Source: The DeFi Report

By Michael Nadeau

Compiled and compiled by: BitpushNews

In politics, a candidate's strength often depends on the loyalty of their core base. In sports, clubs with the most loyal, generational support are often the most valuable. In religion, core believers convert new believers to spread their message.

The same principle applies to consumer product companies and media brands.

Tesla has die-hard fans.

Apple has its fans.

Barstool Sports has a "hardcore audience."

Fox News has a "base", and CNN is no exception.

The loyal "core group" never leaves. These people deeply bind their self-identity to politicians, sports teams, religious beliefs, and product concepts.

Their loyalty means:

Spontaneous free publicity (the most effective form of communication)

Product evangelism spirit

Sense of belonging to a group

Capital access channel

collective belief system

Through this lens, we also apply the same framework to the meme coin community.

Which meme coins have the strongest “fundamentals,” and what does that tell us about the value of their community?

We aim to answer this question using on-chain data.

Disclaimer: The views expressed in this article are the author’s personal views and should not be considered investment advice.

Token holder groups

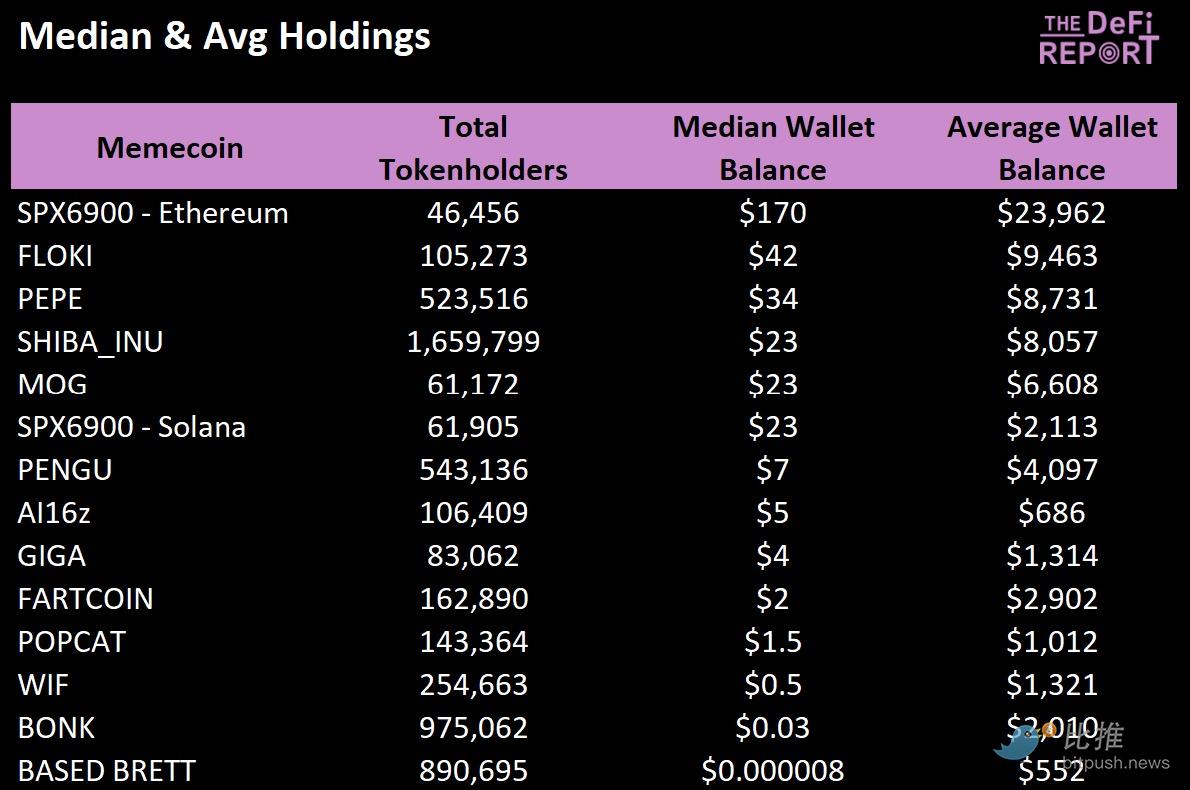

Average and median holdings per wallet

As can be seen from the data, SPX6900 is an outlier in terms of both median and average wallet holdings. Its median wallet balance on Ethereum is four times that of any other “blue chip” meme coin.

You might be wondering why the median balances forWIF , BONK, and Based Brett are so low. The answer is airdrops/dust wallets.

