21Shares filed for a spot SEI ETF, highlighting growing crypto ETF demand and Sei network’s potential as a next-generation Layer-1 blockchain.

The ETF tracks SEI price via CF Benchmarks, with Coinbase handling custody and trading, ensuring transparency, security, and potential staking rewards.

Crypto ETFs bridge traditional finance and blockchain, lowering barriers for investors while boosting legitimacy and liquidity for assets like SEI.

On August 28, 2025, 21Shares, a leading issuer of crypto exchange-traded products (ETPs), filed an S-1 registration with the U.S. Securities and Exchange Commission (SEC). It plans to launch a spot exchange-traded fund (ETF) that tracks the price of SEI, the native token of the Sei network.

This move signals a new wave in the crypto ETF market and gives investors an easy way to access a new blockchain asset. The filing shows the fast evolution of the crypto market and highlights the potential of the Sei network as a Layer-1 blockchain. This article uses the event to discuss the meaning of crypto ETFs and the unique value of the SEI token and the Sei network.

21SHARES’ SPOT SEI ETF: DETAILS AND MEANING

The 21Shares spot Sei ETF aims to track SEI’s price using the CF SEI-Dollar Reference Rate (New York Variant) from CF Benchmarks. The fund uses a passive strategy. It does not use leverage or derivatives. This helps keep pricing transparent and close to the market. Coinbase Custody Trust Company will hold SEI in cold storage. Coinbase Inc. will handle trade execution. These roles support security and liquidity for the fund.

It is notable that 21Shares says the fund may use staking of SEI to earn extra yield for investors. Staking is a consensus method used by many blockchains. Token holders lock assets to help secure the network and receive rewards. But SEC rules on staking in ETF products are still unclear (for example, approval of staking for the Grayscale Ethereum ETF has been delayed many times). 21Shares says it will proceed with care based on regulation.

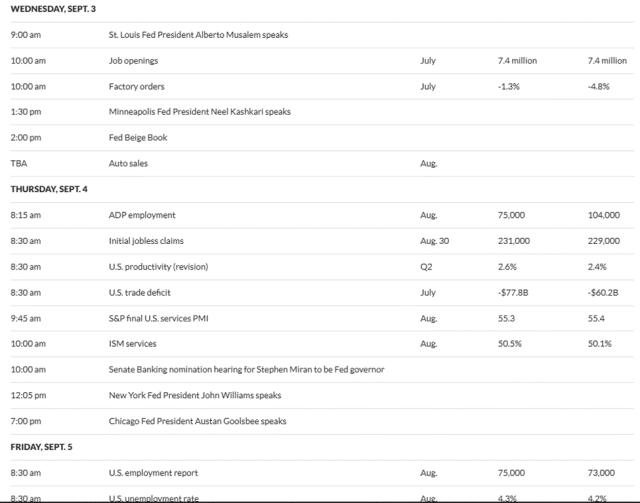

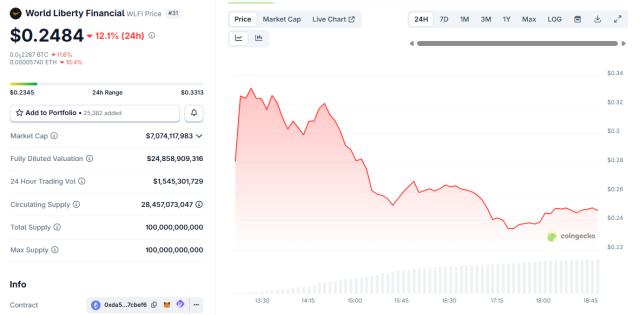

This filing is not an isolated case. In early 2025, Canary Capital also filed for a SEI ETF, showing strong market interest in the Sei network. After the filing became public, the SEI token rose 3.33% in a short time to about $0.31. Its market cap was about $1.82 billion, and daily trading volume was over $210 million. Although recent selling pressure exists, analysts still see long-term potential. Some expect the price to break $0.70 and even reach $1 in the future.

CRYPTOCURRENCY ETFS: THE BRIDGE BETWEEN TRADITIONAL FINANCE AND BLOCKCHAINS

A cryptocurrency ETF combines crypto assets with traditional markets. It lets investors buy fund shares through a brokerage account and hold crypto exposure indirectly. They do not need to manage private keys or use a crypto exchange. This lowers the technical barrier and offers the protection of traditional market rules.

Since the United States approved the first spot Bitcoin ETFs in 2024, the market has grown fast. In August 2024, spot Ethereum ETFs were also approved, paving the way for other assets. Today, applications for Solana, XRP, and Cardano ETFs are waiting for SEC decisions. The rise of crypto ETFs has brought in more institutional money and improved the legitimacy and acceptance of crypto.

However, the SEC is cautious about ETFs for assets other than Bitcoin and Ethereum. It worries about market manipulation, liquidity, and investor protection. The 21Shares Sei ETF filing comes in this setting. Its approval may depend on clearer rules. Analysts expect October 2025 to be an important time for SEC decisions on several crypto ETF filings, including SEI.

