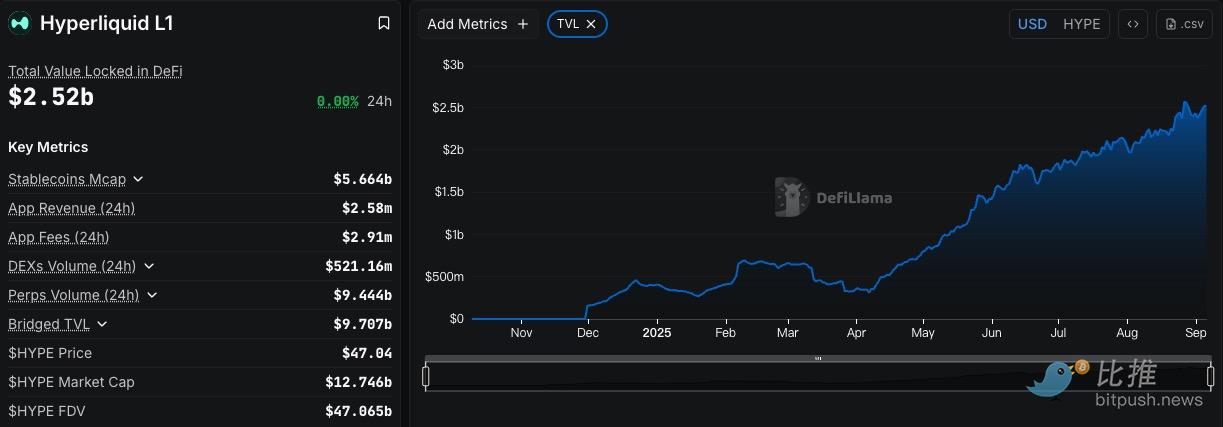

In 2025, Hyperliquid, with its exceptional trading activity, quickly ascended from a second-tier platform to a top-tier DEX. According to DeFiLlama data, the platform's contract trading volume reached $398 billion in August, with spot trading volume reaching $20 billion.

On August 25, its Bitcoin spot trading volume surpassed CEX Coinbase and Bybit .

Its capital accumulation is equally impressive: at the beginning of this year, Hyperliquid's total value locked (TVL) was only $317 million. By September, it had soared to $2.5 billion, a nearly eightfold increase. This demonstrates that Hyperliquid is rapidly gaining traction with users and becoming a key hub for capital and trading liquidity.

Against this backdrop, Hyperliquid's launch of its own stablecoin USDH is clearly in line with the trend.

For an exchange, mastering stablecoins can not only reduce external dependence, but also convert the interest income brought by stablecoin reserves into the driving force for its own development, truly achieving "self-financing".

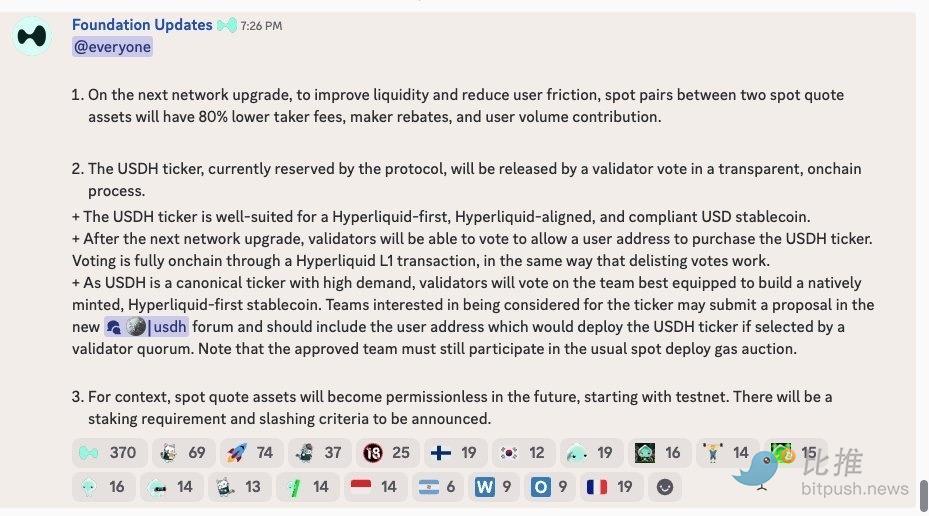

USDH issuance mechanism: decentralized governance-led

Unlike mainstream stablecoins, the issuance of USDH is not directly decided by a single company, but is determined by Hyperliquid's on-chain governance system.

