#ETH

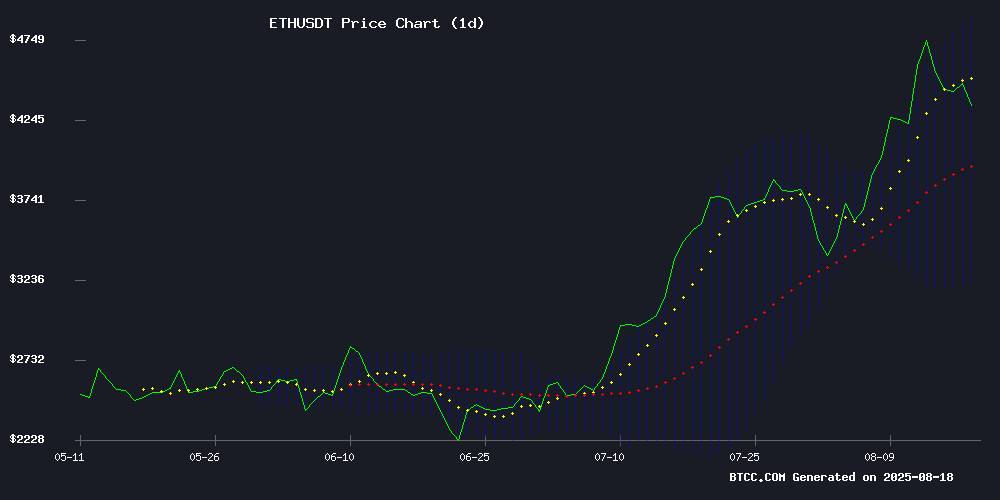

- Technical Breakout: ETH trades above key moving averages with Bollinger Band expansion signaling volatility

- Institutional Adoption: Record ETF inflows and staking growth create structural demand

- Supply Dynamics: Exchange reserves at historic lows may amplify price moves

ETH Price Prediction

Ethereum Technical Analysis: Bullish Signals Emerge

According to BTCC financial analyst Ava, ethereum (ETH) is currently trading at $4,396.83, showing strong bullish momentum above its 20-day moving average of $4,058.74. The MACD indicator remains negative but is converging, suggesting weakening bearish momentum. Bollinger Bands indicate volatility with the price hovering near the upper band at $4,885.61, signaling potential upside if resistance breaks.

Ethereum Market Sentiment: Institutional Demand vs. Short-Term Volatility

BTCC analyst Ava highlights conflicting signals in Ethereum's market sentiment. While institutional inflows via ETFs ($2.85B weekly) and record-low exchange balances point to long-term accumulation, derivatives markets show caution. Notable events include a trader turning $125K into $29.6M using Leveraged ETH strategies, contrasted by the Ethereum Foundation selling 7,000 ETH. The $4,800 resistance remains key.

Factors Influencing ETH's Price

Coinbase Smart Wallets Surpass 1 Million Users Amid Base App Rollout

Coinbase's Smart Wallet has eclipsed 1 million users, driven by a seismic surge in adoption following the launch of its rebranded Base app. On-chain data reveals 1,074,277 total account creations, with 270,000 new wallets added on August 16 alone—the second-largest daily jump in history. The Base Account feature alone generated 279,000 signups, representing 25.9% of the total.

The acceleration stems from Coinbase's strategic pivot in mid-July, repositioning Base as an all-in-one mobile hub integrating social features, mini-apps, and payments. By automatically migrating existing Coinbase Wallet users and funneling new onboarding through Base, the exchange engineered August's growth spurt. Early-month reports already noted hundreds of thousands of Smart Wallet creations before the mid-August inflection point.

Ethereum's Meteoric Rise: From $0.31 ICO to $4,617 Blue-Chip Asset

Ethereum's journey from a speculative 2014 ICO to a $557 billion market cap powerhouse reads like a crypto fairytale. A $1,000 investment during its $0.31 token sale would now be worth nearly $15 million, underscoring ETH's transformation into a institutional-grade asset.

The network survived its 2015 launch jitters, catalyzed DeFi's 2020 explosion, and rode 2021's NFT mania - each wave compounding its dominance. Recent upgrades addressing scalability have further cemented its position as the backbone of decentralized finance.