SEI AND THE SEI NETWORK: THE POTENTIAL OF A NEXT-GENERATION BLOCKCHAIN

SEI is the native token of the Sei network. The Sei network is a Layer-1 blockchain launched in August 2023. It is built for decentralized exchanges (DEXs) and trading infrastructure. Sei uses parallel processing and an optimized consensus to reach high throughput and low latency. It calls itself the first Layer-1 designed for trading.

High-performance trading: The network is optimized for order-book trading. It supports thousands of transactions per second. Confirmations can be in hundreds of milliseconds, faster than many blockchains.

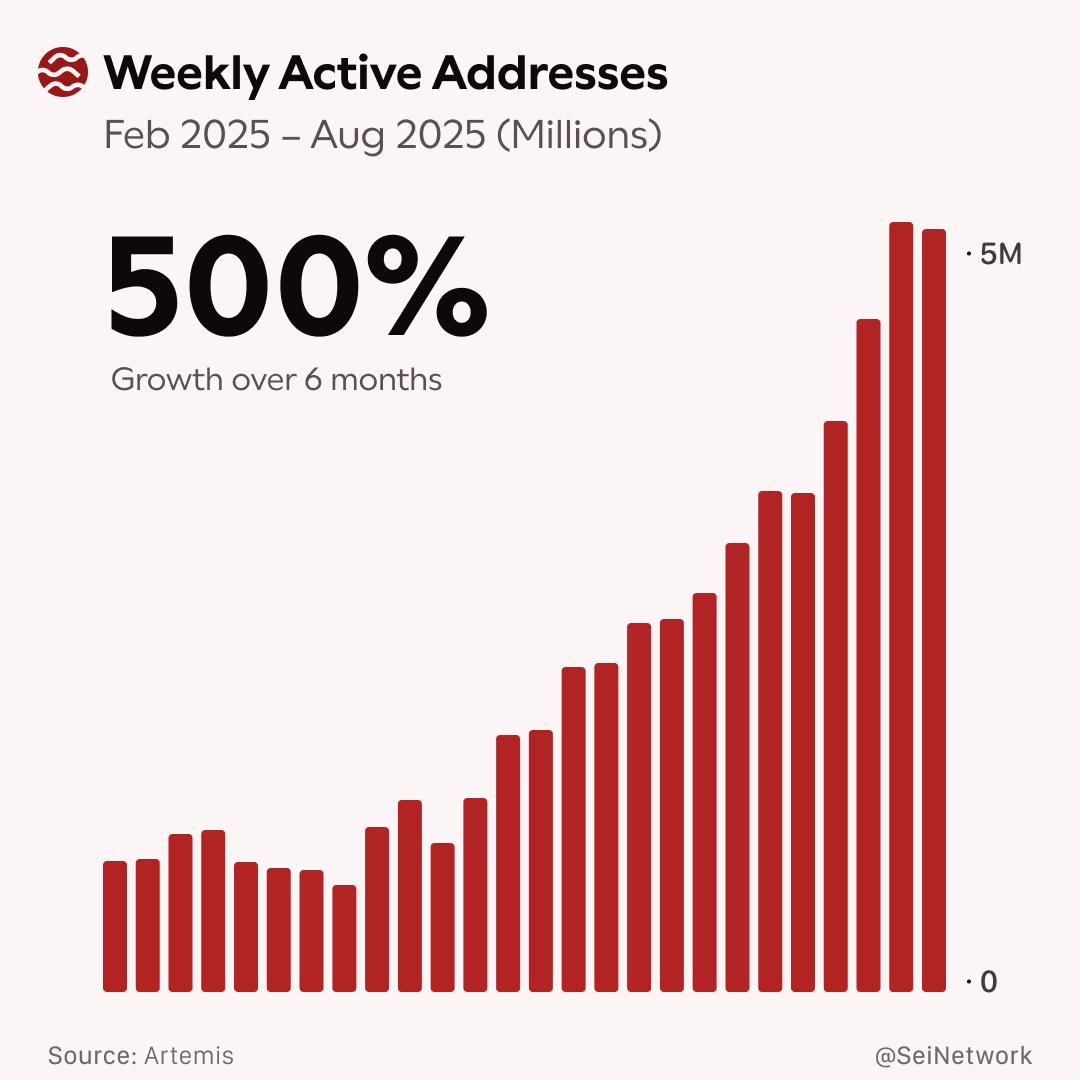

Ecosystem growth: The network supports many DeFi apps, including DEXs, derivatives platforms, and NFT markets. Many developers and projects have joined.

Token utility: SEI is used for gas fees, governance, and possible staking rewards. Holders can stake to secure the network and earn yield.

As of late August 2025, SEI traded around $0.30. Its market cap ranked among the larger crypto assets. Recent volatility lowered open interest, showing weaker short-term demand. Even so, the network’s technology and ecosystem growth support its long-term value.

〈21Shares Applies for a Spot Sei ETF〉這篇文章最早發佈於《CoinRank》。