In the cryptocurrency market over the past 24 hours, approximately $115 million (about 168 billion won) worth of leverage positions were liquidated.

According to the currently aggregated data, short positions accounted for $87.6 million, representing 87.18% of the total liquidations, while long positions were $40.6 million, accounting for 12.82%.

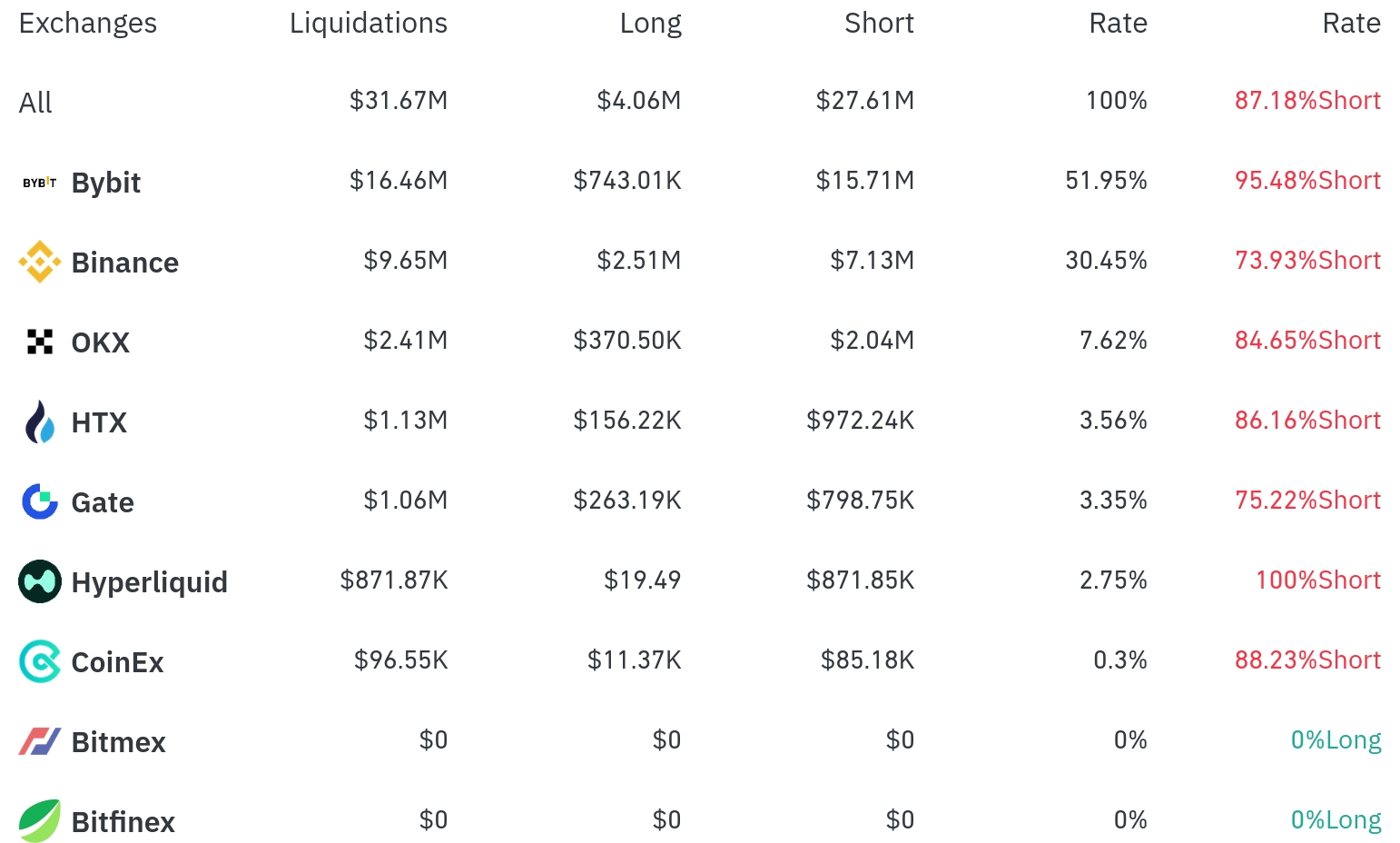

Over the past 4 hours, Bybit had the most position liquidations, with a total of $106.46 million (51.95% of the total) liquidated. Among these, short positions accounted for $105.71 million, or 95.48%.

Binance was the second-highest exchange for liquidations, with $9.65 million (30.45%) of positions liquidated, of which short positions comprised $7.13 million (73.93%).

OKX experienced approximately $2.41 million (7.62%) in liquidations, with short positions at 84.65%.

Notably, Hyperliquid saw nearly 100% short position liquidations, while BitMEX had no liquidations at all.

By coin, Bitcoin (BTC) had the most liquidated positions. Over 24 hours, approximately $38.01 million in Bitcoin positions were liquidated, with $19.54 million in short positions liquidated over 4 hours. This shows that short position investors were heavily impacted as Bitcoin's price recovered to $114,359, a 1.43% increase.

Ethereum (ETH) saw about $58.09 million in positions liquidated over 24 hours, with $2.54 million in short positions liquidated over 4 hours. Ethereum's price increased by 1.99% over 24 hours.

XRP had approximately $9.4 million liquidated and showed a 4.27% price increase. Among other major altcoins, Doge saw $4.12 million in liquidations, followed by Solana (SOL) with $3.8 million.

Interestingly, the ENA Token triggered significant short position liquidations ($5.8 million) with a high price increase of 9.97%, and the PUMP Token also saw liquidations alongside a 10.12% price increase.

Unlike other coins, the FARTCO Token showed much higher long position liquidations ($29,000) compared to short position liquidations ($20,000).

In the cryptocurrency market, 'liquidation' refers to the forced closure of a leverage position when a trader fails to meet margin requirements. This large-scale short position liquidation can be seen as an indicator that the cryptocurrency market is riding a recent upward momentum.

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>