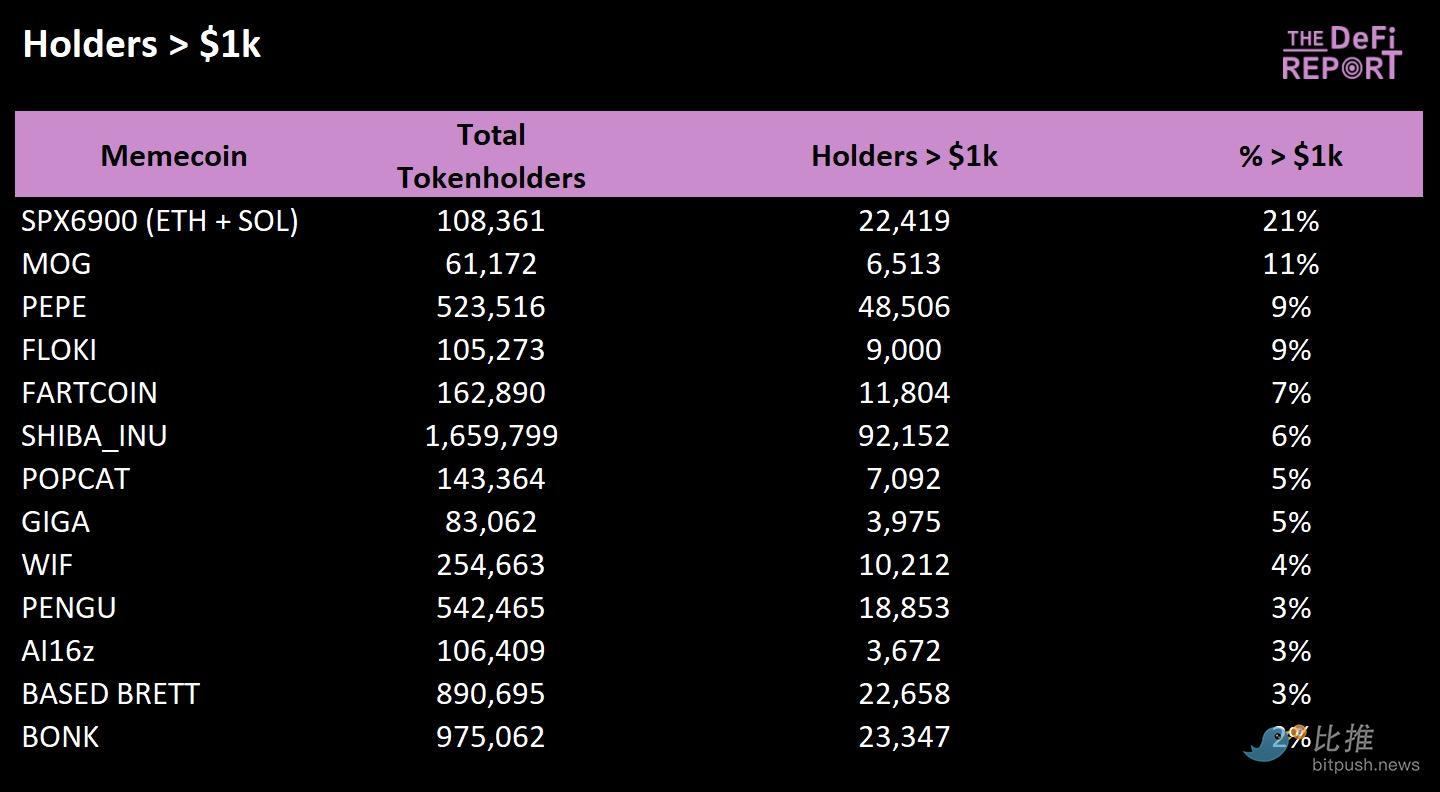

Holders with holdings > $1,000 USD

SPX6900 also stands out in terms of the percentage of holders with holdings exceeding $1,000 – almost double that of second-placed MOG.

