The Bitcoin Futures market sentiment index drops to 36%, showing a clear downward trend as retail investors sell off heavily and the possibility of price testing the 112,000 USD area increases significantly.

Bitcoin's continued sharp decline has led to a pessimistic sentiment in both Futures and spot markets, with many technical indicators supporting the short-term downward trend, creating greater risks for FOMO investors.

- Bitcoin Futures sentiment index falls into the decline zone, signaling increased selling pressure risk.

- Retail investors dominate the market, intensifying selling positions, with Long Short Ratio continuing to decrease.

- Technical indicators like RSI and Stochastic RSI suggest the decline may be prolonged, with the 112,000 USD support area drawing attention.

Is Bitcoin Facing a Short-Term Price Decline?

Bitcoin continuously dropped for five sessions with a 3.24% weekly decline, recording a short-term dip at 114,442 USD before trading around 115,055 USD.

The latest report from CryptoQuant shows that this decline is making market sentiment pessimistic, creating additional short-term selling pressure.

CryptoQuant Market Analysis Report, August 2025

Both Futures and spot markets simultaneously carry a negative sentiment, making investors easily swept into a selling wave, increasing the risk of deep price declines in upcoming sessions. Risk management becomes a critical factor.

What Does the Sharp Decline in Bitcoin Futures Sentiment Index Mean?

According to expert Axel Adler, the sentiment index in the Bitcoin Futures market dropped to 36%, much lower than the neutral threshold (45%), signaling a dominant downward trend.

When the sentiment index drops deeply below 45%, it typically means most traders become cautious, prioritizing capital preservation over opening new buy positions.

Axel Adler, analyst at CryptoQuant, posted on X in August 2025

History shows that significant changes in Futures sentiment index often forecast Bitcoin price volatility. Specifically, in mid-August 2025 when the index surged to 70%, Bitcoin broke through to 123,000 USD. Conversely, the drop to 36% causes strong selling during recovery attempts, maintaining downward pressure. Adler predicts the risk of reaching 112,000 USD is well-founded.

What Role Do Retail Investors Play in the Current Trend?

Analysis from AMBCrypto shows that retail investors are dominating the Bitcoin Futures market with an extremely pessimistic sentiment.

Futures Average Order Size data indicates small orders dominate, reflecting the superior role of individual investors compared to whales at this moment.

CryptoQuant Report, August 2025

The Long Short Ratio (from Coinglass) dropped to 0.8765, meaning selling positions account for 53%, exceeding the 46.7% buy positions. According to market theory, when selling positions overwhelm, most traders are betting on further short-term price declines.

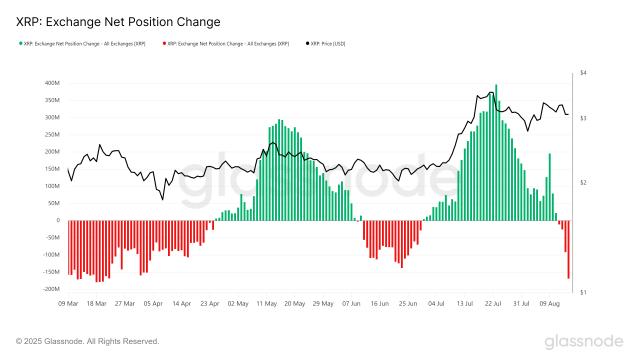

How Has Selling Activity Increased in the Spot Market?

Besides short positions in Futures contracts, retail investors are also selling heavily in the spot market, demonstrated by five consecutive sessions of declining Taker buy-sell ratios, reaching a two-week low.

This indicates a dominant selling sentiment on exchanges, signaling that Bitcoin supply is increasing faster than buying demand.

CryptoQuant Data Source, August 2025

Consequently, Bitcoin scarcity in the market hit a bottom of 41,000 BTC compared to the previous month's 53,000 BTC. This supply surplus always warns of potential further price declines, unless a strong growth momentum (demand shock) emerges to balance supply and demand.

What Do Technical Indicators Forecast for the Next Movement?

Bitcoin's Stochastic RSI currently drops to 10 points, deep in oversold territory, while RSI falls to 44 points, reflecting selling pressure still dominates in the short term.

From technical analysis experience, when both momentum indicators fall deeply below the neutral threshold, the probability of a prolonged downward trend increases significantly. Without new capital entering, Bitcoin could completely test the 112,000 USD support as Adler predicted.

When market sentiment is extremely pessimistic, any short squeeze could quickly reverse and recover price to the 117,000 USD area.

Analysis from TradingView, August 2025

Traders should manage risks strictly, avoiding getting caught in technical recovery bounces (dead cat bounce) if selling pressure shows no sustainable weakening signs.

What Risk Factors Should Bitcoin Investors Currently Note?

Pessimistic sentiment spreads as both Futures and spot markets show selling signals from retail investors. This coincides with increasing liquidation on the selling side, sentiment index plummeting, and momentum indicators confirming the downward trend.

In some past cases, when selling positions become too large, it could lead to a short-term short squeeze. However, this possibility still depends on large capital flow movements, clear recovery signals from technical indicators, and improved market confidence.

Comparing the Impact of Psychological, Technical, and Cash Flow Factors on Current Bitcoin Price

| Factor | Impact on Bitcoin Price | Evidence Data |

|---|---|---|

| Futures Contract Psychology | Deep index decline, signaling high price drop risk | Sentiment Index 36%, CryptoQuant August 2025 |

| Retail Investor Cash Flow | Selling off, increasing downward price pressure | Long Short Ratio below 1, 53% selling position, Coinglass |

| Technical Indicators | RSI, Stochastic RSI both falling into oversold zone | Stochastic RSI 10, RSI 44, TradingView |

| Spot Market Supply | Scarcity decreases, BTC supply more abundant | Scarcity amount reduced to 41,000 BTC, CryptoQuant |

Frequently Asked Questions About Current Bitcoin Market Trends

What is the Bitcoin Futures Market Sentiment Index?

This is a measure of traders' optimism or pessimism in the futures market. The lower the index, the more vulnerable the market is to decline.

Why are Short Positions Dominant in Bitcoin Futures Market?

Dominant short positions mean many investors predict Bitcoin price will continue falling and prioritize short selling, reflecting negative market sentiment.

How Does Bitcoin Scarcity Affect Price?

When Scarcity drops, BTC supply in the market increases. Without corresponding demand, this can push prices deeper down.

When Might a Short Squeeze Occur in the Market?

When too many investors take short positions and Bitcoin price strongly recovers, a buying force might squeeze shorts, causing a rapid price surge.

What Do Low RSI and Stochastic RSI Indicate?

Both indicators in the oversold zone show selling pressure is currently strong, but also hint at potential reversal when negative sentiment reaches its peak.

What Price Range is Currently Supporting Bitcoin?

According to forecasts, the $112,000 area is considered the primary short-term support if the downward trend continues to dominate.

What Should Investors Do in the Current Market Scenario?

Maintain risk management discipline, avoid emotional orders, closely follow technical signals before buying or selling, and prioritize capital preservation over profits.