Get the best data-driven crypto insights and analysis every week:

Thanks for reading Coin Metrics' State of the Network! Subscribe for free to receive new posts and support our work.

Exploring the On-Chain Effects of ETH Treasury Companies

By: Tanay Ved

Key Takeaways:

ETH-focused digital asset treasuries are rapidly scaling, with 2.2M ETH (1.8% of supply) accumulated in just two months, creating a supply-demand imbalance.

These treasuries are taking an active on-chain approach, aiming to deploy capital through staking and DeFi to enhance returns while supporting network security and liquidity.

While still in the accumulation phase, greater on-chain participation could strengthen Ethereum’s liquidity and security but also heighten its exposure to corporate treasury risks.

The Emergence of Digital Asset Treasuries

Digital asset treasuries (DATs), or public companies that accumulate crypto-assets like BTC or ETH on their corporate balance sheets, have emerged as a new channel for market access. The 2024 launch of spot ETFs unlocked a wave of demand from investors previously unable to hold BTC and ETH through direct custody. Similarly, digital asset treasuries provide exposure to these assets and their ecosystems through publicly traded equity, with the ability to raise and deploy capital strategically.

We previously delved into Michael Saylor’s Strategy playbook, raising funds through equity and convertible debt issuance to amass over 628,000 BTC (2.9% of bitcoin’s supply). A wave of companies around the world, from Marathon Digital to Japan’s Metaplanet have followed suit, effectively providing shareholders with amplified or “levered” exposure to BTC. Now, this model is expanding to other ecosystems, with a flurry of entities racing to accumulate Ether (ETH) in their corporate treasuries.

While the goal of boosting shareholder exposure to the underlying assets remains the same, ETH treasuries fundamentally differ from their BTC counterparts in their ability to tap into Ethereum’s staking and DeFi ecosystem. This opens the door to enhance returns through ETH’s native yield and productive deployment of capital on-chain. In this issue of State of the Network, we examine the observed impacts of ETH digital asset treasuries on Ethereum’s supply dynamics and explore the potential network implications as these large vehicles move on-chain.