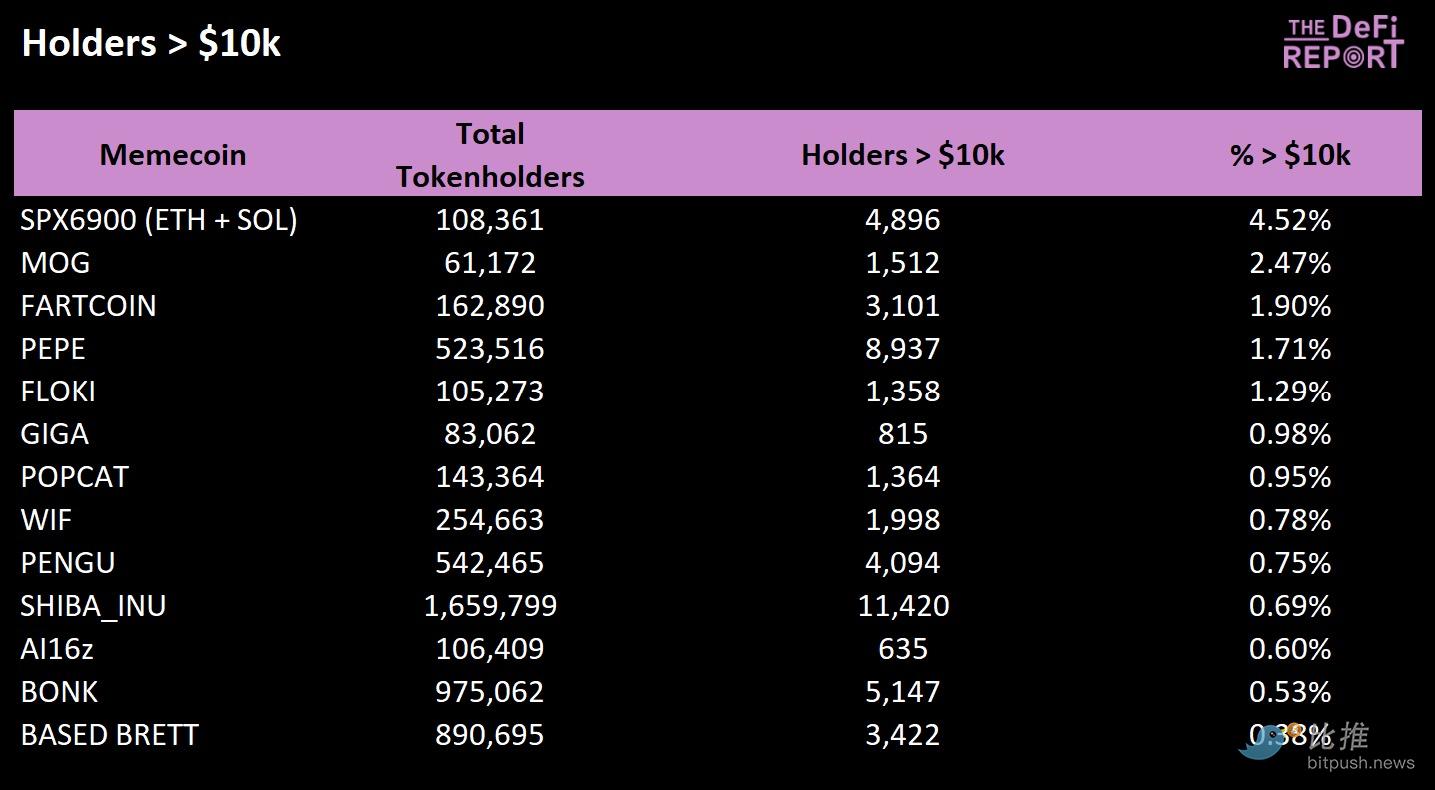

Holders with holdings > $10,000 USD

Today, 4.52% of all wallets holding SPX6900 on Ethereum and Solana hold more than $10,000 — nearly double the amount of the next-largest token.

Holders with holdings > $100,000 USD

Of all wallets holding SPX6900 on Ethereum and Solana, less than 1% hold more than $100,000.

For reference, Bitcoin (BTC) has 167,000 wallets holding over $1 million (0.8%). Ethereum (ETH) has 18,276 wallets holding over $1 million (0.015%). It has 141,000 wallets holding over $100,000 (0.1%).

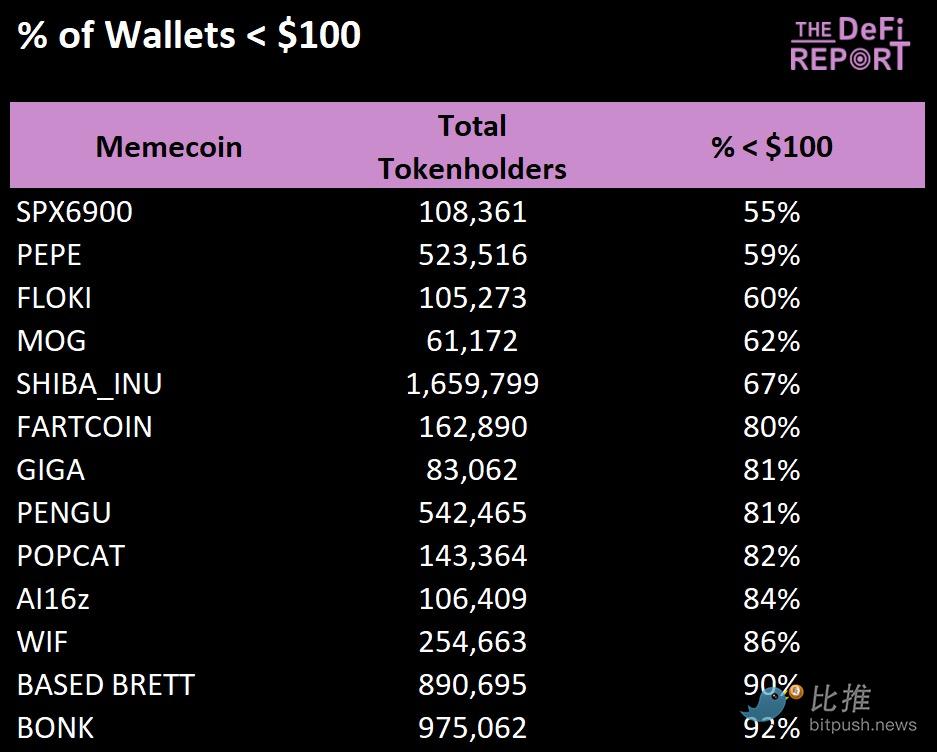

Percentage of holders with holdings < $100

SPX6900 leads the pack in terms of having more high-conviction, large-value token holders. Therefore, it’s no surprise that it has a smaller percentage of wallets holding less than $100 USD.

Token holder retention rate

We believe our retention data provides the strongest signal about the “base” of meme coins.

