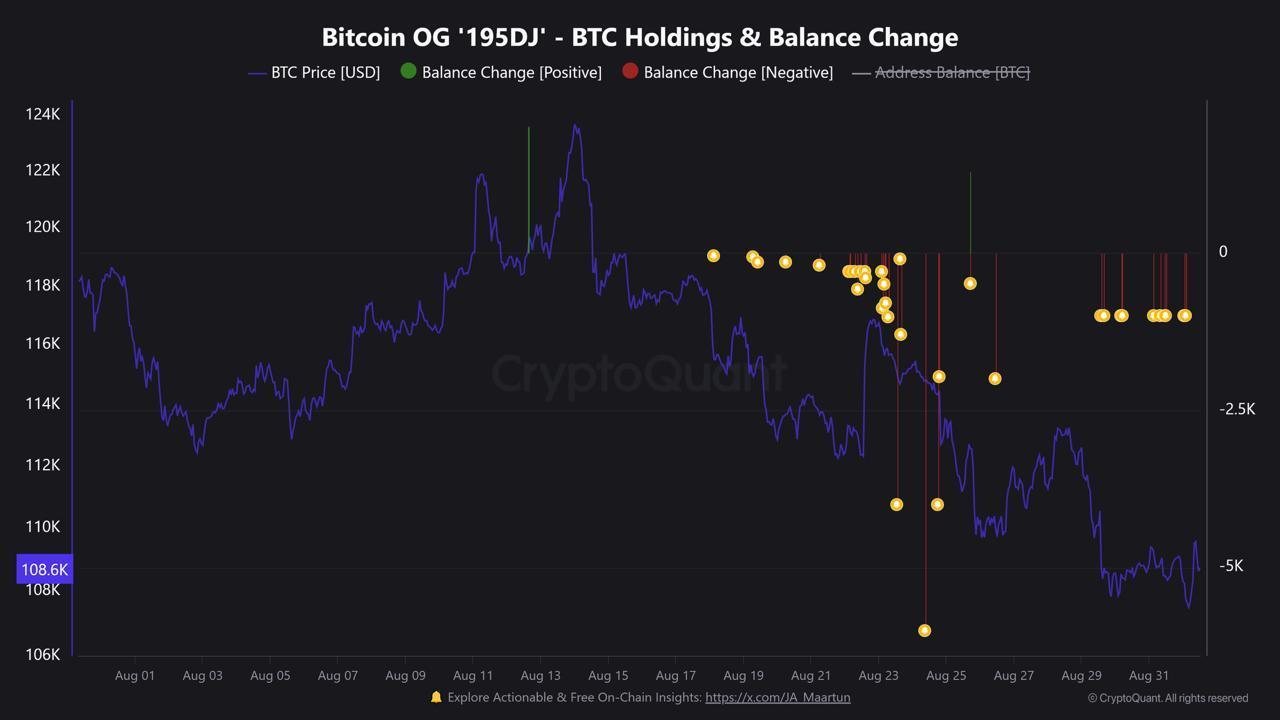

A major Bitcoin whale has sold more than 31,000 BTC since mid-August, according to data from CryptoQuant. The address, known as “195DJ,” still holds nearly 50,000 BTC, worth about $5.4 billion at current prices.

The whale’s move coincided with Bitcoin’s drop from above $120,000 to around $108,600 today. The steady sell-offs began on August 18 and were carried out in multiple waves.

OG Bitcoin Whale's Migration to Ethereum

According to CryptoQuant analyst JA Maartunn, the whale sent Bitcoin to Hyperliquid instead of holding the stablecoin and converting it to Ethereum . The move stands out because the address is a long-time and well-known holder.

Whales typically sell when prices rise and hold assets in cash. The move from Bitcoin to Ethereum suggests another view that ETH could outperform in the short term.

Bitcoin whale OG holdings chart. Source: CryptoQuant

Bitcoin whale OG holdings chart. Source: CryptoQuantLarge sell-offs often affect market liquidation and price stability. Bitcoin lost key support at $111,500, Dip near $107,000 last week.

Analysts note that big moves like this also affect market sentiment. Seeing a long-time whale move into Ethereum could prompt other traders to follow suit.

Historical context of similar whale actions

Previous cycles have shown similar whale behavior. In 2017 and 2021, gradual selling marked distribution phases that capped price increases.

In 2020, some whales moved into ETH ahead of the DeFi boom , while Bitcoin was consolidating.

This model suggests that Bitcoin may underperform while Ethereum attracts attention. However, whales still hold nearly 50,000 BTC, underscoring continued confidence in Bitcoin's long-term Vai .

Macro factors are adding pressure. Gold prices have hit record highs , attracting Capital as a safer hedge. Meanwhile, uncertainty over US monetary policy is keeping risk sentiment fragile.

Bitcoin's technical chart shows a Golden Cross signal, which is often read as a bullish signal. But heavy selling from whales could dampen that signal for now.

Whales’ move to ETH reinforces short-term caution. Bitcoin’s support around $107,000 remains fragile , while Ethereum could benefit from relative Capital .

In the long run, this is not a withdrawal from Bitcoin but a precaution. The diversification of whales into ETH may highlight a temporary change in dynamics rather than a structural change.