Supply Dynamics: The Race to Accumulate 5% of Supply

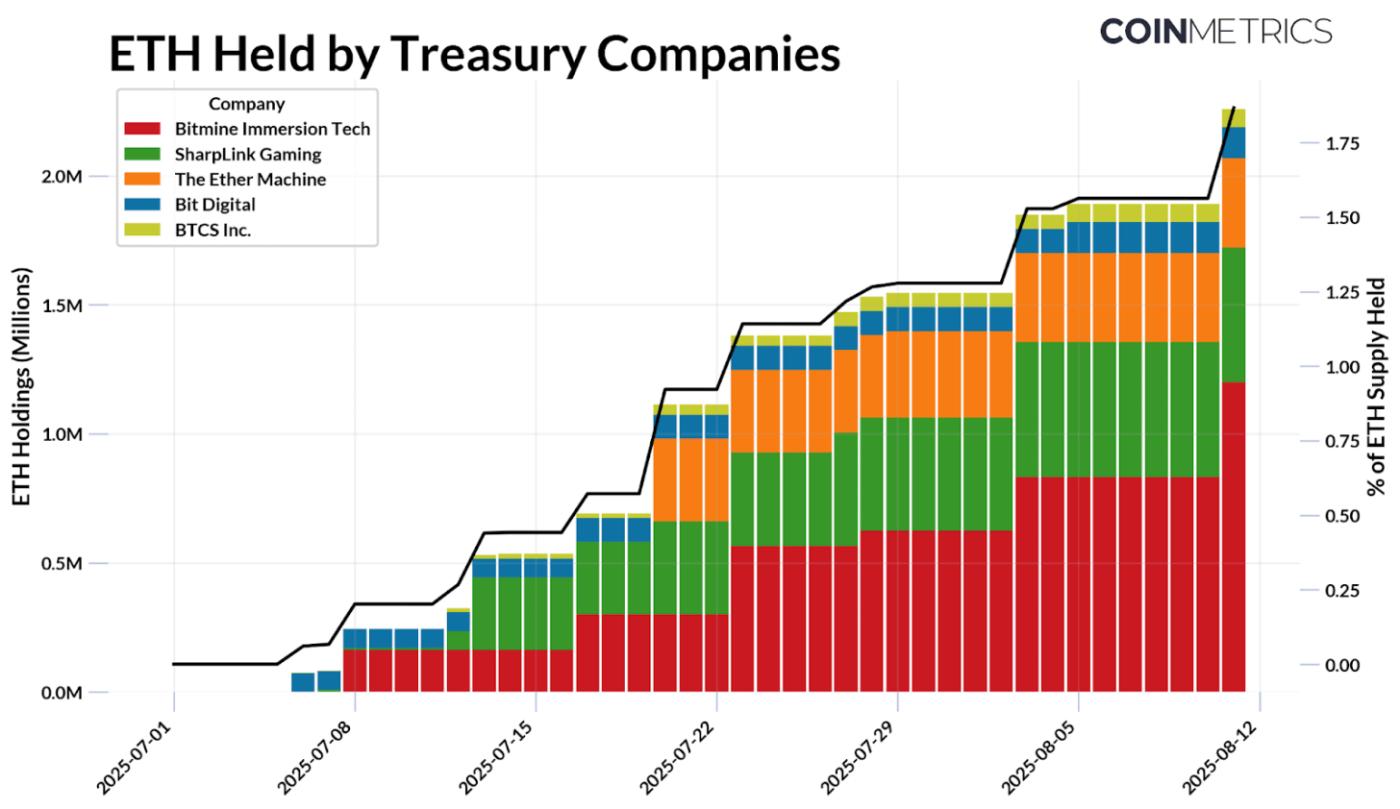

Since just July of this year, Ethereum digital asset treasuries have accumulated 2.2M ETH, representing nearly 1.8% ETH’s current supply. There are currently 5 major players on the block, raising capital through equity-based fundraising such as public share offerings or Private Investment in Public Equity (PIPE) deals to deploy capital and grow the value of their holdings. As of August 11th, these entities hold the following amounts of supply:

Bitmine Immersion Technologies (1.15M ETH, ~$4.8B)

SharpLink Gaming (521K ETH, ~$2.2B)

The Ether Machine (345K ETH, ~$1.4B)

Bit Digital (120K ETH, ~$503M)

BTCS Inc. (70K ETH, ~$293M)

BitMine Immersion Technologies is currently the largest corporate holder of ETH. Now at 0.95% of supply, their holdings are rapidly climbing towards their stated goal of accumulating 5% of ETH’s circulating supply. The race to acquire a larger share of ETH is only accelerating, especially as these companies build reserves at a favorable cost basis as market conditions shift.

Source: Coin Metrics Network Data Pro & Public Filings (As of August 11th, 2025)