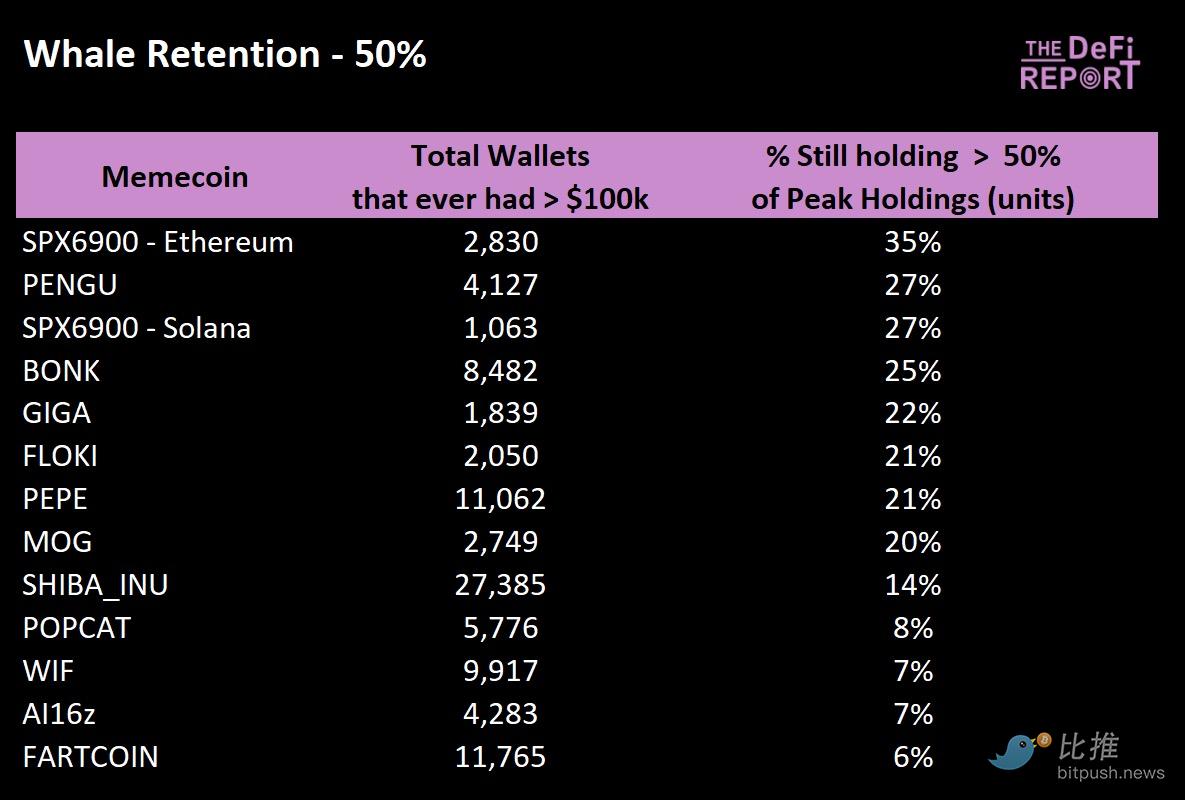

Whale retention rate > 50%

The SPX6900 takes the lead again.

Pengu (Pudy Penguins), BONK and GIGA followed closely behind, completing the top four.

BONK and GIGA have very low median and average holder balances, yet they appear at the top of this ranking. We prioritize whale retention data.

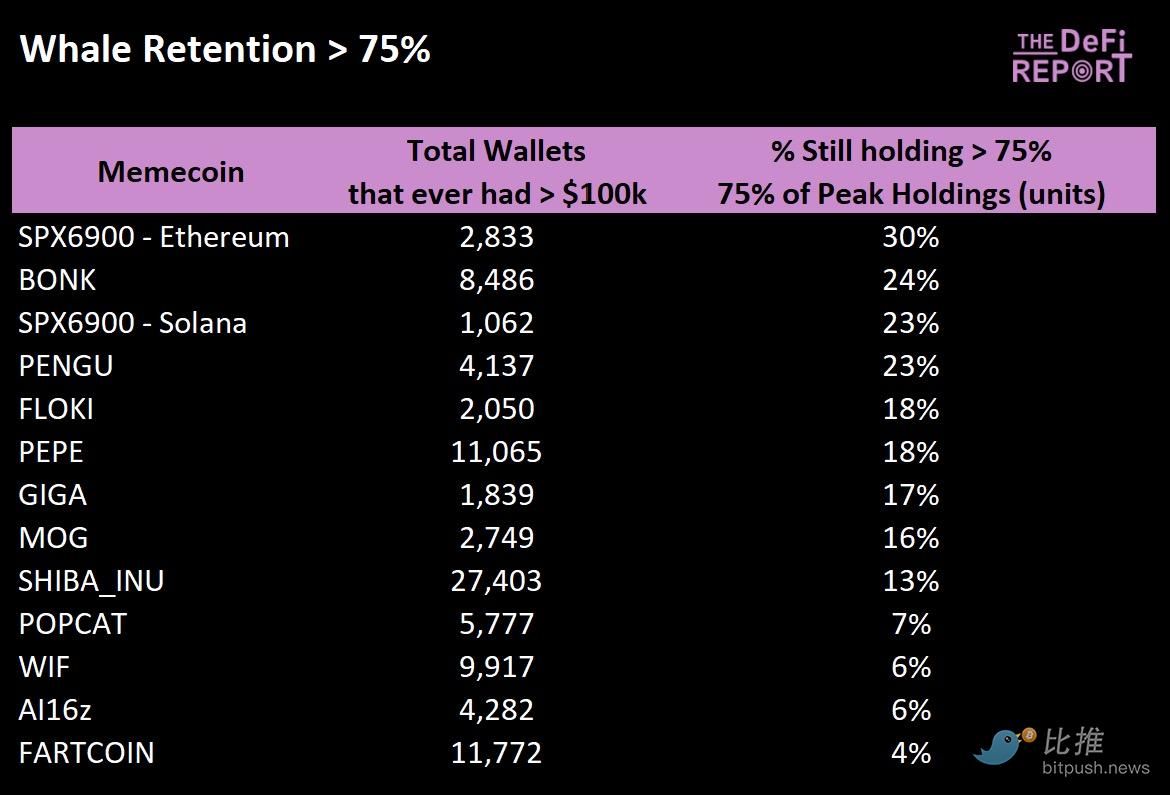

Whale retention rate > 75%

On Ethereum, 30% of SPX6900 wallets that once held $100,000 still retain more than 75% of their peak holdings.

This is interesting.

Some people think that investing in meme coins is "burning money."

But here we see that nearly a third of SPX holders are heavily invested and have remained in the market through a 10-20x rally and an 80% drawdown.

This is a profound belief.

