According to ChainCatcher, QCP Capital's latest report indicates that Bitcoin experienced its third consecutive Friday decline, with prices briefly exploring the support level of $112,000, triggering over $1 billion in leveraged long liquidations in the crypto market since Friday. This sharp drop resonates with traditional market risk-averse sentiment, driven primarily by two factors: unexpectedly weak US employment data and Washington's new tariff policy, causing simultaneous pressure on stocks, bonds, and the crypto market.

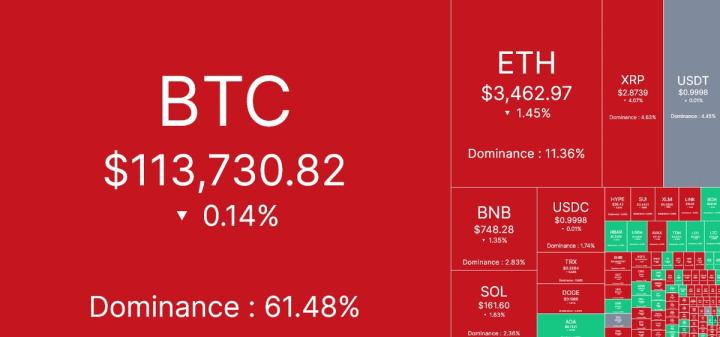

Investors anticipating the Altcoin season were disappointed: SOL plummeted nearly 20% this week, while ETH also dropped by 10%. Even ETF fund flows failed to provide support—on Friday, BTC spot ETF recorded its second-largest fund outflow in history, and ETH ETF saw its fourth-largest withdrawal, dimming hopes of short-term institutional support.

Despite the pullback, macro structural support remains solid. BTC's July monthly line still closed at historical highs, with the current adjustment appearing more like a technical correction than a panic sell-off. Historical data suggests that such post-rally washouts (especially after clearing excessive leverage) often create conditions for a new cycle.

Notably, long-term positive factors such as clearer regulatory frameworks, accelerated stablecoin integration, and institutional tokenization processes remain unchanged. The options market sentiment seems more opportunistic than defensive: last night saw numerous BTC bullish butterfly options (strike prices $118,000/$124,000/$126,000) purchases, betting on a rebound to $124,000 (significantly higher than previous peaks). While short-term bearish bias remains high, it has not reached panic levels, and recovering the $115,000 spot level might restore normalcy.

We maintain a cautiously optimistic stance: vigilance is needed around the $112,000 level, especially amid ongoing macro uncertainties. However, signals like spot ETF fund inflows, declining implied volatility, and narrowing bias could indicate recovering institutional confidence. Tonight's ETF data might serve as a leading indicator—if funds return and volatility indicators compress, it would provide stronger grounds for a "buy the dip" strategy.