This week, several U.S. economic indicators are scheduled. However, they are not as hot as what was witnessed last week.

By predicting these upcoming events, traders and investors can protect their portfolios from sudden shocks.

Initial Jobless Claims

This U.S. economic indicator, announced every Thursday, represents the number of U.S. citizens who first applied for unemployment insurance last week.

Economists surveyed by MarketWatch expect a slight increase to 221,000 after 218,000 reported on July 26.

"Initial jobless claims decreased last week [ending July 26] and remain at a low level year-over-year. Continuing claims indicate a slightly less tight labor market than a year ago." – Economist reporter Nick Timiraos

This U.S. economic indicator is particularly important as labor market data gradually grows as a crucial macro factor for BTC.

The jobless claims data will be released following the Non-Farm Payroll (NFP) data on August 1. The NFP data worsened BTC's recent decline and came in much lower than expected.

If the data signals a deteriorating labor market, potential dollar instability could potentially drive retail and institutional investors towards cryptocurrencies in the long term.

4-week average of initial jobless claims has hooked dramatically lower lately … still nowhere near levels consistent with recession pic.twitter.com/UUfuEeCZpm

— Kevin Gordon (@KevRGordon) July 31, 2025

If last week's jobless claims are higher than the previous week, or continue a trend worse than expected, the labor market weakness could be positive for BTC. This could induce investors to avoid economic uncertainty.

From a perspective, a surprising increase in jobless claims could signal economic weakness and potentially support a more accommodative Fed policy. Such results would be positive for risk assets like cryptocurrencies.

ISM Services PMI

In addition to labor market data, the cryptocurrency market will be watching the ISM Services PMI (Purchasing Managers' Index).

This economic indicator is derived from a monthly survey of private sector businesses, measuring business activity in areas such as new orders, inventory levels, production, supplier deliveries, and employment.

After recording 50.8% in June, economists expect a slight increase to 51.1% in July. If the ISM Services PMI exceeds the expected 51.1%, it would indicate stronger economic activity and could weaken expectations of Fed rate cuts. This could be negative for BTC.

However, a lower-than-expected figure, especially below 50, would suggest economic weakness and potentially raise expectations of monetary easing, which could drive cryptocurrency prices up.

If the data meets predictions, the market might wait and observe, looking for more decisive indicators like jobless claims.

Ahead of this specific U.S. economic indicator on Tuesday, BTC's next move depends on whether the service sector shows signs of overheating or slowdown. This is a crucial factor for the Fed's inflation and policy stance.

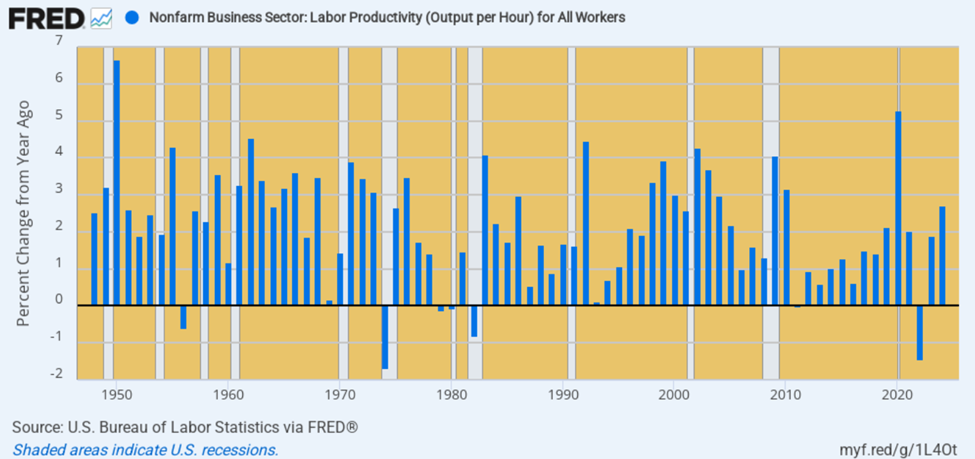

U.S. Productivity, Unit Labor Costs

Also, U.S. productivity and unit labor costs will be a key observation on Thursday, August 7. These will show whether wage increases are driving inflation.

