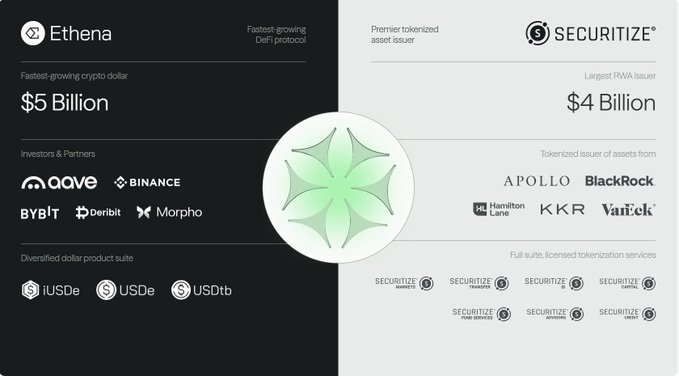

The Converge Blockchain is a massive, under-the-radar catalyst that could drive serious value to $ENA - but almost no one's talking about it yet. It’s tricky to grasp since there isn’t much quality content yet — so let me break it down simply: 1. Ethena sees on-chain asset management as a $500B-$1T opportunity, growing to that TAM over the next 10-15 years. 2. The idea is to onboard: Asset managers, Banks, and other Institutional Investors straight to the blockchain. 3. This unlocks commodities, loans, treasuries (& more) with blockchain properties like 24/7 & instant settlement. 4. Converge will be the perfect blend between DeFi and TradFi, offering both KYC and compliance and permissionless applications. 5. This allows asset managers to purchase treasuries on-chain from TradFi partners but also to take out a loan against them on Aave. 6. Converge is perfectly positioned because Ethena's ties to Web 3 (Aave, Pendle ...) and Secruitize's ties to TradFi (Blackrock, VanEck ...) Ethena is at the forefront of the RWA adoption, and honestly, I think it has way better chances of capturing a large share of this market than some competitors like Ondo. Why? Because they already proved they can scale financial products. USDE is now at $12 billion. It makes sense to assume they will onboard billions to Converge.

Ansem

@blknoiz06

07-26

ethena's ceiling is higher than luna's because the mechanism is safer

ethena's ceiling is higher than circle's because they have premium yield through usde & fallback to safer stable with equivalent usdc backing with UStb

+ their own L1 otw w/ converge, and no 50% profit share

Signal Square

Channel.SubscribedNum 42920

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share