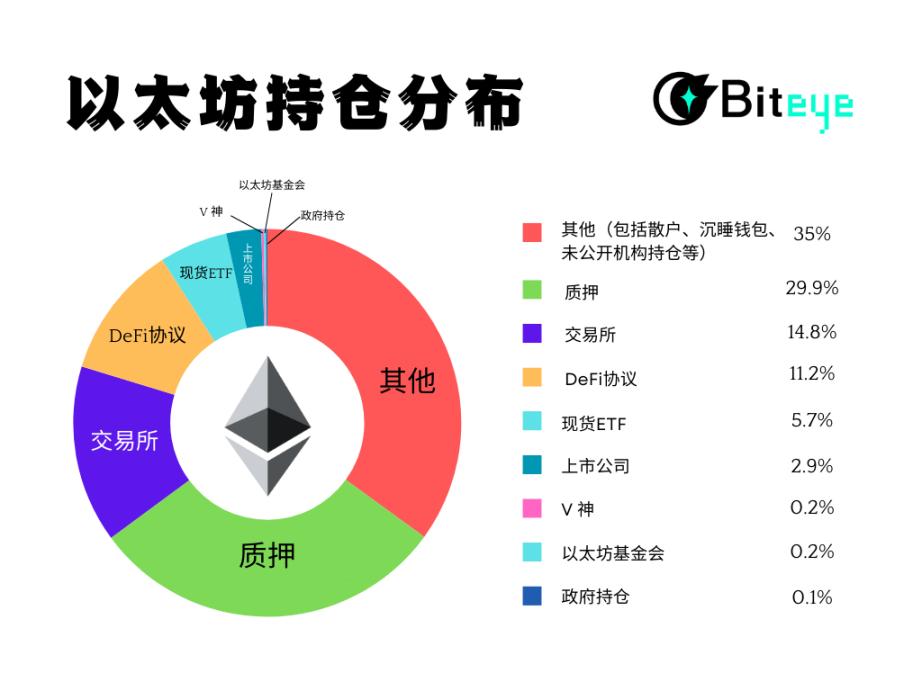

From spot ETFs, to foundations and Vitalik Buterin, to listed companies and exchanges.

The holding structure of ETH is completely different from what it was a few years ago.

This article will help you quickly understand: Why study holdings? What is the actual holding situation of ETH?

1/12 ⭐️ First of all, why is it important to study the holding structure?

We all know that crypto market narratives tend to change quickly, so:

Who is buying? How much?

Who is selling? Where is the selling pressure concentrated?

Which funds are locked up for a long time and which funds may flow out at any time?

These issues determine the price elasticity of ETH and its potential for ups and downs in the next cycle.

Taking Bitcoin as an example, the incremental buying of ETFs has already made Wall Street capital part of the price floor. Ethereum is following the same path.

2/12 Spot ETF

Over the past year, the most important funding channel for Ethereum has been spot ETFs.

As of August 28th, nine US spot ETFs collectively held approximately 6.9 million ETH, representing 5.75% of the total ETH supply (approximately 120.71 million). The significance of this capital lies not only in its scale, but also in:

They are "compliant funds" and backed by client funds of pension funds, investment banks and securities firms.

Once you enter the market, liquidity is relatively stable, and it is difficult to chase rising and falling prices like retail investors.

in:

BlackRock iShares ETHA: approximately 3.32 million ETH.

Grayscale ETHE & ETH Mini: approximately 2 million pieces in total.

Fidelity, Bitwise, VanEck, etc.: a total of approximately 1.58 million coins.

3/12 Listed Companies

As of now, a total of 17 listed companies hold a total of 3.5 million ETH, accounting for 2.9% of the total supply of Ethereum.

The top ten companies hold a total of approximately 3.8 million ETH, including:

Bitmine Immersion: 1.8 million, +186.8% change in 30 days, currently the largest single institutional holder.

SharpLink Gaming: 797,000, +82.0% change in 30 days

The Ether Machine: 345,000, +3.2% in 30 days

Others such as ETHZilla, FG Nexus, etc. are also gradually increasing their investment.

In general, Bitmine and SharpLink increased their holdings most aggressively, representing the emerging power of "crypto-stocks"; while Coinbase, Bit Digital and others increased their holdings more steadily.

4/12 Foundation

Currently, the Ethereum Foundation holds approximately 231,600 ETH, accounting for approximately 0.19% of the total supply.

While not massive, this portion of funds represents a long-term strategic reserve. The Foundation typically sells off small amounts of ETH periodically to support R&D, community funding, and operations, essentially creating a "healthy selling pressure."