These data points represent wage increases in the second quarter (Q2). In the first quarter (Q1), U.S. productivity decreased by 1.5%, but economists now expect a 1.9% increase.

Meanwhile, U.S. unit labor costs increased by 6.6% in the first quarter, but economists expect a slight 1.3% increase in the second quarter.

Rising labor costs without productivity increases would indicate persistent inflation, which is expected to be positive for BTC.

More closely, the discrepancy could change the Fed's expectations, and cryptocurrencies are known to respond well to signs of disinflation or economic slowdown.

However, if labor costs rise at the same pace as productivity, companies can pay higher wages without raising prices. Such a scenario could promote economic growth without tightening liquidity, which would be positive for BTC.

With the One Big Beautiful Bill passed and 100% expensing locked in, America is experiencing a CapEx Comeback.

— Treasury Secretary Scott Bessent (@SecScottBessent) July 31, 2025

AI is accelerating. Productivity is rising.

If the Fed had any imagination, they'd embrace the Greenspan model—because the Golden Age of America is upon us. pic.twitter.com/es5HB3zDi6

If labor costs decrease while productivity rises, this would be a highly disinflationary and business-friendly scenario. This would reduce inflation pressure and increase the likelihood of rate cuts or liquidity support, which would be positive for cryptocurrencies.

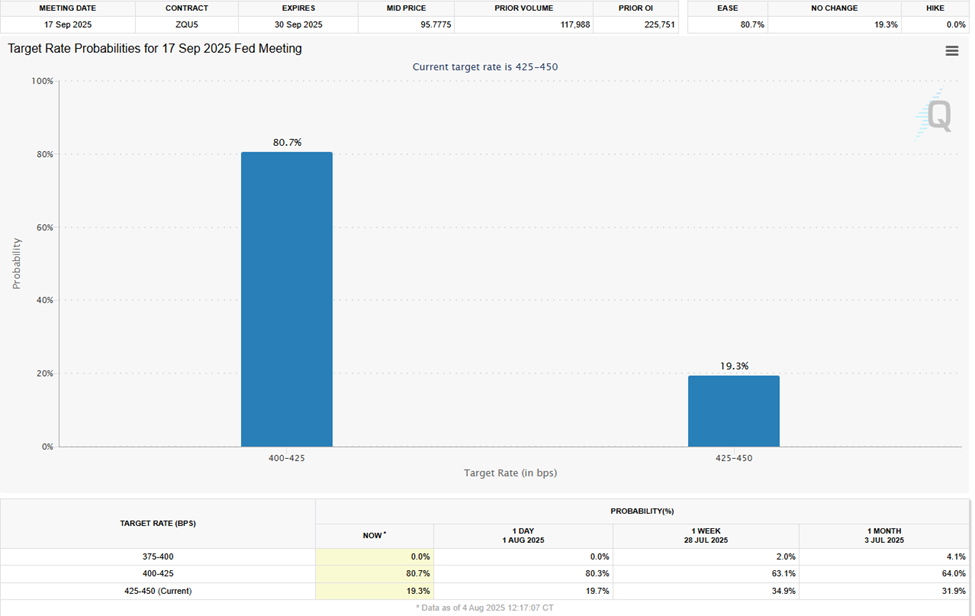

According to the CME FedWatch Tool, rate bettors see an 80.7% chance of the Fed cutting rates at the September 17 meeting.

Atlanta Fed President Raphael Bostic's Speech

In addition to data points among U.S. economic indicators, traders and investors will be watching statements from policymakers. This week, Atlanta Fed President Raphael Bostic is scheduled to speak on Thursday, and the market will pay attention to signals about policymakers' economic outlook.

Atlanta Fed President Rafael Bostic shows a hawkish tendency towards monetary policy and prefers a cautious approach to interest rate cuts.

"If you're expecting interest rate cuts, don't hold your breath. Atlanta Fed President Rafael Bostic recently stated that he supports only one interest rate cut this year and emphasized the Fed's uncertainty due to tariffs." A user recently said.

As one of the Fed's policymakers, Bostic's statements on inflation, interest rates, or balance sheet policies can significantly change market expectations.

If his statements are hawkish, they will likely have a bearish effect on Bitcoin. However, a dovish stance would have a bullish effect, especially in contrast to Powell's tone.