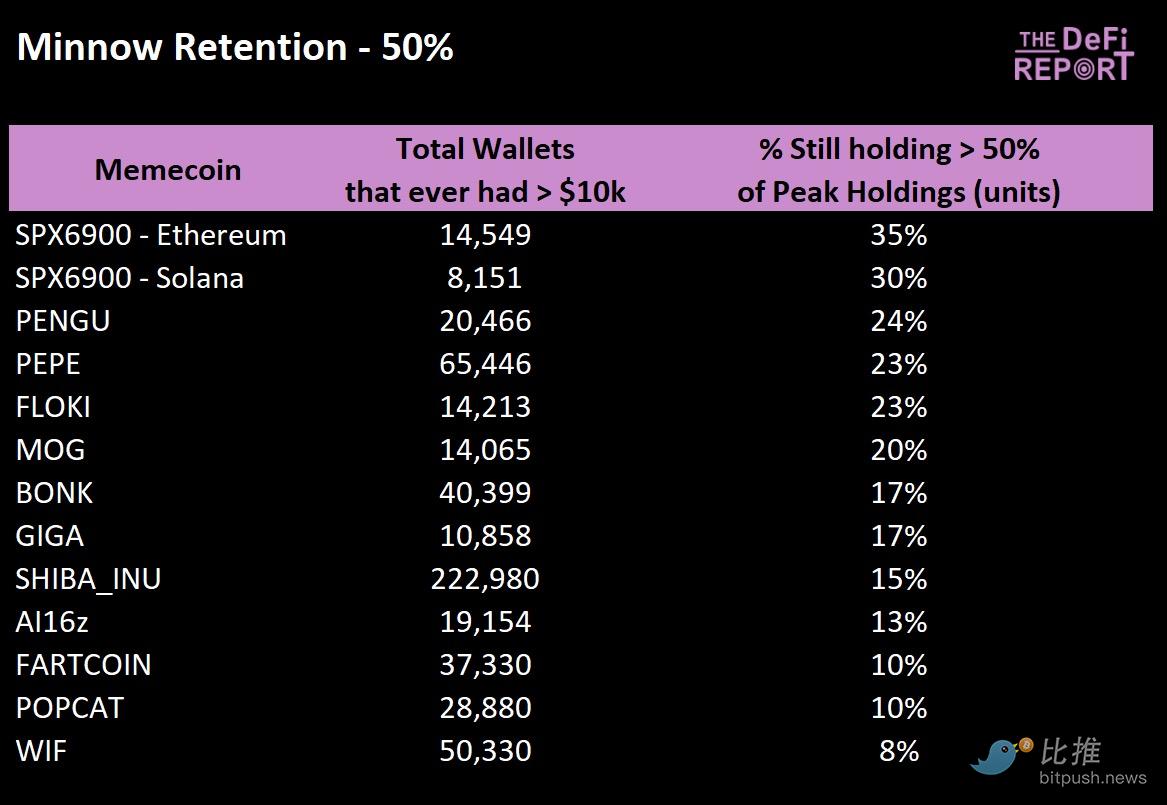

Small and scattered investor retention rate > 50%

We see the same level of conviction across all groups of SPX6900 holders.

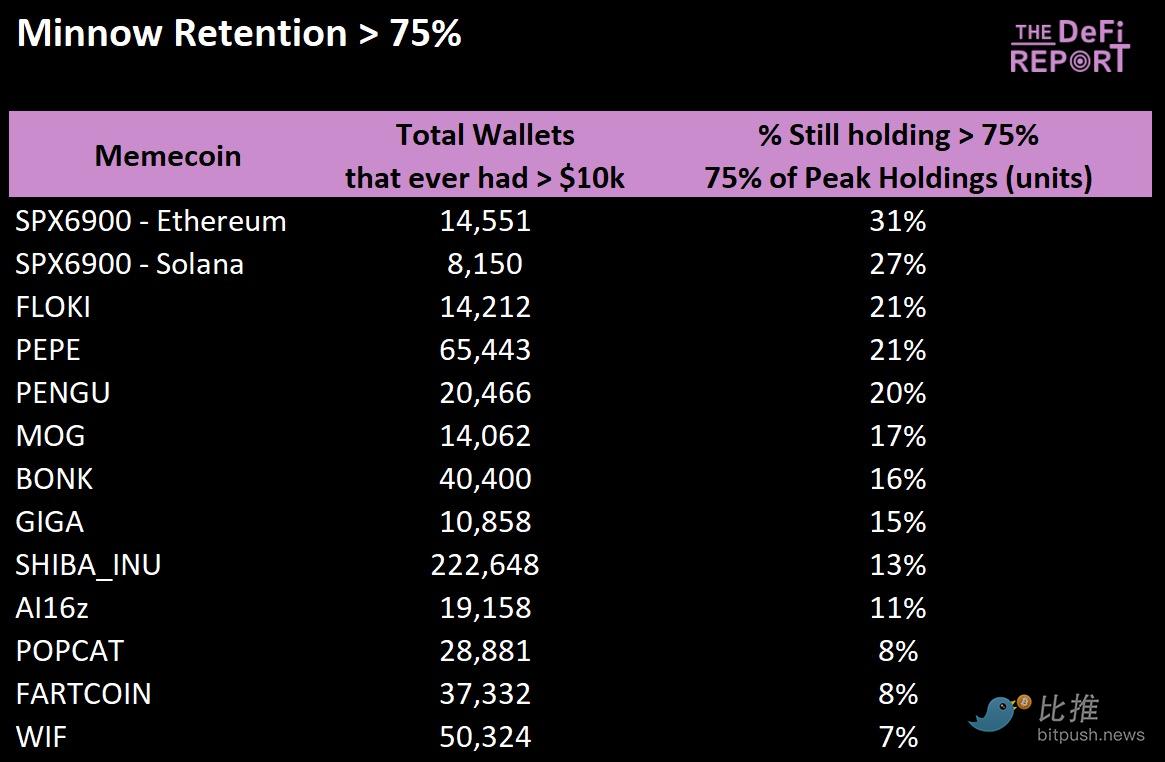

Small and scattered investor retention rate > 75%

Again, roughly one-third of SPX6900 holders who once held $10,000 worth of tokens still hold more than 75% of their peak holdings.

