The cryptocurrency market has closed its first down week after five consecutive weeks of gains. Profit-taking pressure following the recent rally is fueling short-term pessimism, which can be confirmed in the liquidation maps of various altcoins.

In this situation, some altcoins pose a high liquidation risk for derivatives traders in early August. Which altcoins might these be?

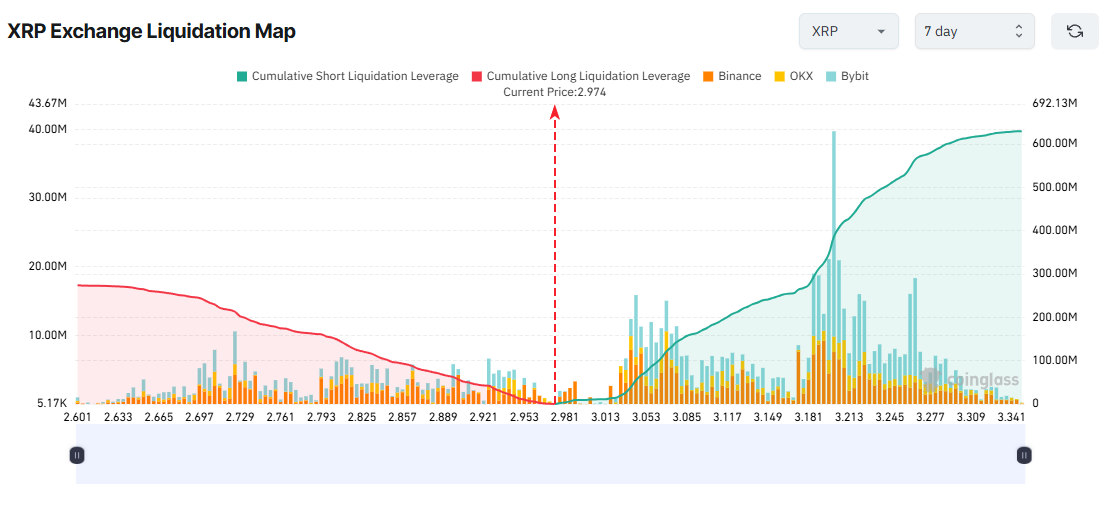

1. XRP

The 7-day XRP liquidation map shows a significant imbalance between long and short positions. According to the data, the accumulated short trading volume (green bars on the right) significantly exceeds the long trading volume (red bars on the left).

This reflects the prevailing sentiment that XRP's price will continue to decline in the first week of August.

This downward expectation seems to stem from XRP recording two consecutive weeks of losses, dropping over 18% from $3.65 to $2.97. As a result, many short-term traders believe the downtrend will continue.

However, if XRP recovers this week, short traders could face unexpected liquidation. If XRP rises to $3.20, over $400 million in short positions could be liquidated.

From the July high to the early August low, XRP has fallen 25%. Historically, such sharp declines often lead to notable rebounds. Therefore, some analysts are warning about potential liquidations from this recovery.

"XRP is liquidating short positions after liquidating long positions with high leverage. Many short positions will be liquidated if XRP rises to $3.06." – Analyst CW statement.