5/12 Staking

Currently, approximately 36.137 million ETH are staked, representing nearly 30.1% of the total supply, and the scale of staking has repeatedly reached new highs. This locked-up ETH effectively reduces the circulating supply, alleviating selling pressure from both the supply and demand perspectives.

Staking means decreased liquidity, but it also gives rise to new derivatives like LST and re-staking. This is also the biggest difference between ETH and BTC: ETH is a productive asset that can generate interest.

6/12 Exchanges and Whale

Exchange reserves: Currently, approximately 17.845 million ETH, accounting for 14.8% of the total, a recent low. This indicates that more people are choosing to stake or hold ETH long-term, resulting in a decrease in the amount of ETH available for sale on exchanges.

Whale: A small number of on-chain whale hold hundreds of thousands of ETH, potentially causing significant market fluctuations at any time. For example, Rain Lohmus, founder of LHV Bank, holds 250,000 ETH, representing approximately 0.2% of the total network supply. His wallet, valued at over $1 billion, has not seen any transactions since 2015, but it is believed he may have lost his private key. For example, the "7 Siblings" (a mysterious group of on-chain whale) hold over 1.2 million ETH. By 2025, whale addresses (holding 10,000-100,000 ETH) will collectively control approximately 22% of the ETH supply.

Recently, the chain also tracked a mysterious institutional whale that quietly built a position of more than 200,000 ETH in mid-August, with funding sources including FalconX, Galaxy Digital and BitGo.

This "rotation" of large amounts of funds often amplifies market fluctuations.

7/12 DeFi Protocols

Currently, about 41.35% of ETH has been locked in contracts such as staking and DeFi, accounting for almost half of the circulation.

Of this, approximately 13.5 million ETH (approximately 11.25% of the total supply) is locked in various DeFi protocols and smart contracts such as cross-chain bridges, reflecting that ETH is being widely used in ecological applications rather than being idle.

8/12 V God

According to Arkham data, Vitalik Buterin personally holds approximately 240,000 ETH, accounting for approximately 0.2%.

This percentage is not high in the total 120 million ETH, but the significance of Vitalik Buterin’s holdings lies more in the “signaling effect”:

When he sells his coins, the market will speculate whether it is a donation or a simple reduction in holdings.

His hoarding of coins represents his confidence in the long-term value of ETH.

Therefore, the market even considers Vitalik Buterin's transfers as a "short-term indicator." This level of attention, in turn, creates a unique narrative for ETH.

9/12 Government Holdings

According to disclosed data, governments around the world hold a total of approximately 64,500 ETH, accounting for about 0.05% of the total supply. Although the scale is not as large as ETFs and listed companies, it means a stronger "legalization signal."

US government: approximately 60,000 ETH, worth approximately $270 million

Michigan State Government: approximately 4,000 ETH, worth $8 million

Royal Government of Bhutan: approximately 495 ETH, valued at $2.2 million.

10/12 Celebrity Shill

In addition to discussing the capital structure, this article also mentions the recent shill for ETH by celebrities.

EthHub co-founder @sassal0x: Half a year ago, he proposed that the price of ETH is expected to exceed $15k USD in 2025, and he has remained optimistic about the rise recently.

BitMEX co-founder @CryptoHayes: Recently, he once again expressed the view that ETH is expected to reach $10k–$20k.

Bitmine CEO Tom Lee @fundstrat: I believe we will see ETH at $15k this year.

LD Capital founder @Jackyi_ld: ETH is expected to break through the BTC exchange rate high, with the goal of reaching more than $10k, and at the same time usher in a round of price increases for mainstream currencies.

11/12 Other holdings

In addition to staking, ETFs, exchanges, and foundations, over 55 million ETH is categorized as “Other,” primarily consisting of the following sources:

1. Retail investors: They are numerous but dispersed. Each address holds a small amount of shares, but as a whole they constitute the basic foundation of the market.

2. Early dormant wallets: including accounts that lost their private keys in the early days, such as Rain Lohmus, founder of LHV Bank, who still holds about 250,000 ETH.

3. Undisclosed institutional holdings: Some venture capital firms and non-listed companies hold ETH, but these holdings may not be included in public financial statements.

12/12 Summary

Putting these channels together, ETH holdings have formed a layered funding network.

After the Bitcoin ETF brought in hundreds of billions of dollars in incremental funds, the reallocation of ETH holdings has only just begun. If ETH's valuation logic used to be "technology + narrative," the future will be more about "capital + liquidity."

This pattern means that ETH may be closer to "institutional assets" than ever before.