Ethereum DEX volume hit $140.1B in August, with record active addresses, showing ecosystem recovery despite TVL below 2021 highs.

Bonk.fun partners with WLFI to launch USD1 stablecoin on Solana, aiming to boost liquidity and strengthen Solana’s stablecoin strategy.

Japan Post Bank to issue a digital currency in 2026, supporting security tokens and NFTs, signaling deeper blockchain adoption in traditional finance.

ETHEREUM DEX MONTHLY VOLUME HITS $140.1 BILLION IN AUGUST

According to DefiLlama, in August 2025, Ethereum on-chain decentralized exchange (DEX) trading volume reached $140.1 billion, setting a new monthly record. Active addresses also hit 16.77 million, another all-time high. Ethereum’s current TVL stands at $92.58 billion, still about 17% below its $108.8 billion peak at the end of the 2021 bull cycle.

Analysis: Ethereum set new highs for both DEX trading volume and active addresses in August, signaling rapid recovery in ecosystem activity and liquidity. While TVL hasn’t fully returned to bull market levels, record trading volume suggests capital efficiency is improving, with users favoring high-frequency trading and liquidity usage over passive lock-ups. This “trading > TVL” trend highlights Ethereum’s central role in DeFi, and with L2 scaling and new protocol growth, on-chain activity still has room to expand.

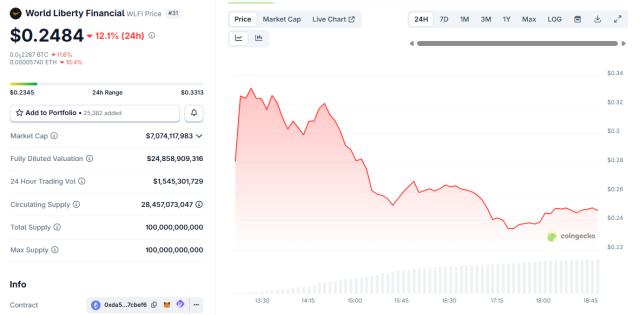

BONK.FUN PARTNERS WITH WLFI

Solana ecosystem launchpad Bonk.fun announced on X that it has partnered with WLFI, a crypto project linked to the Trump family, becoming the official launchpad for the USD1 stablecoin on Solana. Details of the launch and the broader significance of the collaboration will be released later.

Analysis: The partnership brings USD1 stablecoin into Solana’s issuance and distribution pipeline, strengthening its stablecoin and application layer strategy. If USD1 can leverage Bonk.fun’s traffic and ecosystem resources for rapid rollout, it could expand Solana’s stablecoin use cases and liquidity. Strategically, this collaboration enhances Solana’s financial infrastructure and could fuel a secondary wave of ecosystem growth. However, USD1’s compliance, market adoption, and circulation scale remain key variables.

JAPAN POST BANK PLANS TO LAUNCH DIGITAL CURRENCY IN 2026

Japan Post Bank announced plans to launch its own digital currency in 2026, with use cases including blockchain-based financial products such as security tokens and NFTs. As one of Japan’s largest financial institutions, this move could mark a major milestone for integrating blockchain into traditional banking.

Analysis: Japan Post Bank’s digital currency plan signals the country’s financial system is moving closer to digital assets and blockchain finance. Unlike private stablecoins or Web3 projects, a bank-issued currency carries greater compliance and credibility, potentially providing a robust settlement and trading channel for security tokens and NFTs. If successful, it could accelerate regulated growth of Japan’s digital asset market and financial digitalization. However, its positioning relative to the central bank digital currency (CBDC), and the balance between innovation and regulation, will be critical factors.

〈CoinRank Crypto Digest (9/01)|Bonk.fun Partners with WLFI〉這篇文章最早發佈於《CoinRank》。