Several important events occurred this week in the cryptocurrency field, with Bitcoin reaching a new All-Time-High, XRP price fluctuating due to social media hype, and experts predicting that Ethereum will soon lead the next altcoin season.

These are just a few of the major events in recent days, as institutional acceptance is driving optimistic sentiment everywhere. Learn about all of these and more at BeInCrypto.

CPI Data Pushes Bitcoin to New ATH

This week in the cryptocurrency field, various macroeconomic factors have pushed Bitcoin to new heights. Besides significant ETF inflows, the latest US CPI report brought unexpected optimism. Following a disappointing jobs report earlier this month, this further increased optimism, driving BTC profits higher. Yesterday, this asset temporarily reached a new All-Time-High.

Bitcoin (BTC) Price Performance. Source: BeInCrypto

Bitcoin (BTC) Price Performance. Source: BeInCryptoOf course, subsequent trading caused its price to drop the next day. However, this record helped attract attention to Bitcoin, and institutional acceptance continues to reach new milestones. Individual investors are being rewarded for their BTC investments, and analysts can point to many optimistic trends.

XRP Escrow Unlock Causes FUD

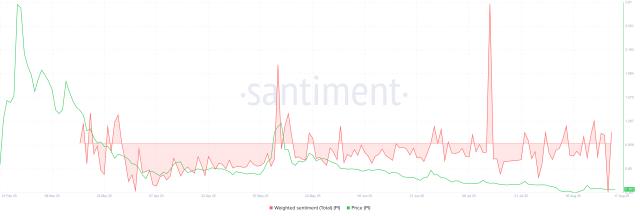

Another major event this week involved XRP, which has been trending upward. However, Ripple unlocked 3.28 billion tokens from escrow accounts, raising concerns about a potential massive sell-off. This briefly interrupted XRP's upward momentum, but it was just social media panic; whales took the opportunity to accumulate tokens at low prices.

A few days later, things looked much more optimistic. XRP had regained most of its lost momentum, and Ripple achieved other significant breakthroughs. Although Ripple and SEC finally dropped cross-appeals in their landmark legal battle, the Commission granted a waiver allowing the company to meet its largest requirements.

This was a very unconventional move, but it brings significant benefits to Ripple. Despite legal setbacks, Ripple will be able to sell securities to small retail investors in the future. This itself represents a substantial untapped revenue source.

Experts Predict Altcoin Season

The cryptocurrency community has been awaiting the next altcoin season, and this week seems very close. Two days ago, Jamie Elkaleh predicted that Ethereum's recent performance makes it a strong candidate to lead this market shift. In an exclusive interview with BeInCrypto, Ray Youssef agreed that we are very close:

"Institutional capital flow into Ethereum will extend the altcoin summer — but the real question is, for how long and which coins will benefit. By the time crypto winter arrives, coins receiving institutional support are most likely to retain value. Speculative tokens without real utility, no users, and no role in the developing Web3 economy will disappear forever," Youssef told BeInCrypto.

This morning, Coinbase also predicted that the next altcoin season will occur in Q3 2025. Among these experts, there is significant data supporting these optimistic statements. Ethereum has demonstrated strong performance, and it could transform the entire industry.

New UK Tax Regulations Coming into Effect

Finally, BeInCrypto wants to remind readers in the UK that HMRC is changing cryptocurrency tax policies for next year. Lee Murphy, Managing Director at The Accountancy Partnership, provided some cryptocurrency tax tips earlier this week.

"If you earn cryptocurrency as part of your job, you'll be subject to income tax instead of [capital gains]. If you mine or stake cryptocurrency as a reward, HMRC will also consider this part of your income, so they will be taxed like any other income," Murphy said.

However, mostly, he warned that HMRC is becoming stricter in collaborating with exchanges and analyzing blockchain data. UK readers should look for potential loopholes to avoid the heaviest obligations, but completely evading taxes is riskier than ever. If caught, tax evaders could face severe penalties.

These are just some of the biggest events that occurred in the cryptocurrency field this week. As always, BeInCrypto is here to help you stay updated on the most important market trends.