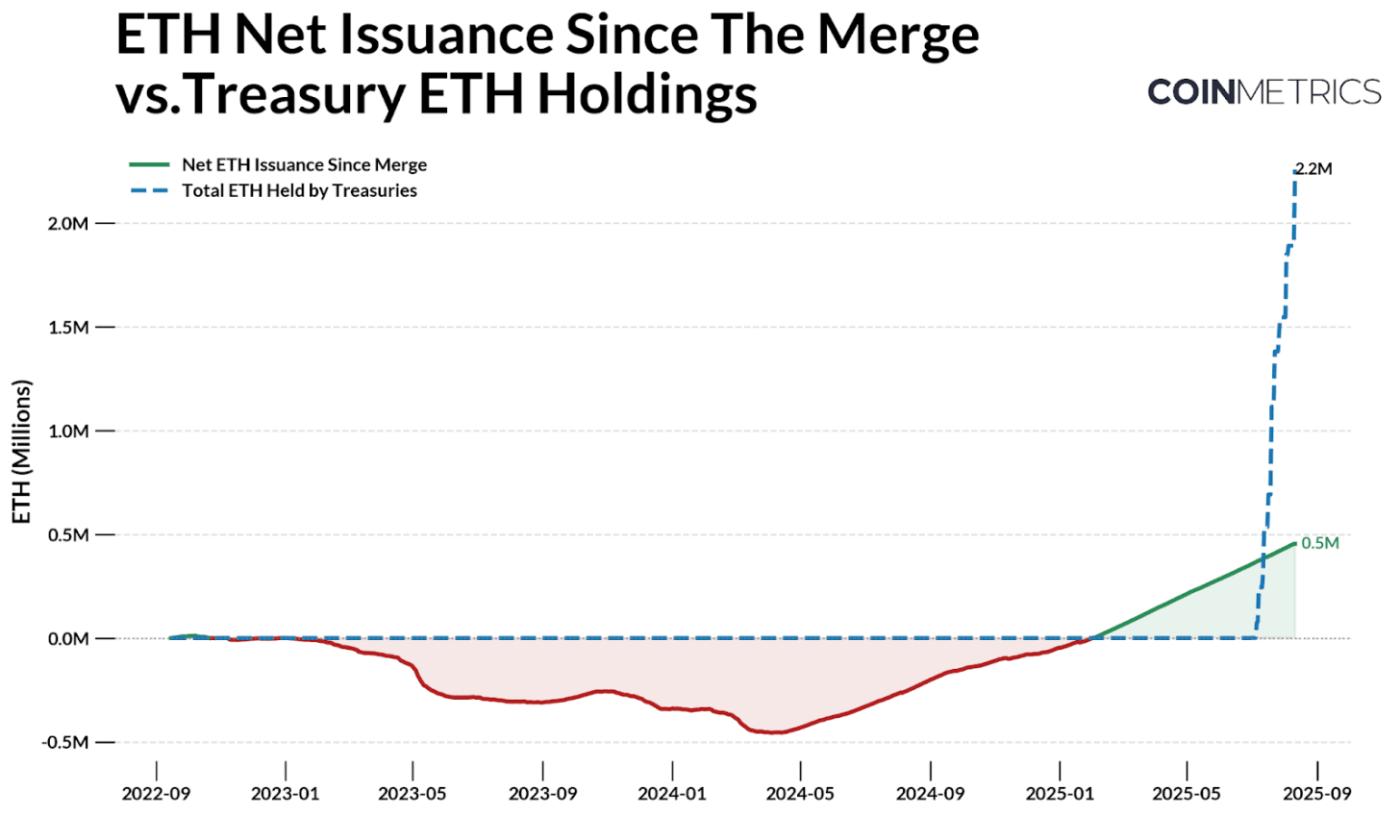

This trend is also striking when viewed alongside Ethereum’s issuance dynamics. With Ethereum’s supply governed by proof-of-stake (PoS), where new ETH is issued to validators and a portion of transaction fees is burned, net issuance can swing between negative (deflationary) and positive (inflationary).

Since “The Merge” in September 2022, a total of 2.44M ETH has been issued, while 1.98M ETH has been burnt, resulting in a net supply growth of 454.3K ETH. Since July, ETH treasury companies have collectively accumulated 2.2M ETH, far exceeding net new issuance over the same period. While Bitcoin’s capped supply and halving schedule directly reduce new issuance over time, Ethereum’s supply is dynamic and currently inflationary. This makes the scale and pace of recent demand even more notable given that ETH’s market cap is roughly 4.5x smaller than BTC’s.

Source: Coin Metrics Network Data Pro & Public Filings

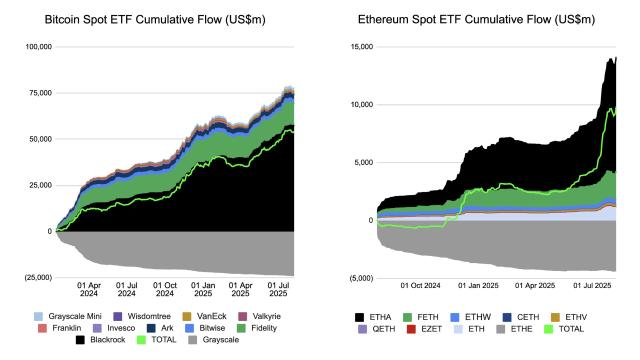

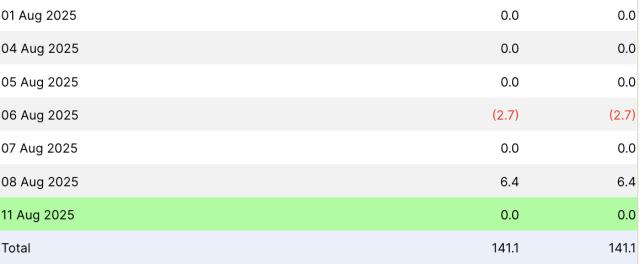

This demand-supply imbalance is even more pronounced when factoring inflows into Ether ETFs, which have also accelerated in recent months. Combined together, these vehicles are steadily absorbing more of Ethereum’s 107.2M free float supply (available supply in the market), on top of the 29% of ETH staked on the consensus layer and 8.9% held in other smart contracts. As a result, sustained accumulation from treasuries and ETFs could amplify price sensitivity to new demand.

