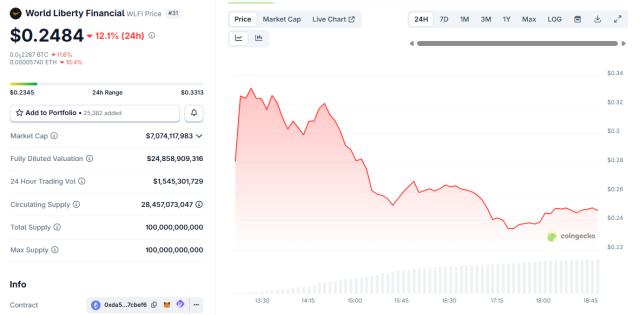

South Korea's two major crypto exchage have simultaneously expanded their listings. According to an official announcement, Upbit will open three major trading pairs: USD1 against Korean won ( KRW ), USDT, and Bitcoin ( BTC ) at 16:00 on September 1 , Korean time, and will further launch WLFI against KRW , USDT, and BTC at 22:00 that evening.

Bithumb also launched the USD1/KRW trading pair at 4:00 PM on the same day. This meant USD1 gained direct liquidity in Korean won, allowing Korean retail investors and quantitative funds to enter and exit the market directly in their local currency, shortening the conversion time between fiat and USD1. This also boosted WLFI's market presence.

In terms of market structure, KRW direct trading pairs often serve as a megaphone for the South Korean market. With more tradable KRW pairs on the front end, market making and arbitrage paths are shortened, spreads narrow more quickly, and trading density is more concentrated. For USD-denominated stablecoins, this acts like a large "liquidity node" in Asia, allowing capital momentum to flow in and out with less friction and facilitating market capitalization surges.

WLFI contracts total US$880 million

The market popularity of WLFI is reflected on the leverage side. According to Coinglass data, the open interest of WLFI contracts across the entire network has reached US$ 880 million, equivalent to 2.563 billion WLFI , a huge increase of 47.58% in the past 24 hours.

This trend of rising derivatives positions before widespread spot trading is common in anticipatory trading, where funds first stake in the futures market, waiting for spot liquidity to open up before completing a round of turnover through basis and inter-market spreads. For volatility, this often means a higher probability of a "high-opening" scenario, making the short-term market more like surfing than rafting.