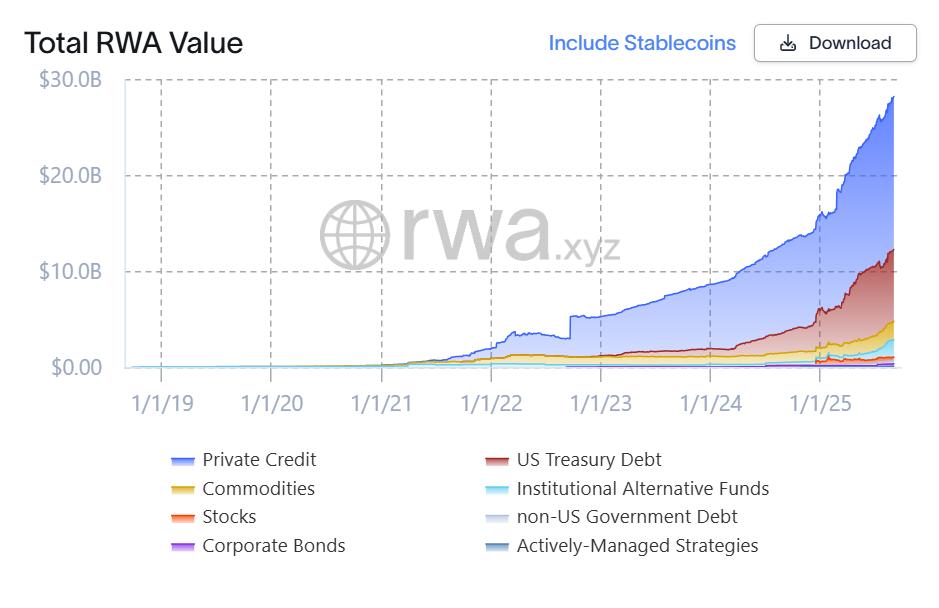

Venture Capital are pouring Capital into startups building crypto-asset infrastructure, with the real-world asset (RWA) Tokenize market exploding to $28 billion.

Venture Capital is shifting its strategy away from chasing short-term speculative trends and is focusing on building the foundational infrastructure for a mature digital economy. At the heart of this trend is the Tokenize of real assets ( RWA ), with the total value of onchain assets rising sharply from $15 billion to $28 billion this year alone, indicating growing interest from financial institutions.

The appeal of RWAs lies in their ability to combine the stability of traditional assets with the efficiency and transparency of blockchain. While U.S. Treasury bonds and private credit were the initial spearheads, the scope of applications is rapidly expanding to include stocks, real estate, and even energy infrastructure.

Recent investments suggest that a comprehensive infrastructure ecosystem is taking shape. Plural , in a $7.13 million Capital round led by Paradigm , is focused on Tokenize energy assets such as solar farms and data centers. This is a direct response to the massive energy demand from the artificial intelligence (AI) revolution, transforming energy infrastructure into a high-yielding, investible asset class on the blockchain.

In parallel, Credit Coop, after raising $4.5 million, is developing a programmable credit marketplace that allows businesses to use their expected cash flow as collateral, opening up a new and effective Capital channel.

In the data space – the core of the digital economy – Irys has raised $10 million to build a layer-1 blockchain specifically for big data applications like AI. With the datachain model, Irys provides a low-cost, programmable storage infrastructure that allows individuals and organizations to truly own, control, and extract economic value from data – the long-standing promise of decentralized technology.

Transaction and settlement infrastructure is also an essential link. Yellow Network, backed by a Ripple co-founder, is building a back-end system that enables secure cross-chain transactions between institutions. Meanwhile, Utila, with $22 million in new Capital , offers a complete stablecoin operating solution, from custody to compliance.

With over $60 billion in processed volume , Utila is demonstrating the central Vai of stablecoins as payment and settlement tools in the emerging digital economy.