First, Hyperliquid has reserved a ticker symbol for USDH. Next, teams will be invited to submit proposals outlining how to issue and operate the stablecoin. Validators will then vote over five days to determine which team will win.

Even if authorized, the team still needs to participate in Hyperliquid Layer 1's "spot deployment gas auction" to complete the launch. This means that the issuer of USDH is not determined by the foundation, but is determined through community competition.

This mechanism not only embodies the spirit of decentralization, but also enables Hyperliquid to enhance community participation and cohesion through governance. Furthermore, the Foundation explicitly states that USDH must be "compliant." This lays a foundation for its future stable operation in the context of new regulations like the GENIUS Act.

Differences from USDT and USDC

The stablecoin market is currently dominated by USDT and USDC, with a combined market share exceeding 80%. In comparison, USDH is positioned as a more "eco-native" stablecoin.

First, the issuing entities are different. USDT and USDC are issued by centralized companies like Tether and Circle, and their reserves are managed by these companies. USDH, on the other hand, is deployed by a team selected through governance voting, making it more aligned with its role as a "protocol native asset."

Secondly, their usage scenarios differ. USDT and USDC cover nearly the entire crypto ecosystem and serve as universal settlement tools. USDH, on the other hand, primarily serves Hyperliquid's internal transactions, becoming a dedicated stable asset for derivatives, clearing, and liquidity pools.

More importantly, the revenue model differs. While USDT and USDC's reserve interest is exclusively accrued to the issuing company, once USDH is operational, its reserve income is likely to be redistributed through governance, flowing back to validators or the community. This makes Hyperliquid's stablecoin not just a payment tool, but also a "blood circulation system" that drives ecosystem growth.

In terms of transparency and compliance, USDT has always been questioned, while USDC has gained some trust with the help of Circle's background. Hyperliquid clearly emphasizes the compliance attributes of USDH and combines its operations with on-chain governance, which "theoretically" will lead to higher transparency.

Community controversy

It is worth noting that the USDH plan sparked heated debate in the community as soon as it was announced.

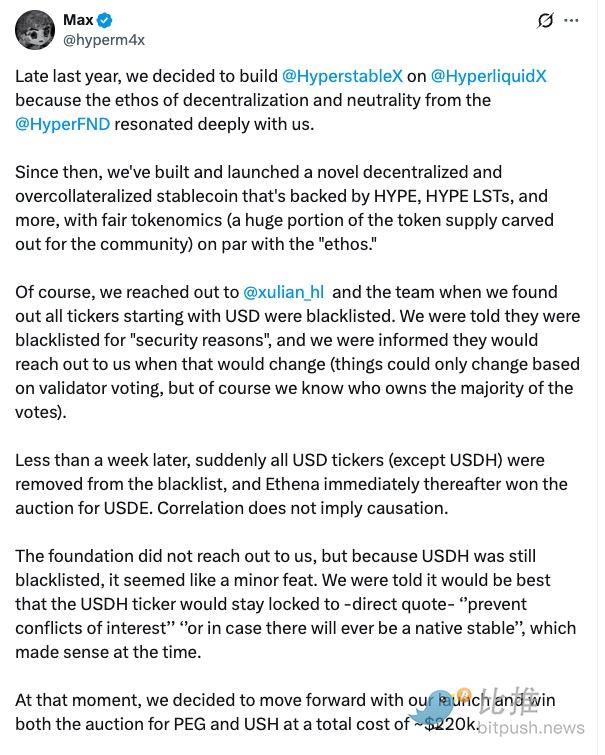

Max, a developer of Hyperstable, a long-established stablecoin protocol within the ecosystem, was the first to speak out. He pointed out that the USDH symbol had previously been blacklisted, forcing them to use "USH" as the stablecoin symbol. The foundation's sudden unblocking of USDH has left Hypertable feeling that the rules have been temporarily modified, "extremely unfair to the team that has already invested significant resources."