Ecosystem Impact: Staking, DeFi and On-Chain Activity

While most ETH treasuries are still in the accumulation phase, a portion of their capital may ultimately find its way on-chain. By tapping into Ethereum’s staking and DeFi infrastructure, these firms aim to enhance risk-adjusted returns and make productive use of their holdings – a contrast to the more passive approach taken by Bitcoin treasuries. This shift is already underway, with SharpLink Gaming staking a majority of its holdings, BTCS Inc. using Rocket Pool to drive revenue, and others like The Ether Machine and ETHZilla preparing for more active on-chain management.

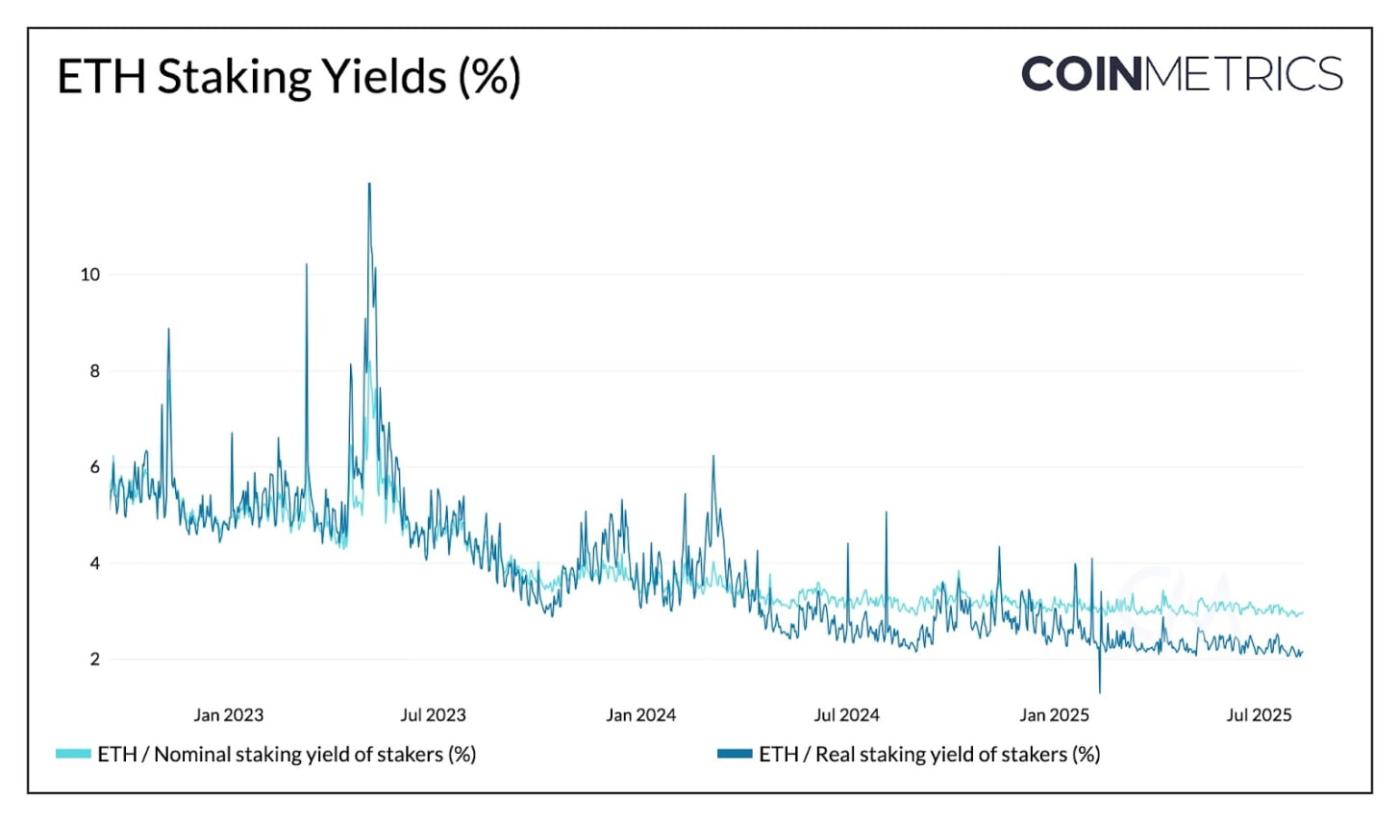

Source: Coin Metrics Network Data Pro

Ethereum currently offers 2.95% nominal and 2.15% real (inflation-adjusted) yield through staking rewards for securing the network. This can provide treasury companies with a steady stream of income in addition to the price appreciation of the underlying asset. For example, if 30% of the 2.2M ETH held by treasury companies today were staked at the current ~3% nominal yield and a $4K ETH price, it could generate roughly $79M in annual income. While an influx of staking could compress yields, the effect would be modest since Ethereum’s reward rate decays gradually as the total amount staked increases.

