Quick Facts:

- According to K33 data, open interest in Bitcoin notional perpetual contracts has surged to a two-year high, increasing the risk of long liquidations.

- Vetle Lunde, head of research at K33, said that last week, a large investor holding 22,400 bitcoins rotated funds into Ethereum, helping Ethereum hit a new historical high, highlighting the change in market momentum.

Bitcoin’s recent price weakness may not be over yet, according to K33 data. Surging leverage and a significant rotation into Ethereum (ETH) put the leading cryptocurrency at risk of further downside in the near term.

Vetle Lunde, head of research at K33, stated in a report released Tuesday that notional open interest in Bitcoin perpetual contracts has surged to a two-year high of over 310,000 BTC (approximately $34 billion), with an increase of 41,607 BTC in the past two months alone, including a 13,472 BTC surge over the weekend alone, indicating a possible inflection point. He explained that this surge, coupled with a surge in annualized funding rates from 3% to nearly 11%, indicates that long positions are becoming more aggressive during a period of relatively stagnant prices.

Lunde noted that current market conditions resemble the leverage accumulation seen in the summers of 2023 and 2024, both of which saw large liquidations in August. However, this time, the peak in open interest occurred later in the month, suggesting the market could enter a more prolonged period of consolidation—potentially catching buy the dips hunters off guard. He warned that "the risk of a long squeeze is increasing in the near term," adding that it may be prudent to adopt conservative positions until the market digests the excess leverage.

“Substantial” rotation to Ethereum

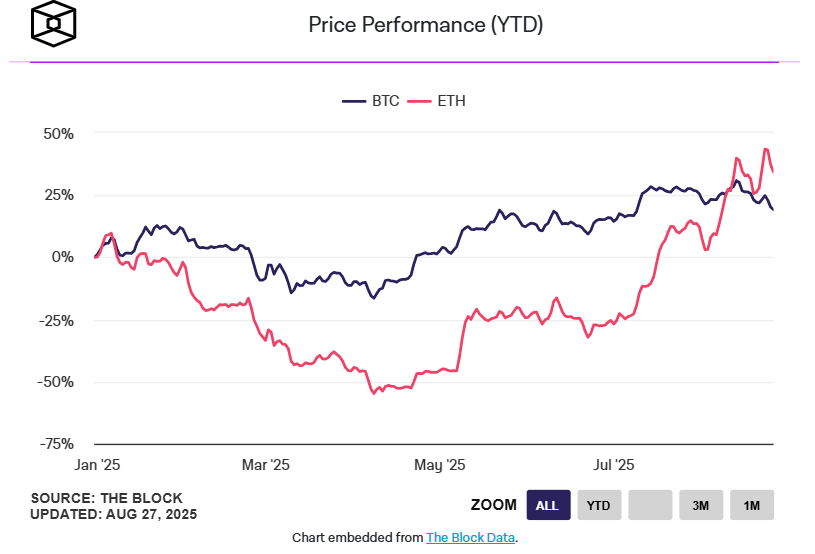

Lunde cited a large rotation into Ethereum by a long-term holder last week, who swapped 22,400 Bitcoin for Ethereum via the decentralized exchange Hyperunit as one reason for the increased market volatility. This move by one large investor propelled Ethereum to a new all-time high of $4,956 over the weekend, ending a 1,380-day correction and shifting market momentum in favor of Ethereum.

The Ethereum/Bitcoin (ETH/BTC) ratio also broke above 0.04 for the first time in 2025, highlighting Ethereum's current relative strength. However, Lunde noted that despite Ethereum's gains against the US dollar (ETH/USD), its long-term relative trend against Bitcoin remains weak—with 1-year, 2-year, and 3-year rolling ETH/BTC returns still in negative territory.

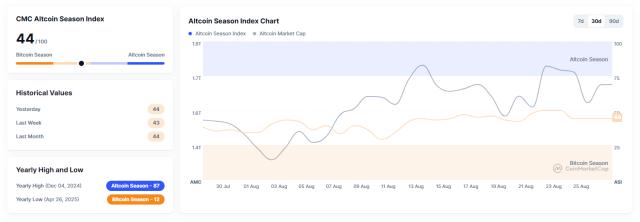

Historically, Ethereum's all-time highs have often marked the apex of the entire crypto market. Past cycles, such as those in 2017 and 2021, have shown a similar sequence: Ethereum broke out, Altcoin surged, and Bitcoin stagnated due to waning demand—sparking concerns that the current crypto bull run might be nearing its end .

However, compared to Bitcoin's previous high of less than 40%, BTC's current market share remains high at 58.6% . Lunde stated: "Thus, while the relationship between Ethereum's historical highs and Bitcoin is concerning, we haven't seen any clear signs of overheating in the Altcoin market as a whole."

Meanwhile, institutional flows remain cautious. According to K33, CME traders have reduced their Bitcoin exposure, while the options market has shifted significantly to a defensive stance, with the skewness of long-dated options entering positive territory for the first time since 2023. In contrast, Ethereum futures are trading at a double-digit premium and have outperformed Bitcoin since early August, driven in part by significant ETF inflows and accumulation in corporate coffers. However, as Ethereum's relative strength becomes apparent, traders are cautiously waiting to see whether this market cycle will follow historical trajectory or take a completely different approach.