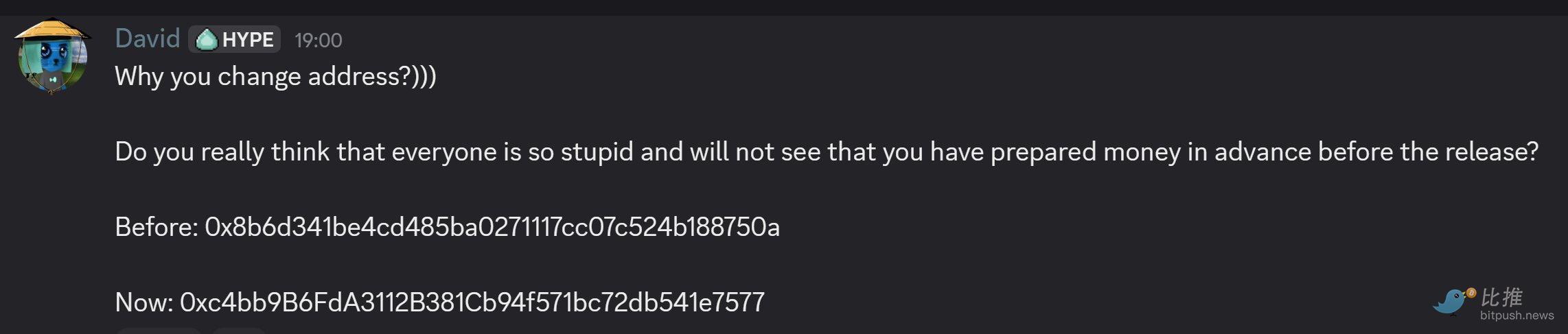

Meanwhile, the proposal of another candidate, Native Markets, also sparked controversy. Community members discovered that the team's wallet had received funding from Hyperliquid only hours before the announcement, yet the proposal they submitted was detailed and comprehensive, seemingly pre-planned. This raised questions about whether they had prior knowledge of the announcement or even an undisclosed relationship with the foundation.

Supporters argue that the USDH unblocking wasn't a "backroom operation," but rather a result of a shift in the compliance landscape following the GENIUS Act's implementation. Since the external environment has changed, the rules naturally need to adapt. Underlying this debate is a question about Hyperliquid's ability to maintain neutral governance and treat developers fairly.

A new phase in the stablecoin race

The broader context is that the stablecoin market itself is experiencing a new round of expansion. According to DeFiLlama data, the total global stablecoin market capitalization has exceeded $285 billion, having grown by over 5% over the past week. Tether's USDT holds a 58% share, followed closely by USDC.

Meanwhile, industry giants and emerging players are entering the market: MetaMask is collaborating with infrastructure provider M0 to launch mmUSD; payments giant Stripe has partnered with Bridge to issue its own stablecoin. Within this trend, Hyperliquid's USDH isn't an isolated attempt, but part of a larger movement. Exchanges, public chains, wallets, and payment companies are all seeking to control their own monetary systems, reducing external dependence and capitalizing on the long-term benefits of reserve assets.

A successful USDH launch would mark a significant step toward Hyperliquid's self-sustaining growth, signifying its move beyond simply being a trading platform and towards building a complete financial ecosystem. The next step will depend on the community's consensus and actions. This is just the beginning.

Twitter: https://twitter.com/BitpushNewsCN

BitPush TG discussion group: https://t.me/BitPushCommunity

Bitpush TG subscription: https://t.me/bitpush