Corporate treasuries are approaching this through two ways: by running their own validators or utilizing liquid staking protocols. The latter, which was clarified by the SEC to not be considered securities, allows firms to stake with third party providers like Lido, Coinbase or RocketPool, while receiving a “liquid” receipt token in return.

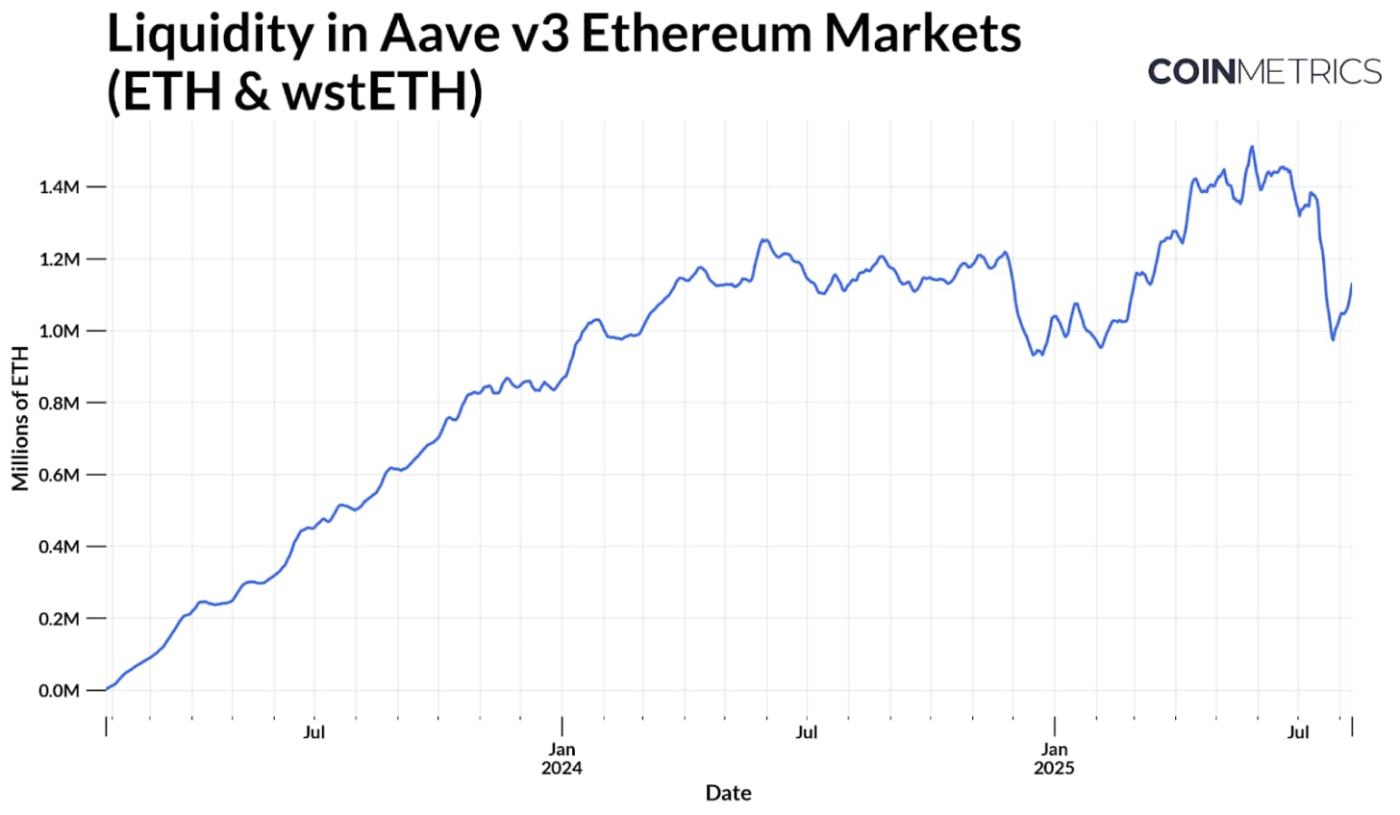

While carrying additional risk, these tokens such as Lido’s stETH are widely used in DeFi for collateralized borrowing or to gain additional yield over the benchmark staking APY in a capital efficient manner. Taking Aave v3 as an example, ETH and liquid staking tokens like wrapped stETH form a deep pool of available liquidity (the amount of assets supplied that remain available to borrow). This has grown to around 1.1M ETH, and treasuries could further strengthen it, compounding yield while enhancing market liquidity.

