On August 27th, Google Cloud announced the launch of Google Cloud Universal Ledger (GCUL) , a layer-1 blockchain infrastructure designed specifically for financial institutions. The announcement sparked a strong market reaction, as it marked Google's official transition from a mere cloud service provider to a blockchain builder.

For a long time, Google played a supporting role behind the scenes, providing cloud hosting, node services, and APIs for Web3 projects. Now, however, it has thrust itself into the spotlight, directly competing with blockchain projects from fintech companies like Stripe and Circle , as well as traditional financial institutions like JPMorgan Chase's Onyx and Canton Network . This is a significant bet, and it's reshaping the industry landscape.

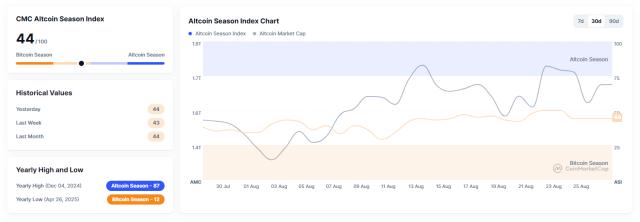

The accelerated evolution of the competitive landscape

The emergence of GCUL is not an isolated incident, but the latest in a growing trend of "building your own blockchain." In the past two years, both fintech companies and traditional exchanges have been quietly launching their own blockchains.

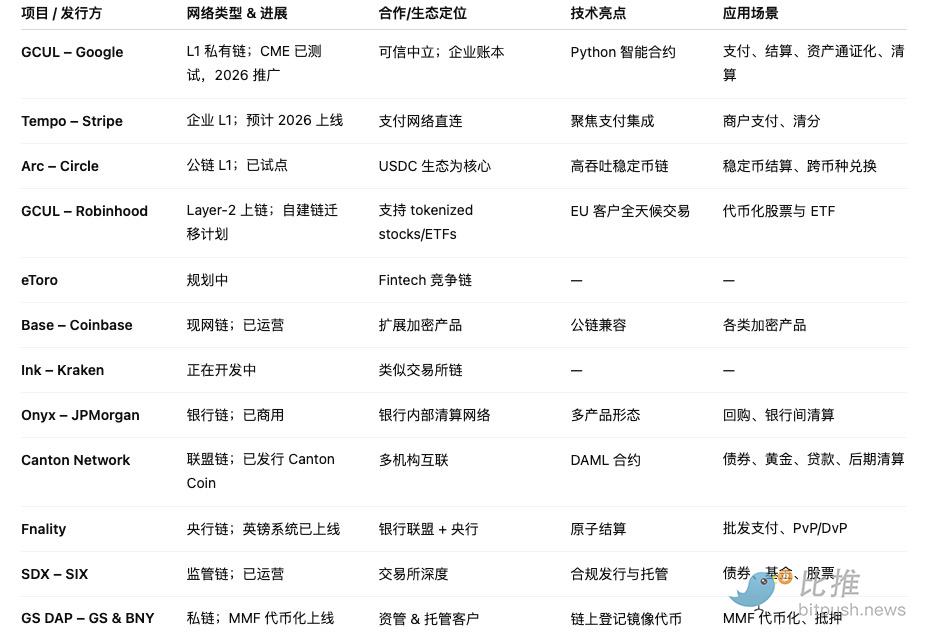

In the fintech world, Stripe launched Tempo with a clear purpose: to move its vast merchant payment network directly onto blockchain, thereby reducing settlement costs and improving transaction efficiency. Circle announced Arc this summer, using the USDC stablecoin as blockchain fuel and emphasizing high-speed settlement and cross-currency exchange capabilities. Unlike these two blockchains, Google's GCUL doesn't rely on a specific ecosystem. Instead, it touts its "trusted neutrality" and seeks to ensure that any institution can use it with confidence.