Belief. Delusion? Call it what you will. The data doesn’t lie; it’s sending a signal.

DEX Fund Flows

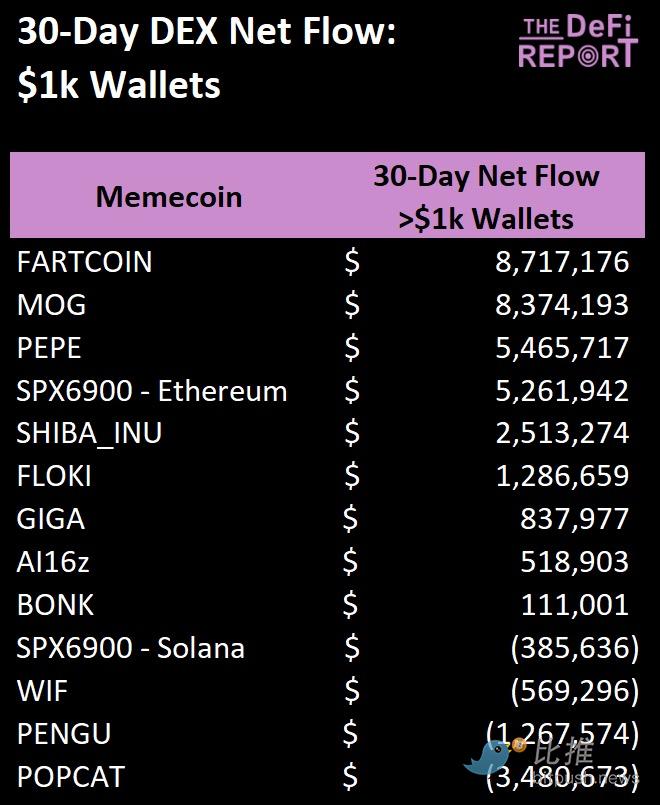

30-day Net Fund Flow: Wallets > $1,000 USD

In addition to analyzing wallet group holdings and retention rates, we also examine the net inflow/outflow of decentralized exchanges (DEXs) by different groups at key turning points to understand the buying and selling behavior of different communities.

Net inflow = selling activity.

Net outflow = buying activity.

This is the first category where the SPX6900 failed to lead.

*Note that more established meme coins (Pepe, Shiba, Bonk ) are traded on most centralized exchanges in addition to our data here.

Remember, Inflow = coins sent to the DEX (sell).

