Shiba Inu (SHIB) has been one of the quieter major Token in recent months. Over the past three months, the coin has gained just 0.09%, remaining virtually unchanged while other major cryptocurrencies have rallied. At the time of writing, Shiba Inu is trading near $0.0000122, down 1.4% over the past 24 hours and down nearly 7.2% year-to-date.

The reason for this lack of volatility lies in on- chain signals — and they currently suggest that the oscillating structure may eventually break, but with sellers in control.

Profit taking patterns explain range trading

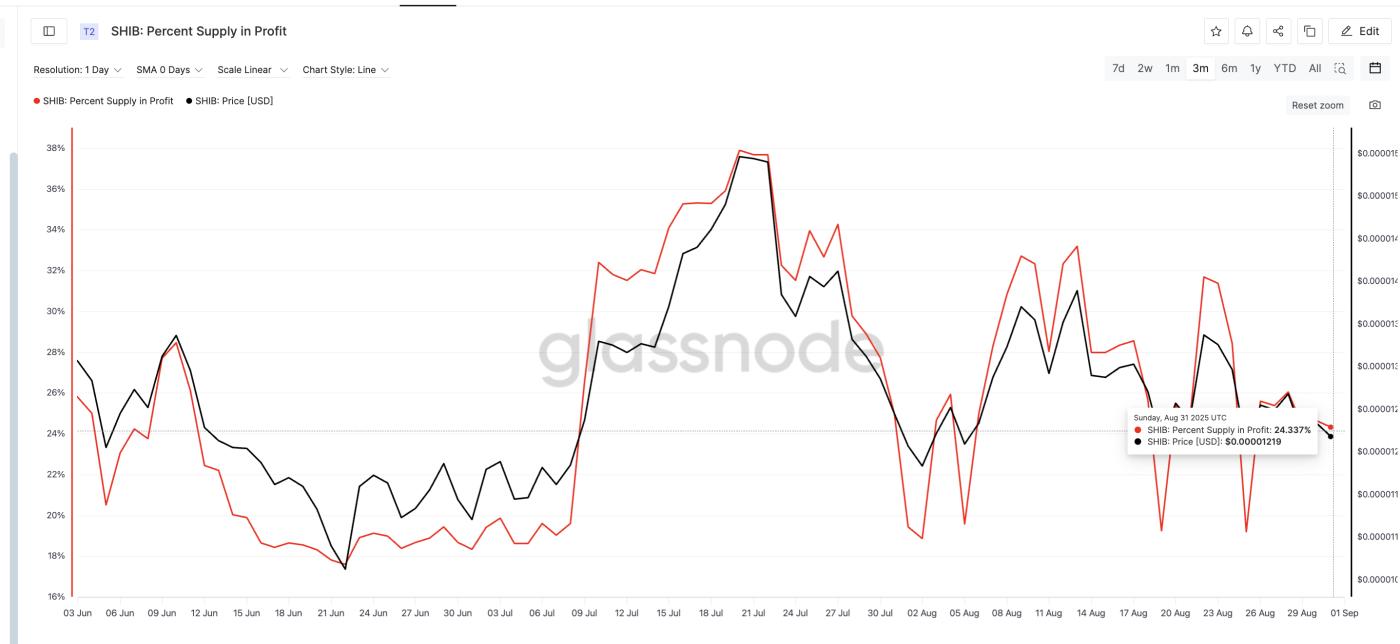

SHIB 's profitable supply percentage is at 24.3%, near the midpoint of its historical highs and lows. Bull runs tend to fade when the index approaches 37%, while sustainable Dip typically occur near 19%.

Being in the middle explains why the Shiba Inu price has been stuck in neutral (no net movement for three months): enough holders are in profit to trigger occasional profit-taking, but not enough losers to spur capitulation and new buying.

Profitable SHIB Supply Explains Price Fluctuations: Glassnode

Profitable SHIB Supply Explains Price Fluctuations: GlassnodeThat balance has kept SHIB in a narrow band.

To stay updated on TA and the Token market: Want more information on Token like this? Sign up for Editor Harsh Notariya's daily Crypto Newsletter here .

SHIB Price and Bearish Divergence: TradingView

SHIB Price and Bearish Divergence: TradingViewBut the 4-hour chart now shows a bearish divergence, where the Shiba Inu price makes a higher high while the RSI records a lower high. Since the RSI tracks momentum by comparing buying and selling pressure, this shows that although buyers have pushed the price higher, their strength is waning as profit takers step in.

Simply put, bulls are encountering heavier selling pressure than before, a setup that usually foreshadows bears.