Source: Coin Metrics Network Data Pro

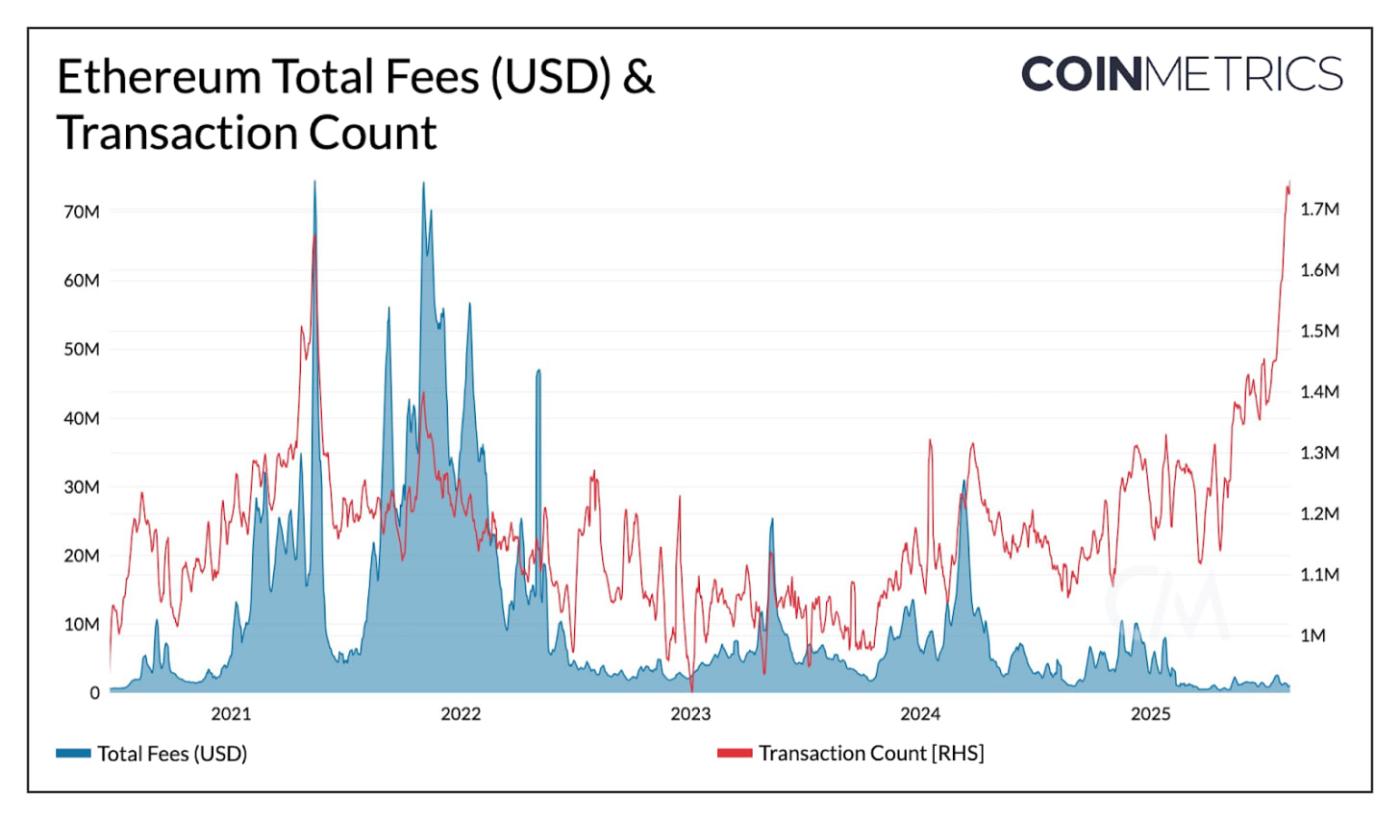

Despite Ethereum now exceeding record transaction counts on mainnet (1.7-1.9M per day), total fees remain near multi-year lows as recent gas limit increases and blob capacity expansions have eased congestion and offloaded activity to L2s. If the capital from treasury companies moves on-chain at scale, high value transactions on Ethereum L1 could boost aggregate blockspace demand and fee revenue, potentially creating a positive feedback loop between treasury activity, liquidity, and on-chain usage.

