Financial markets are holding their breath as Jerome Powell arrives in Jackson Hole, Wyoming, for what could be his final major speech as Federal Reserve Chairman.

For more than a decade, Powell’s words have reverberated through global markets, and Friday’s speech promises to be no exception. Investors in cryptocurrency and stock markets are looking for clues about whether a September rate cut is in the cards, while also watching for a lasting shift in the Fed’s framework that could shape Powell’s legacy.

Powell's final speech at Jackson Hole could shape his legacy

The Jackson Hole economic symposium has long been a stage for Fed chairmen to signal strategy changes, which explains why it is known as the Oscars of Monetary Policy.

“…a line from Powell can move stocks, bonds and Bitcoin globally,” wrote analyst Bull Theory .

Recent history reflects this strength , including Powell’s 2021 speech, which reassured markets with dovish signals. Similarly, the Fed chair’s 2022 hawkish shift prompted sell-offs in the stock and cryptocurrency markets .

Last year's remarks drew mixed reactions , but in 2025, anticipation is heightened by the realization that this could be Powell's final appearance at the event.

Economists say Powell could use the moment, in addition to cutting interest rates, to outline major changes to the central bank's dual mandate of inflation and employment .

These reforms will outlast his tenure and shape monetary policy for years.

“Jerome Powell will deliver his final speech at Jackson Hole this Friday. While investors will be listening for signs of a rate cut next month, Powell could announce bigger changes to the central bank’s dual mandate — and seal part of his legacy,” Yahoo Finance writes .

Meanwhile, within the Fed, the debate is Chia . Cleveland Fed President Beth Hammack said she would not support a cut “if the meeting were tomorrow,” citing stubborn inflation signals.

Jeffrey Schmid of the Kansas City Fed echoed that caution, though both stressed openness ahead of the September decision.

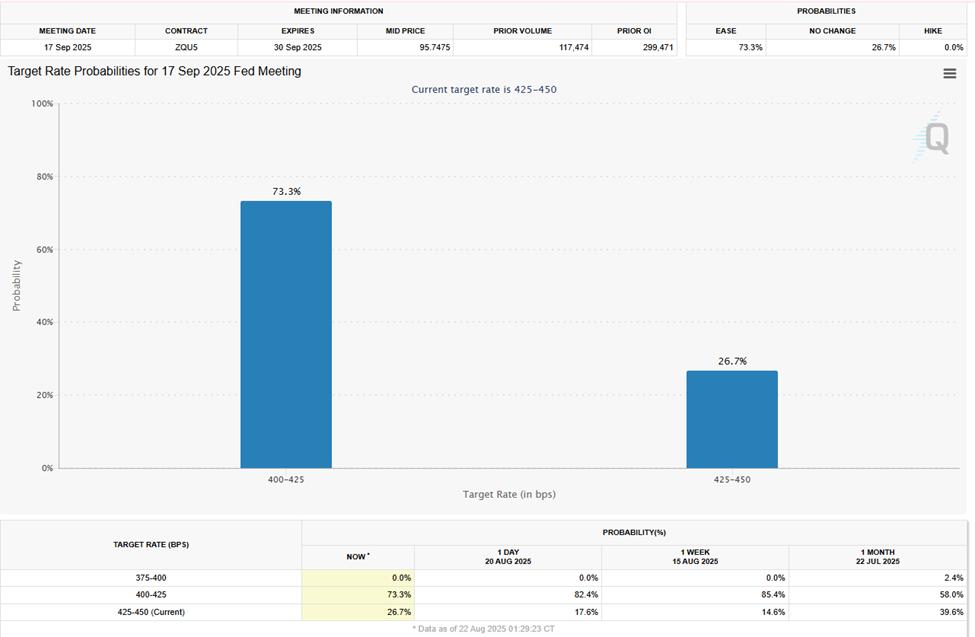

In contrast, Fed Governors Michelle Bowman and Christopher Waller have leaned more dovish. However, market odds are pricing in a 73.3% chance of a 0.25% cut , but uncertainty remains high.

Rate cut probability. Source: CME FedWatch Tool

Rate cut probability. Source: CME FedWatch ToolPowell is also expected to formally abandon the Medium inflation target policy adopted in 2020. In retrospect, this policy accepted exceeding the 2% inflation target to balance out previous misses.

Central banks have used monetary policy for years to keep inflation at their target, usually at or below 2%. Meanwhile, governments will continue to work to control debt to maintain this economic balance.

BeInCrypto reported on the mechanism by which the end of the 2% inflation target could positively impact cryptocurrencies .

Macro uncertainty risks crypto and stock markets

Reports suggest that investors have started hedging on the SPY and Tesla markets.

Beyond traditional markets, Powell’s words could once again be Vai for Bitcoin. In 2021, a dovish Jackson Hole kicked off what some are calling the Bitcoin Supercycle .

Cryptocurrency analyst Remington believes conditions this year are even better, pointing to the Fed's three previous rate cuts and a market ready for new Capital inflows.

“Bitcoin will get a new growth impetus and consolidate at new levels,” he said .

Capital could spill over into altcoins, potentially leading to explosive returns for Token with low market Capital , according to analysts. Others, however, are more cautious, including Nic Puckrin, founder of Coin Bureau.

“…what is driving the market down is not crypto-specific factors but macroeconomic instability,” Puckrin said in a statement to BeInCrypto.

He pointed to mixed inflation data, weak jobs reports , geopolitical risks and political pressure from the US on the Fed as reasons why investors are taking a defensive stance.

Meanwhile, Bitcoin price has slipped below a key trendline following profit-taking, and is trading at $113,144 at the time of writing.

Bitcoin (BTC) price performance. Source: TradingView

Bitcoin (BTC) price performance. Source: TradingViewFor Powell, Jackson Hole is about more than the next move on interest rates. It’s an opportunity to leave a clearer and more sustainable policy framework after years of extraordinary volatility.

For markets, both Wall Street and crypto, the concern is whether his final move will reinforce caution or spark a new wave of risk appetite.