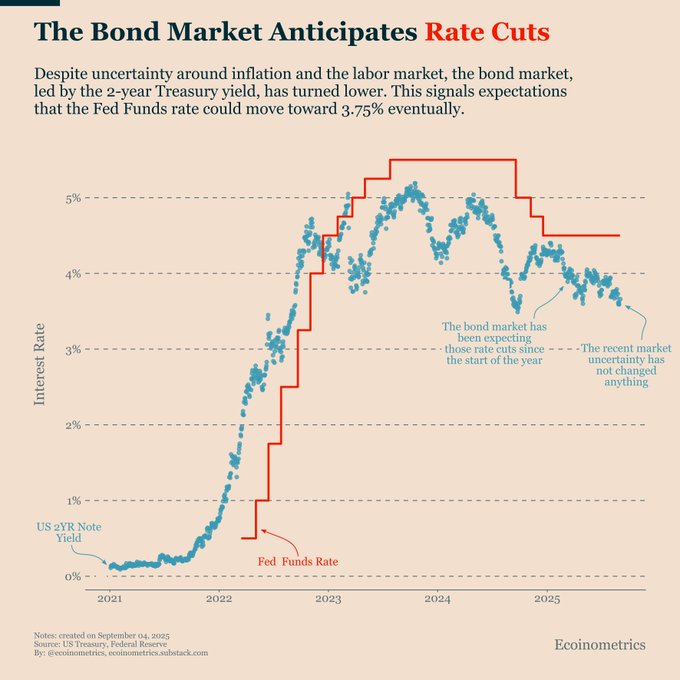

The bond market is leaning toward rate cuts.

The 2-year Treasury yield is drifting lower, signalling expectations that the Fed will keep easing.

That would be the ideal scenario for Bitcoin.

Moving slowly is safest for Bitcoin.

A forced U-turn from the Fed if inflation pops would crunch liquidity and hurt risk assets far more that if they take their time.

Follow @ecoinometrics for more data-driven insights on Bitcoin and macro.

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share