Linking Corporate Treasury Outcomes to On-Chain Health

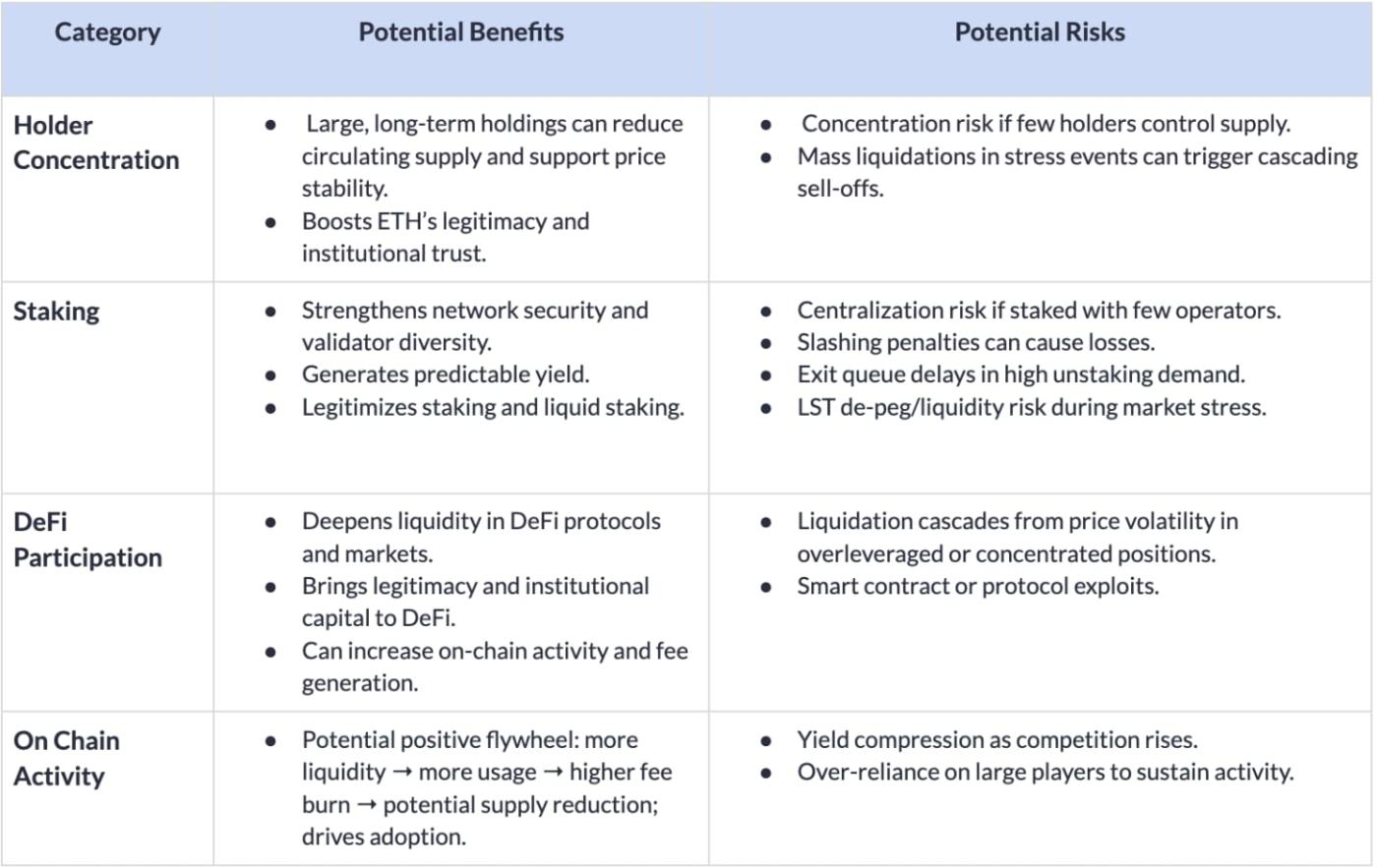

As publicly listed ETH treasuries expand their on-chain footprint, their financial performance increasingly carries implications for Ethereum’s long-term network health, linking off-chain corporate outcomes to potential on-chain effects. Large, long-term holdings can reduce circulating supply, boost legitimacy, and deepen on-chain liquidity, but concentration, leverage, and operational risks mean that outcomes at the corporate level could spill over into the network.