While ethereum now occupies the conservative wing of crypto portfolios, traders increasingly pair its stability with high-risk bets like MAGACOIN FINANCE. The market's next fireworks likely won't come from established players, but from overlooked projects still flying under the radar.

Ethereum Faces Divergent Signals as Exchange Outflows Clash with Bearish Derivatives

Ethereum's price action above $4,400 masks underlying market tension. While weekly gains of 4.21% suggest resilience, a 7.14% late-week pullback has injected caution. The altcoin now treads water in consolidation, its trajectory clouded by conflicting indicators.

Binance and Coinbase recorded $888 million in ETH outflows this week, typically a bullish signal suggesting accumulation. Yet derivatives tell a darker story: open interest plunged 29% as prices retreated from $4,700, with perpetual funding rates flipping negative across major exchanges. When shorts pay to maintain positions, history shows we're often NEAR oversold extremes.

CryptoQuant analyst Amr Taha identifies this crossroads - bearish paper markets versus bullish on-chain flows. Such divergence frequently precedes violent moves. With ETH's supply dynamics tightening post-Dencun and institutional products gaining traction, the scales may tip abruptly when positioning resets.

Ethereum Faces $4,800 Resistance as ETF Inflows Cool

Ethereum enters the new week grappling with a formidable $4,800 resistance level, a threshold that could dictate its near-term trajectory. The cryptocurrency recently tested $4,788—just shy of its all-time high—before retreating to $4,450, as spot ETF inflows showed signs of fatigue.

After eight consecutive days of institutional demand totaling $3.7 billion, U.S. spot ETH ETFs recorded $59.34 million in net outflows on August 15. While BlackRock's ETHA product saw $338 million inflows, Grayscale and Fidelity witnessed $101.74 million and $272.23 million withdrawals respectively.

Order book data reveals a towering sell wall at $4,800 on Binance's ETH/USD pair—dubbed the "final boss" by analysts. This liquidity cluster represents billions in potential selling pressure that must be overcome for any parabolic continuation.

Ethereum Trader Turns $125K into $29.6M in Four Months with Leveraged ETH Strategy

An anonymous Ethereum trader transformed a $125,000 investment into $29.6 million over four months by aggressively compounding leveraged long positions on ETH. The trader utilized Hyperliquid to maximize gains, reinvesting profits into larger positions as Ethereum's price rallied.

On-chain data reveals the trader deposited initial capital across two accounts, eventually accumulating 66,749 ETH (worth $303 million at peak) without ever cashing out. This 236x return exemplifies the explosive potential of disciplined leverage during bullish market cycles.

Ethereum's current price of $4,530 reflects renewed market optimism. While such extreme success stories are rare, they underscore the asymmetric upside of crypto derivatives when volatility aligns with position direction.

Ethereum Foundation Wallet Sells Over 7,000 ETH Amid Market Debate

Ethereum's recent rally to levels last seen in November 2021 has sparked intense market debate. Analysts remain divided—some foresee an inevitable correction, while others anticipate a breakout beyond all-time highs. The Ethereum Foundation-linked wallet 0xF39d sold 7,294 ETH ($33.25 million) over three days at an average price of $4,558, signaling profit-taking near key resistance. This wallet previously demonstrated sharp timing, accumulating 33,678 ETH at $1,193 in June 2022.

Institutional demand and record inflows into Ethereum ETFs continue to fuel bullish sentiment. On-chain activity suggests smart money is repositioning as ETH consolidates. The coming weeks will test whether the market faces a healthy pullback or gears up for uncharted territory.

Ethereum Whale Activity Surges Amid Market Consolidation

Ethereum's price volatility has captured market attention as it briefly surpassed $4,790 before retracing to key demand levels. The asset continues to exhibit bullish market structure, forming higher lows while consolidating below the critical $4,900 resistance level—a breakout point that WOULD propel ETH into unprecedented price territory.

Whale activity has intensified significantly, with Arkham Intelligence reporting three new addresses acquiring $279.5 million worth of ETH within 24 hours. This substantial accumulation during a consolidation phase signals strong conviction among deep-pocketed investors. The buying pressure coincides with declining exchange supplies and growing institutional interest, creating conditions ripe for potential upward momentum.