Traditional finance is also not far behind. JPMorgan Chase launched Onyx as early as 2019 and has implemented JPM Coin in the repo market and interbank clearing. The Canton Network is a multi-party consortium blockchain, jointly promoted by giants such as Goldman Sachs, Deutsche Börse, Microsoft, and BNP Paribas, with the goal of interconnecting the ledgers of different institutions. Meanwhile, Fnality launched a central bank-regulated payment system in the UK. SIX Swiss Exchange's SDX focuses on tokenizing bonds and stocks. Goldman Sachs and BNY Mellon's GS DAP has already moved money market funds onto the blockchain, enabling on-chain registration and instant transfers.

New competitors are constantly emerging among retail brokerages and crypto exchage. Robinhood has launched a second-layer network based on Arbitrum in Europe, supporting 24/7 trading of tokenized stocks and ETFs, and plans to migrate to its own blockchain in the future. Coinbase launched Base early on, becoming one of the first exchanges to run on a public blockchain based on Ethereum. Kraken is also developing a chain called Ink, attempting to replicate this model. It can be said that whether it's Wall Street investment banks, Silicon Valley tech companies, or even the brokerages and exchanges most familiar to retail investors, they are all vying for a say in the "next settlement network" in various ways.

What it means for the crypto industry

This trend presents both opportunities and challenges for the crypto-native world. In the short term, the tokenization of institutional assets is more likely to occur on permissioned blockchains like GCUL, Onyx, and Canton, rather than Ethereum or Solana. Clearing, staking, and wholesale payments require compliance and auditing, making it difficult for open public chains to directly handle these scenarios.

But this doesn't mean public chains are obsolete. On the contrary, with GCUL's emphasis on neutrality and programmability, it could become a bridge: assets are first generated and registered on GCUL, then access the open crypto market through cross-chain channels. At that point, DeFi could usher in new sources of liquidity, and traditional financial assets could find new trading channels. This "handshake between TradFi and DeFi" may be the most anticipated change in the coming years.

The emergence of new opportunities

A new wave of entrepreneurship is brewing around GCUL and other emerging chains. Institutions moving to blockchains will require compliant identity authentication tools, on-chain audits, and risk control systems—all areas where startups can enter the market. As more securities, bills, and funds become tokenized, the question of how to securely custody and manage these assets will spawn a new generation of custody and risk management companies. At the same time, exchanges, brokerages, and clearing houses will inevitably need new cross-chain bridges and gateways to connect with different chains, which also represents a huge market opportunity.

This scenario is very similar to the situation a decade ago when AWS first became popular. While the underlying cloud computing landscape was dominated by giants, the real drivers of innovation were the thousands of startups developing around APIs and service interfaces. Today, GCUL is likely to repeat this pattern, only with the main battlefield expanding from the internet to global finance.

A dual-track future

It can be foreseen that blockchain finance in the future will present a "dual-track parallel" pattern.

One track is the open world of public chains. Ethereum, Solana, Avalanche, and others continue to drive retail innovation, driving diverse applications like DeFi, NFTs, and GameFi, emphasizing openness and community-driven development. The other track is institutional permissioned chains: GCUL, Tempo, Arc, Onyx, Canton, Fnality, SDX, GS DAP, and private chains built by exchanges like Robinhood, Coinbase, and Kraken. These emphasize compliance and stability, directly connecting to the global financial system.

In the short term, these two tracks will develop independently, without interfering with each other. However, in the long term, they will inevitably converge. Once compliant interfaces and cross-chain tools mature, assets generated by institutions on permissioned blockchains will be able to enter the public blockchain market, and innovative products on public blockchains will be able to enter the compliant blockchain in a modified form. That moment will mark the true and deep integration of traditional finance and crypto finance.

The launch of GCUL is more than just a technological experiment by Google; it's a bet by tech giants on the future of financial infrastructure. This is a global race with a single goal: to define the next-generation financial settlement network. For ordinary users, the immediate changes may not be noticeable. But in the future, when the stocks you buy, the bills you pay, and even your salary payments are all processed on these chains, you will realize that this "ledger war" is quietly transforming the entire financial world.

Twitter: https://twitter.com/BitpushNewsCN

BitPush TG discussion group: https://t.me/BitPushCommunity

Bitpush TG subscription: https://t.me/bitpush