On-Chain Implications of Large ETH Treasury Holdings

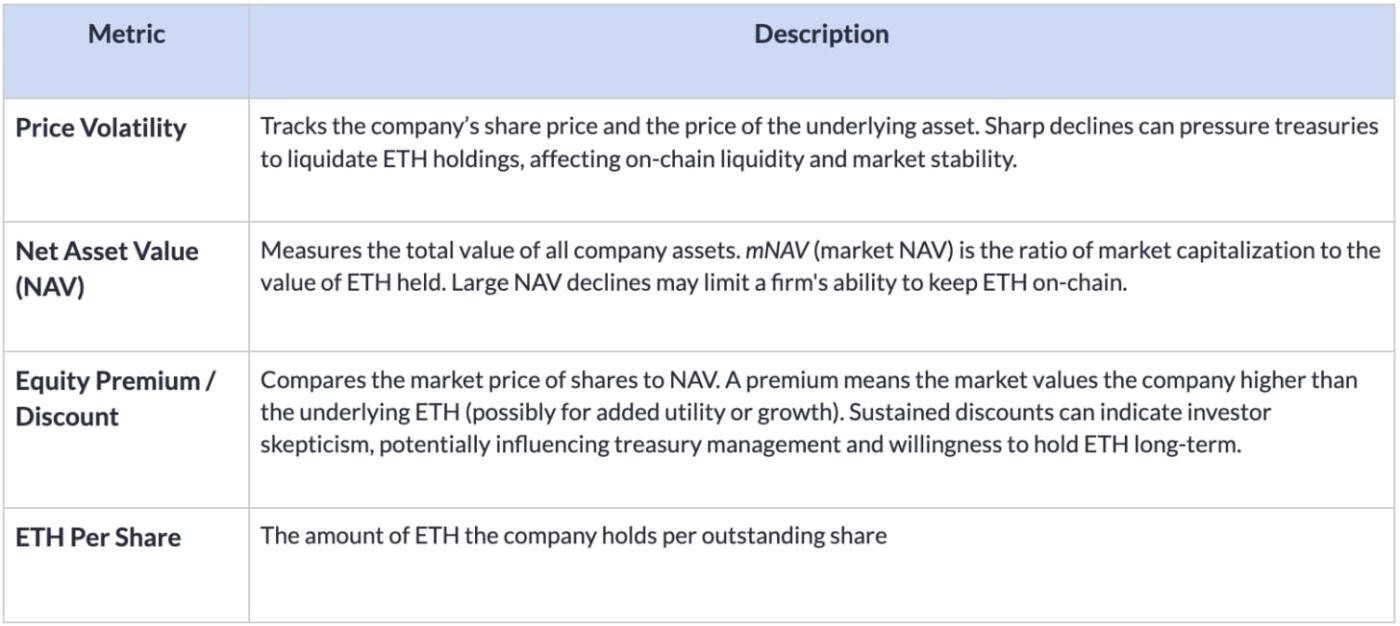

While these are network-level considerations, corporate treasuries themselves are subject to market forces and investor sentiment. A strong balance sheet and sustained investor confidence can allow treasuries to expand holdings, and increase participation. Conversely, sharp drops in underlying price, tightening liquidity, or excessive leverage can lead to ETH sales or reduced on-chain activity.

Indicators Tied to Treasury Company Performance

By tracking both the network-level implications and the financial health of these companies, market participants can better anticipate how corporate treasury behavior might affect Ethereum’s supply dynamics and its network health at large.

Conclusion

The rapid emergence of corporate ETH treasuries is portraying Ethereum’s appeal as both a reserve asset and a source of on-chain yield. Their growing presence could deepen liquidity and strengthen network activity, but also carries risks tied to leverage, financing, and robust capital management. Off-chain pressures, from equity performance to debt obligations, could quickly ripple on-chain as they become more intertwined. Tracking both balance sheet health and on-chain activity will be key to understanding the impact of these vehicles as they grow larger.

Coin Metrics Updates

This week’s updates from the Coin Metrics team:

Follow Coin Metrics’ State of the Market newsletter which contextualizes the week’s crypto market movements with concise commentary, rich visuals, and timely data.

As always, if you have any feedback or requests please let us know here.

Subscribe and Past Issues

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.