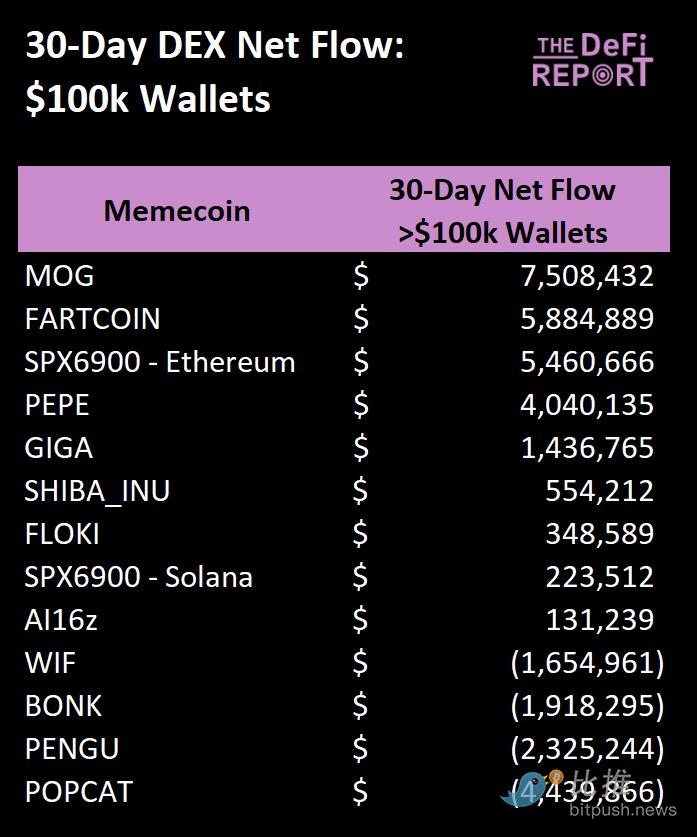

30-day Net Fund Flow: Wallets > $100,000

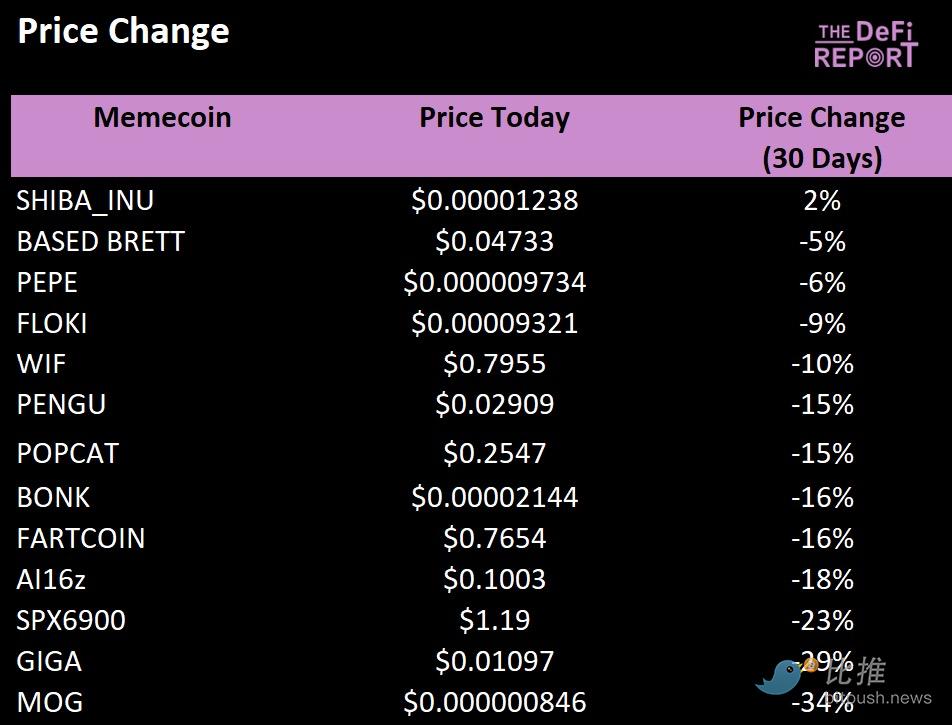

30-day price change

Unsurprisingly, the tokens with the highest DEX inflows tend to be the ones with the weakest price performance over the past 30 days.

fair value

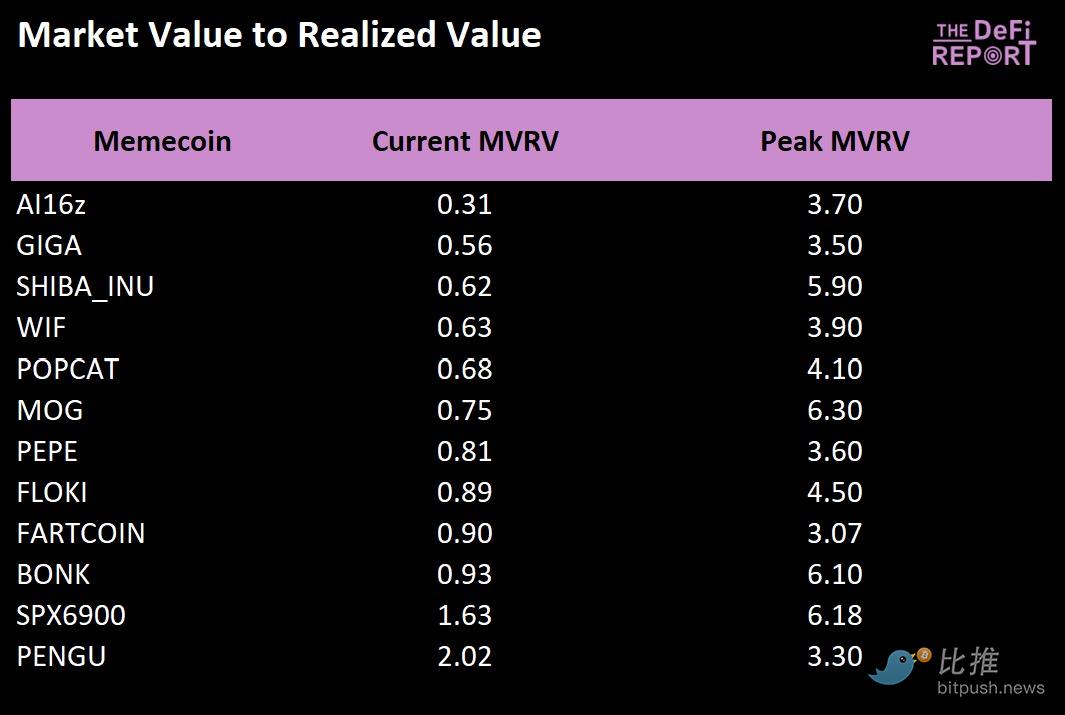

MVRV (Market Value to Realized Value Ratio)

MVRV measures “realized price,” which is a proxy for the cost basis of all tokens in circulation versus their market price.

The MVRV of the SPX6900 is 1.63, which means that the average SPX6900 holder has an unrealized gain of 63% (the average Penguin holder is up 102%).

The average holder of the remaining tokens is currently experiencing unrealized losses (MVRV below 1).

No wonder market sentiment is negative.

Momentum and Price Action

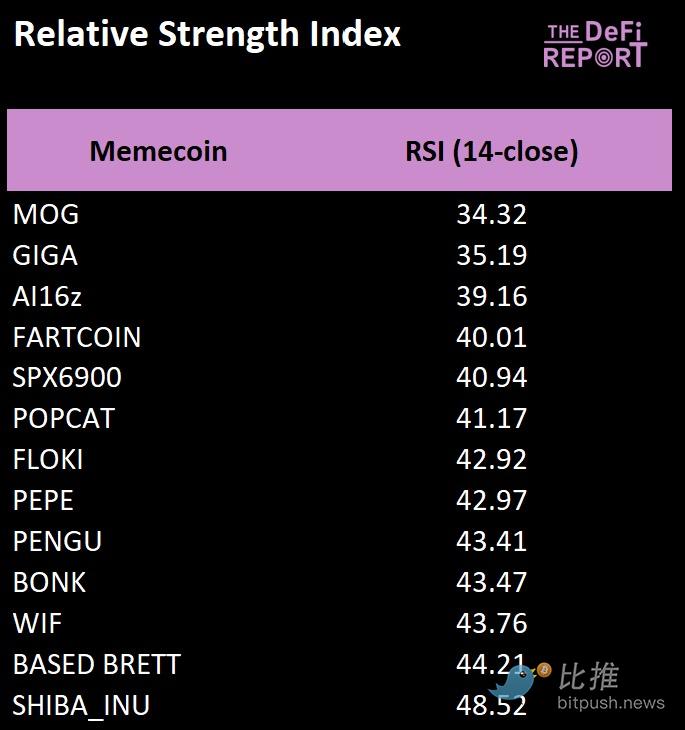

RSI (Relative Strength Index)

When the RSI approaches 30 or falls below 30, it indicates that the coin is in an “oversold” condition.

