The CFTC’s FBOT guidance creates a clear legal path for U.S. users to trade on compliant foreign exchanges.

Overseas platforms, U.S. brokers, and liquidity-sensitive traders stand to benefit most from the new rules.

Key questions remain: which exchanges will register first, whether U.S. futures exchanges can host spot crypto, and how the SEC will react.

Early this morning, the U.S. Commodity Futures Trading Commission (CFTC) officially released new guidance to clarify registration rules for foreign trading platforms (FBOTs). The announcement provides a legal path for non-U.S. trading platforms to register and allows American users to trade on them under CFTC oversight.

This marks a significant step for both crypto users and exchanges, reshaping how Americans can legally access global liquidity and setting new competitive dynamics in the market.

WHAT THE CFTC ANNOUNCED

The CFTC reaffirmed its long-standing FBOT framework, which applies to all non-U.S. exchanges that want to provide direct market access to American users. According to Acting Chairwoman Caroline D. Pham, this guidance aims to restore regulatory clarity, resolve confusion caused by recent enforcement cases, and ensure U.S. traders have access to the deepest global markets.

For decades, Americans have been able to trade on non-U.S. exchanges under FBOT registration. The new announcement removes the uncertainty that had emerged and signals the CFTC’s support for President Trump’s “crypto sprint” initiative.

WHY IT MATTERS

For American traders, this is a big change. Until now, many relied on VPNs to trade on overseas platforms—risky and often in violation of U.S. rules. Under the new guidance: • Only compliant and regulated exchanges can apply. • Access typically requires going through a U.S. broker or futures firm. • Unregistered platforms remain off-limits.

The impact is threefold: 1. Liquidity – U.S. capital flowing into global order books means tighter spreads and deeper markets. 2. Legitimacy – compliant overseas exchanges can now openly serve U.S. customers. 3. Clarity – traders no longer need to rely on hidden workarounds.

WHO BENEFITS

The main beneficiaries include overseas exchanges that successfully register as FBOTs, U.S. brokers who can channel client orders overseas, and traders seeking better liquidity.

The CFTC’s move also reflects a broader regulatory shift—from relying mainly on enforcement to providing clear, rules-based access. This structure is a long-term positive for adoption, liquidity, and mainstream recognition of crypto markets.

WHAT TO WATCH NEXT

In the short term, there are three important questions: 1. Which overseas exchanges will be the first to register as FBOTs? 2. Will the CFTC go further and allow U.S. futures exchanges to host spot crypto trading? 3. How will the SEC respond—will it try to assert jurisdiction in this area?

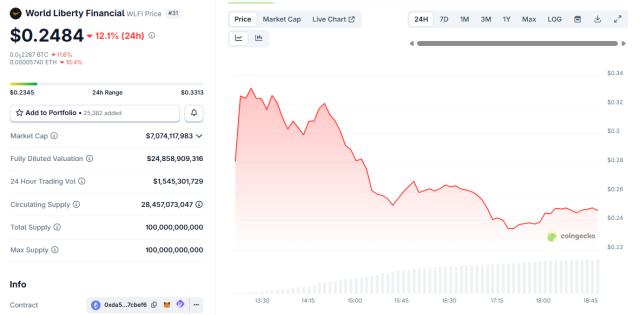

With total crypto market capitalization approaching $4 trillion—BTC above $2.2 trillion and ETH near $580 billion—regulatory clarity could amplify momentum. Analysts expect BTC to reach $150,000–225,000 and ETH to surpass $7,000 if bullish conditions hold. The CFTC’s framework could accelerate that trajectory by unlocking new pools of liquidity for U.S. traders.

CONCLUSION

The CFTC’s new FBOT registration path bridges U.S. traders and overseas exchanges, bringing legal clarity to a gray area that shaped trading for years. For exchanges, the race is now about who registers first and captures compliant U.S. flows. For traders, it means safer access to deeper global markets. For the industry, it signals a regulatory shift toward clear rules and away from patchwork enforcement.

〈CFTC’s New Rules: Pathways for Foreign Exchanges and Who Stands to Gain〉這篇文章最早發佈於《CoinRank》。