Data shows that self-managed superannuation funds in Australia reduced their crypto holdings by 4% to AUD 3.02 billion, a move that goes against the market trend.

A new report from the Australian Taxation Office (ATO) shows that Self-Managed Super Funds (SMSFs) have cut their crypto holdings despite a booming year for the market. As of June 2025, the total value of crypto assets in SMSFs reached AUD 3.02 billion ($1.97 billion), down 4% from AUD 3.12 billion a year earlier.

This is surprising given that Bitcoin prices have increased by around 60% over the same period, while the Asia-Pacific region has increasingly asserted its position as a global hub for crypto assets. However, experts say that this figure does not fully reflect the overall picture.

According to Simon Ho, SMSF Strategy Director at Coinstash, the ATO data is lagging as it is based on tax returns due in May 2026. More importantly, he highlighted the 41% increase in crypto holdings from June 2023 to June 2025, which he sees as a sign of growing adoption, driven by a clearer regulatory environment.

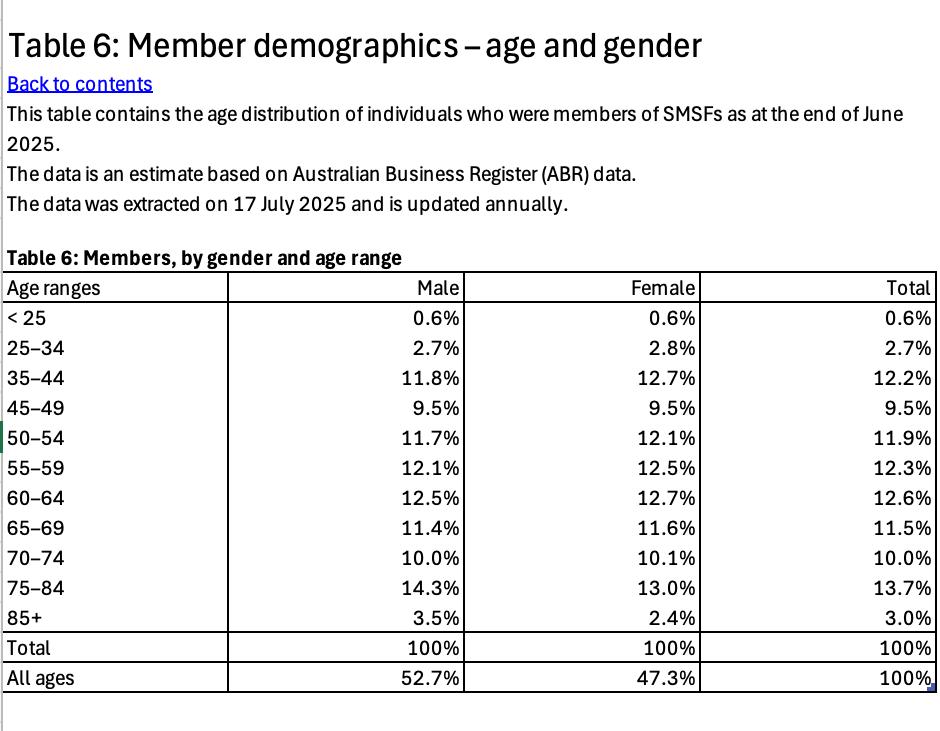

Demographics are also a long-term driver. Currently, 96.7% of SMSF members are over 35, while a survey by Independent Reserve found that more than 53% of Australians aged 25–34 already own crypto assets . As this younger generation enters the retirement planning stage, Capital into digital assets could increase significantly.

Catching the trend, major exchanges such as Coinbase and OKX have launched specialized services for SMSF customers. At the same time, the industry continues to urge the government to soon issue a clear legal framework to strengthen Australia's competitive advantage.

The trend is not limited to Australia. In the UK, multiple surveys show similar interest, while in the US, recent executive orders have given 401(k)s access to Bitcoin. All reflect a global shift in how pension plans view digital assets as part of their long-term savings portfolios.