Historically, a small allocation to certain projects at these turning points has produced excess returns within 3-6 months.

The key is that you need to be confident that the bull market structure is still intact.

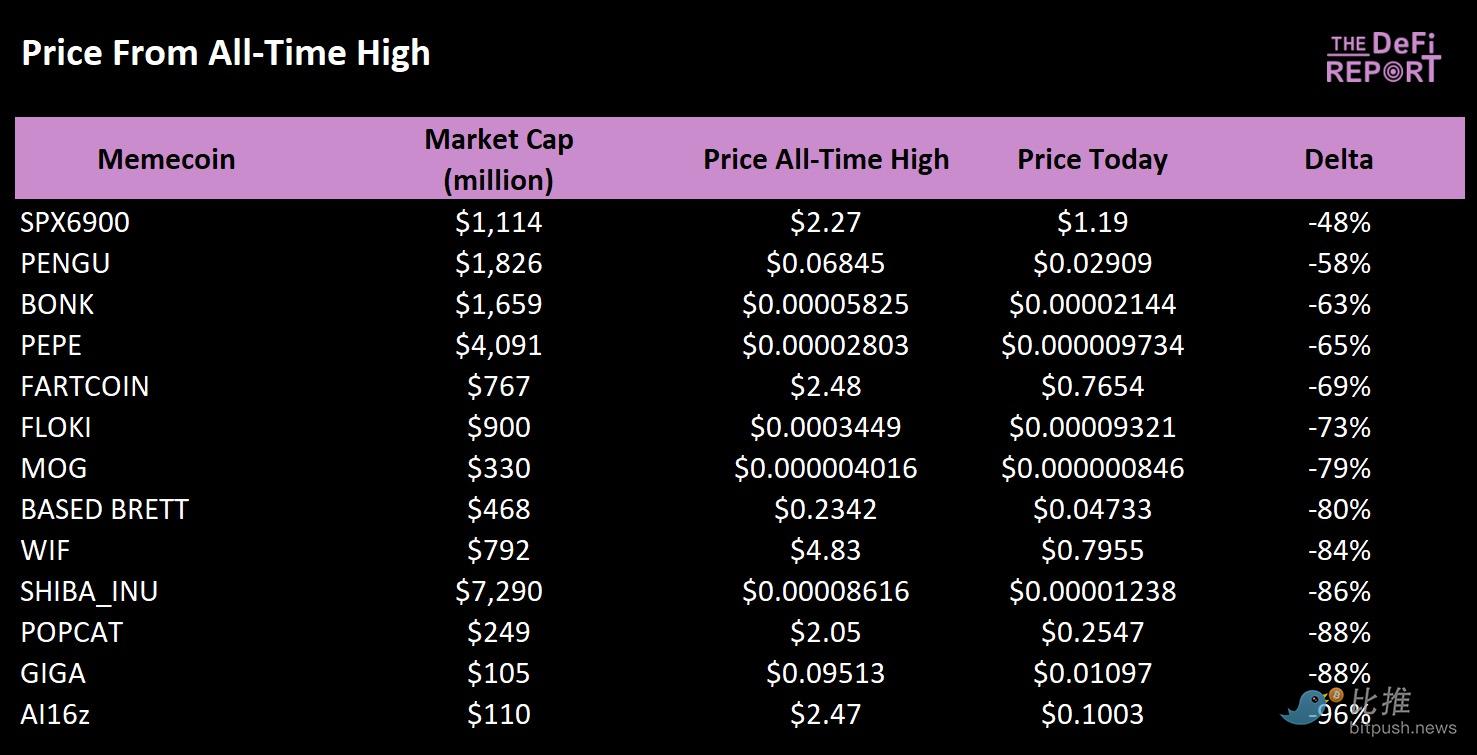

The percentage of price from the historical high

Conclusion

Price action ties it all together. Meme coins with the strongest token holder cohorts and retention rates also perform best in the market.

In our opinion, the "basic plate" is one of the reasons.

Either you have one or you don't.

The tokens we believe have the strongest fundamentals are:

The SPX6900 is particularly interesting to us.

Why?

Its data performance is very impressive, but what is the reason behind it? Why can SPX6900 achieve the "MEME belief" that other communities cannot achieve?

We think the key points are:

A "core figure" who not only invests real money but is also highly trusted by the community (e.g. Murad);

Targeting a public pain point. The SPX6900's slogan is "Turning up the Stock Market." While this might sound absurd, it accurately captures the plight of the global youth: they struggle to make a name for themselves and feel left behind. This emotional resonance has brought the community together.

A unique community culture. "Turning up the stock market," "Stop trading, believe in something," "Eternity," "No candlestick charts, but I love you," and "Daily fixed investment." You might not understand these slogans, but for the community, they represent a sense of identity and belonging.

Unrealistic beliefs + outrageous price targets. If you think back to the early days of Bitcoin, the SPX6900 is a bit like it: a small group of people with absurd beliefs, a grand idea, and a very cohesive community;

It withstood several major declines. The SPX6900 experienced extreme volatility, rising tenfold and falling 80%. This volatility wiped out speculators, but the true "hardcore community" never left.

A group of people who volunteered to work for the project for free called it "powering with love."

Twitter: https://twitter.com/BitpushNewsCN

BitPush TG discussion group: https://t.me/BitPushCommunity

Bitpush TG subscription: https://t.me/bitpush