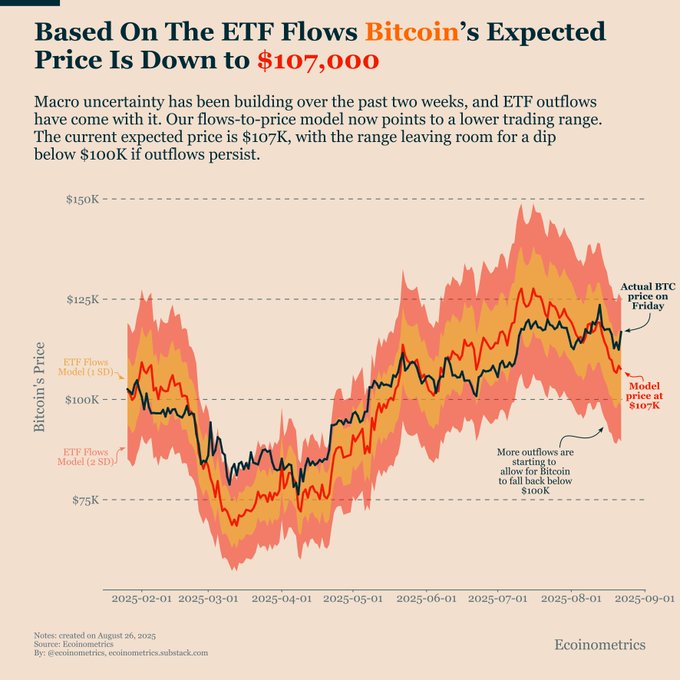

ETF flows are pulling Bitcoin lower.

As of Friday, our flows-to-price model put the expected price at $107K, with downside risk below $100K if outflows persist.

The macro uncertainty of the past few weeks is showing up directly in the flows.

The key here is that flow-driven selling matters more than day-to-day volatility.

Negative ETF flows mean actual capital is leaving the structure, not just traders reacting to price.

That’s why flows, not short-term noise, are the signal to watch.

Follow @ecoinometrics for more data-driven insights on Bitcoin and macro.

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share