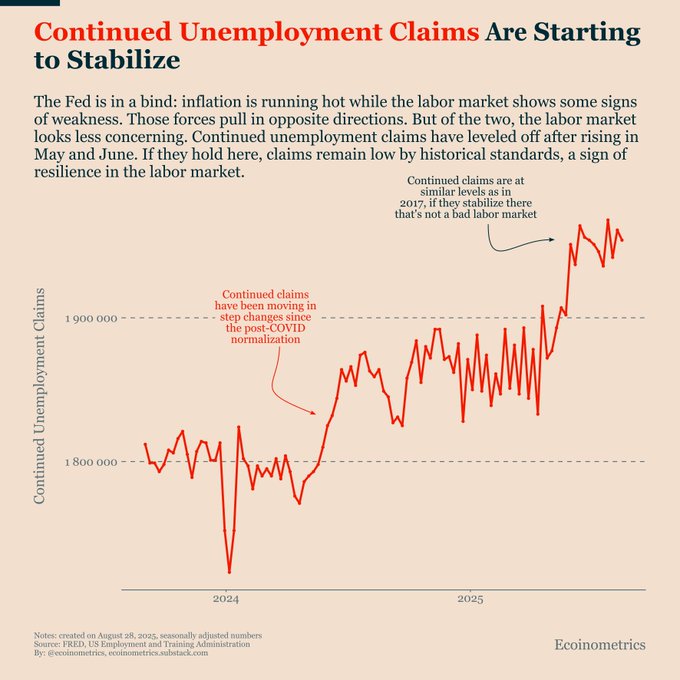

The Fed is in a bind: inflation is still running hot while the labor market shows some signs of weakness.

Of the two, the labor market looks less concerning.

Continued unemployment claims have leveled off, if they stabilize here, that’s not a weak labor market by historical standards.

That means inflation stays the Fed’s main concern. And as long as inflation is sticky, the risk is the Fed leans more hawkish than markets expect, a setup that can hit Bitcoin and other risk assets.

For Bitcoin, the path forward hinges less on short-term labor weakness and more on whether inflation forces the Fed to stay tighter for longer. That’s where the real macro risk lies.

Follow @ecoinometrics for more data-driven insights on Bitcoin and macro.

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share