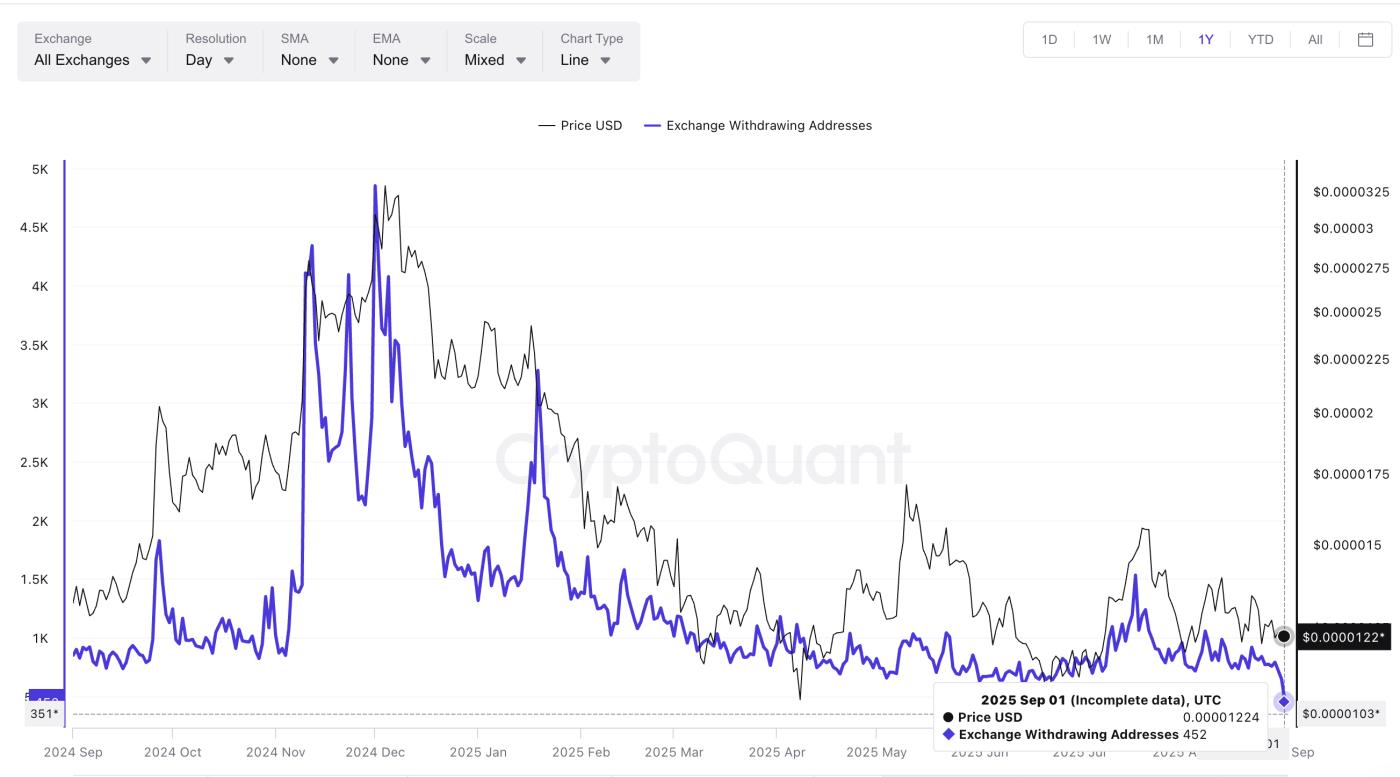

Weak withdrawals underscore waning interest

Typically, increased exchange withdrawals indicate that investors are moving Token into long-term holdings. However, instead of XEM at raw outflows, the Exchange Withdrawal Addresses metric counts the number of unique addresses making withdrawals — a more accurate measure of widespread participation.

Shiba Inu Buying Interest Is at an All-Time-Low: CryptoQuant

Shiba Inu Buying Interest Is at an All-Time-Low: CryptoQuantThat number has dropped to just 452, the lowest in a year.

Fewer addresses withdrawing coins from exchanges means there is less new buying interest. In other words, while the SHIB price is near its cycle low, traders do not seem eager to accumulate. Unless this changes, weak demand will add downward pressure.

Lack of buyers threatens Shiba Inu prices

With buying interest waning and bearish divergence emerging, the price chart for SHIB is vulnerable. Immediate resistance lies at $0.0000123, followed by a stronger hurdle at $0.0000135. Only a break above $0.0000141 could invalidate the bearish case and signal a bullish trend for Shiba Inu price.

Shiba Inu Price Analysis : TradingView

Shiba Inu Price Analysis : TradingViewOn the downside, a clear break below $0.0000119 could take SHIB price to $0.0000116 or lower, eventually ending the range-bound phase but not in the way the bulls would like.