Market observers note the strategic timing of these acquisitions, interpreting them as positioning for an anticipated breakout. Ethereum's technical resilience and whale accumulation patterns mirror conditions preceding previous bullish phases, suggesting the asset may be preparing for another significant MOVE that could influence broader altcoin markets.

Hyperliquid Trader Nets $30 Million in 4 Months via Aggressive ETH Long

A cryptocurrency trader turned a $125,000 investment into $29.6 million in just four months by leveraging Ethereum's rally on Hyperliquid, a decentralized perpetual exchange. The trader's strategy involved compounding gains as ETH surged from below $2,000 to over $4,000, ultimately amassing 66,749 ETH worth $303 million at peak valuation.

The feat underscores how strategic positioning in volatile markets can yield exponential returns. While this case highlights trading prowess, other Ethereum gains originate from early investments or ecosystem participation rather than active speculation.

Institutional Accumulation and Staking Growth Fuel Ethereum's Long-Term Prospects

Ethereum's market dynamics reveal a tale of institutional conviction overshadowing short-term volatility. SharpLink Gaming's quarterly report—showing $103 million in non-cash impairments alongside a 728,000 ETH treasury expansion—highlights the dichotomy between accounting optics and strategic accumulation. The network now counts 2.7 million ETH held by treasury firms, with BitMine Immersion alone controlling 1.2 million ETH.

Staking yields continue to anchor Ethereum's utility proposition, generating 1,326 ETH for SharpLink since inception. Meanwhile, traders are pivoting to low-cap ETH-based tokens like Remittix, betting on outsized gains as the ecosystem matures. Market dips, often triggered by superficial financial reporting, now serve as entry points for long-term holders.

Ethereum Price Aims at $5,000 As Exchange Balance Falls To 9-Year Low

Ethereum's failure to breach key resistance has not dampened investor optimism, with sentiment indicators pointing to a potential rally toward $5,000. The altcoin's sentiment index remains below 2.00—a historical threshold for retail trader FUD that often precedes contrarian price movements.

Exchange reserves tell a compelling story: 14.88 million ETH now sit on trading platforms, the lowest since 2015. This nine-year supply crunch coincides with steady accumulation, as buyers absorbed $211 million worth of ETH last week. The disciplined pace of accumulation suggests conviction rather than speculation.

Market psychology appears to be repeating familiar patterns. Previous peaks in June and July 2025 saw euphoria trigger corrections, while current skepticism persists alongside steadily climbing prices. Santiment data reveals this divergence—traders doubt the rally even as Ethereum establishes higher price floors.

Ethereum ETFs Draw $2.85B Weekly Inflows as Institutional Demand Surges

Ethereum's price volatility belies a deepening institutional conviction. After testing resistance near $4,800, ETH's pullback reveals fierce seller activity—yet the asset continues drawing record ETF inflows totaling $2.85 billion this week. This divergence between price action and capital flows suggests accumulation by long-term holders.

Public companies now mirror Bitcoin's adoption playbook by adding Ethereum to corporate treasuries. The dual forces of ETF demand and corporate buying are systematically reducing exchange liquidity. "When institutions and corporations accumulate simultaneously, you get supply shocks," observes analyst Ted Pillows.

The $4,900 level looms as the next psychological battleground. Market structure appears bullish despite choppy trading, with derivatives data showing Leveraged longs being replaced by strategic positions from asset managers. Such conditions typically precede breakout momentum.

How High Will ETH Price Go?

Ethereum shows strong potential to test $5,000 based on:

| Factor | Data | Implication |

|---|---|---|

| Price vs. 20MA | $4,396.83 vs $4,058.74 | Bullish momentum |

| Bollinger Bands | Upper at $4,885.61 | Volatility expansion likely |

| ETF Inflows | $2.85B weekly | Institutional FOMO |

| Exchange Balance | 9-year low | Supply squeeze risk |

Key resistance at $4,800 must break for $5,000 target, says Ava.

border-collapse: collapse; width: 100%;