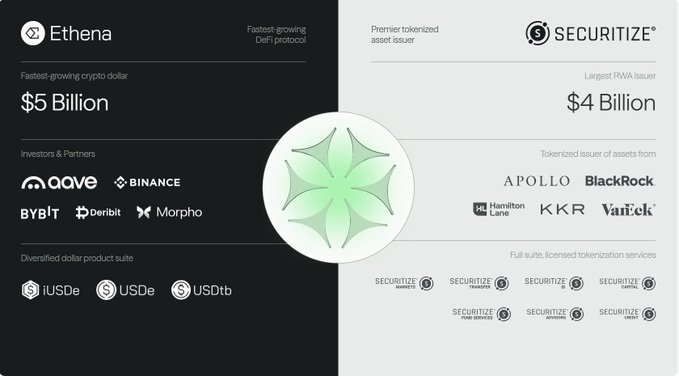

Converge is a massive $ENA catalyst: On-chain asset management could grow to a $500B-$1T sector in the next 10-15 years, with Ethena capturing a fair amount of that. Think about it: Why would Banks & Investment Managers not buy & sell their bonds, loans, and commodities on the blockchain with 24/7 availability and instant settlement? It gets interesting when you add DeFi to the equation. TradFi could interact with protocols such as $AAVE, $PENDLE, and others. We are witnessing the institutional adoption of Web 3 projects, and if you have a long enough time horizon, you can easily capitalise on that. I'm excited. (but also keep in mind I am a short-term trader, I get in and out of stuff, I don't want to make it sound like I am holding ENA for the next 10 years.)

Crypto Stream

@CryptoStreamHub

09-03

The Converge Blockchain is a massive, under-the-radar catalyst that could drive serious value to $ENA - but almost no one's talking about it yet.

It’s tricky to grasp since there isn’t much quality content yet — so let me break it down simply:

1. Ethena sees on-chain asset x.com/973261472/stat…

Signal Square

Channel.SubscribedNum 42920

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share