Jack Dorsey's Block Saw Stock Surge in Pre-Market Trading After Reporting Additional Bitcoin (BTC) Purchases in Q2.

Block is one of the companies accelerating the Saylor-style flywheel as corporate Bitcoin adoption increases.

Block Increases Bitcoin Holdings by 108 in Q2

According to a filing with the U.S. Securities and Exchange Commission (SEC), Jack Dorsey's Block Inc. purchased 108 BTC in the second quarter. With the current Bitcoin trading price at $116,554, this BTC purchase amounts to $12.58 million.

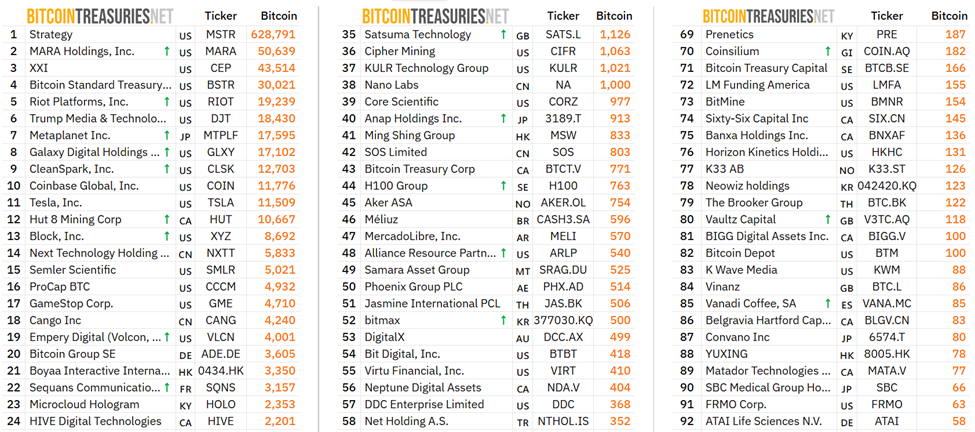

After the purchase, Block now holds 8,692 BTC tokens, valued at over $1 billion. This makes Block Inc. the 13th largest listed company holding BTC.

This move positions Block Inc. as one of the companies driving the Saylor-style trend alongside Twenty-One Capital and MicroStrategy.

Recently, Bitcoin pioneer Max Keiser told BeInCrypto that companies should accumulate BTC by mimicking the strategy.

"For a company to survive, it must mimic the strategy, and if it doesn't 'Saylorefy', it will die." – Max Keiser, BeInCrypto Interview

According to Max Keiser, companies adopting this strategy can drive Bitcoin to $2.2 million per coin.

Meanwhile, Block's XYZ stock rose nearly 10% in pre-market trading due to investors' enthusiasm for companies adopting Bitcoin financial strategies.

Block Q2 Earnings Exceed Wall Street Predictions

Beyond the optimism about Bitcoin purchases, the pre-market surge in XYZ stock is also due to a positive Q2 earnings report.

The report shows Block's total revenue reached $6.05 billion in Q2, with total profits rising even more sharply. Notably, it increased by 8.2% to $2.54 billion, thanks to Bitcoin-related revenue from Cash App.

Bloomberg reported that Block raised its annual earnings forecast after Q2 results exceeded Wall Street predictions.

The report indicates that strong growth was driven by the robust growth of Block's Cash App lending products and stable payment processing through the company's Square merchant network.

These results demonstrate continued confidence in Block's fintech ecosystem and Bitcoin's long-term value.

While Block's total profits increased year-over-year, its Bitcoin holdings experienced a valuation loss of $21.217 million. Analysts attribute this to the decline in Bitcoin's fair value.

This means Block's BTC holdings have decreased in value as Bitcoin's market price has fallen.