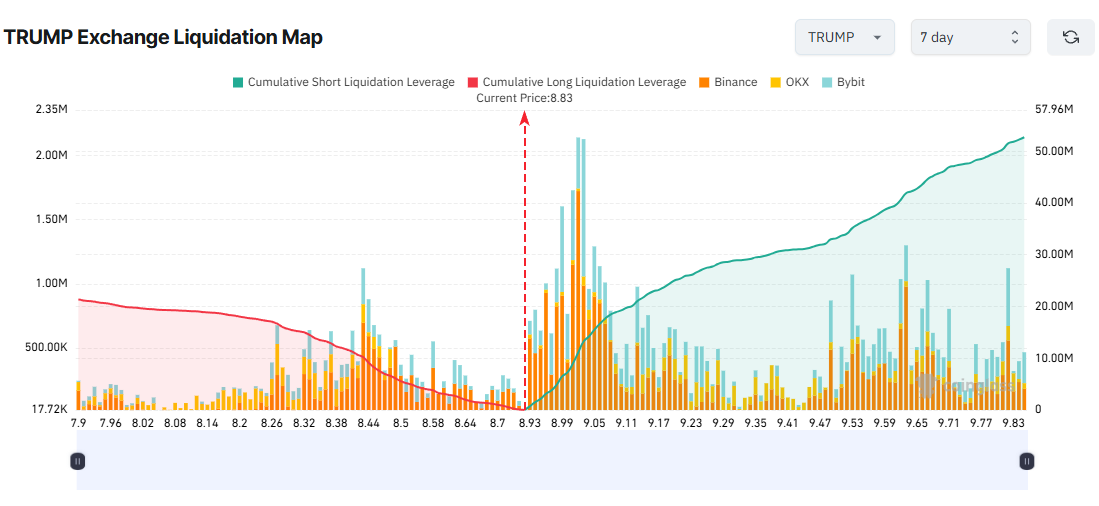

2. TRUMP

The TRUMP meme coin's liquidation map also shows a significant imbalance, with most potential liquidations concentrated on the short side.

However, many analysts believe TRUMP has found a bottom around the $8.50 range. This has been an important support level for several months. If TRUMP rises to $9.80 this week, approximately $50 million in accumulated short positions could be liquidated.

At the end of July, SunPump, TRON's meme coin trading platform, announced the listing of TRUMP, which strengthened the token's liquidity. This announcement followed Justin Sun's public promise to invest $100 million in TRUMP.

These developments could provide more momentum for TRUMP's potential recovery and potentially hurt traders betting on price declines.

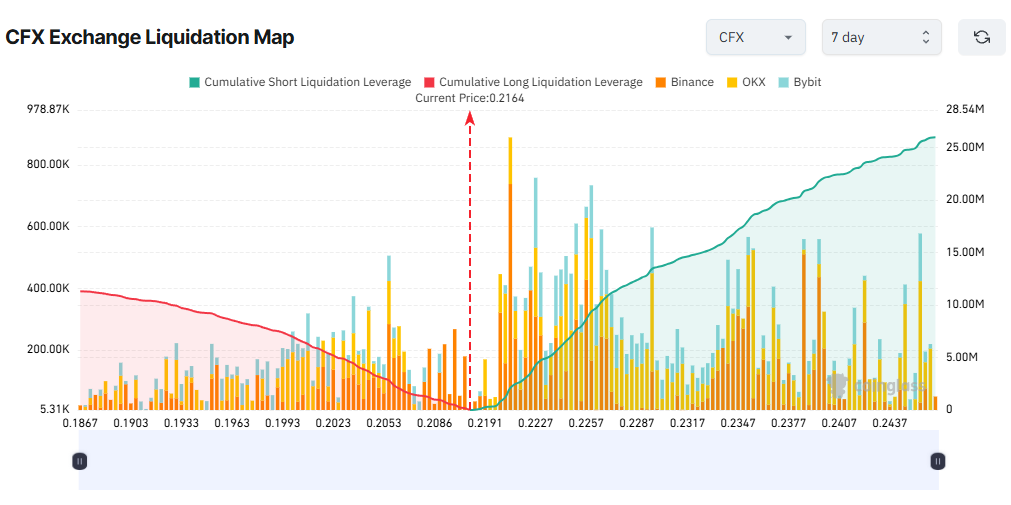

3. CFX

Conflux (CFX) surprised many investors by increasing its market cap to over $1 billion after its price nearly quadrupled last month.

The liquidation map shows that most traders expect CFX to enter a correction in early August. This is evident from the large trading volume of potential short liquidations significantly exceeding the long side.

If CFX continues its rally and reaches $0.243, approximately $25 million in short positions could be liquidated.

Recent project updates could help maintain a positive sentiment towards this altcoin. On August 1st, Conflux announced the Conflux v3.0.0 upgrade, which received positive feedback from the community.

"This major upgrade introduces eight new CIPs to improve EVM compatibility, fix bugs, and optimize network specifications!" – Conflux Network announcement.

Additionally, Google Trends data shows a surge in searches for "Conflux Network" last month. Renewed investor interest in the project could disappoint leverage traders betting on a price decline.