Two large Ethereum investors are taking advantage of the recent market correction to increase their stake in the asset.

In early August, whale wallets invested over $400 million in ETH, indicating confidence in the asset's long-term value.

Ethereum Whales Increase On-Chain Activity... Buying at the Bottom

One of the most notable transactions occurred in a wallet tracked by Arkham Intelligence. Over three days, this wallet purchased approximately $300 million worth of ETH through Galaxy Digital's over-the-counter trading desk.

Currently, this wallet holds about $26 million in unrealized losses.

Somebody is buying a TON of ETH.

— Arkham (@arkham) August 3, 2025

In the past 3 days, this address has accumulated $300M of ETH from Galaxy Digital OTC.

It's currently worth $274M, with this address down $26M or 8.7% so far.

Address: 0xdf0A67Ded855F8ea4baB6399690883243c0e2EF3 pic.twitter.com/pB9Foxm1wx

However, the scale and speed of the purchase suggest a strategic long-term accumulation rather than short-term speculative trading.

Another key participant in this buying spree is SharpLink, an Ethereum-centric company.

According to Lookonchain, the company purchased 30,755 ETH over two days, spending $108.57 million at an average price of $3,530.

SharpLink currently holds 480,031 ETH, valued at approximately $1.65 billion.

SharpLink(@SharpLinkGaming) received another 15,822 $ETH($53.9M) 6 hours ago.

— Lookonchain (@lookonchain) August 3, 2025

They spent 108.57M $USDC to buy 30,755 $ETH in the past 2 days, with an average buying price of $3,530.

SharpLink now holds a total of 480,031 $ETH($1.65B).https://t.co/fWtEg2UYB8 pic.twitter.com/EX6r4mQXCY

These purchases were made when Ethereum dropped to its recent low near $3,300. According to BeInCrypto's data, ETH has slightly recovered and is trading at around $3,477 at the time of writing.

Industry experts noted that these whale activities reflect an optimistic outlook on Ethereum.

In July, ETH surpassed $3,900 due to record institutional inflows, increased ETF exposure, and expansion of stablecoin-based DeFi.

Experts argue that this is not a short-term rally but a signal of Ethereum's expanding role in global finance.

The increase in network on-chain activity supports this view.

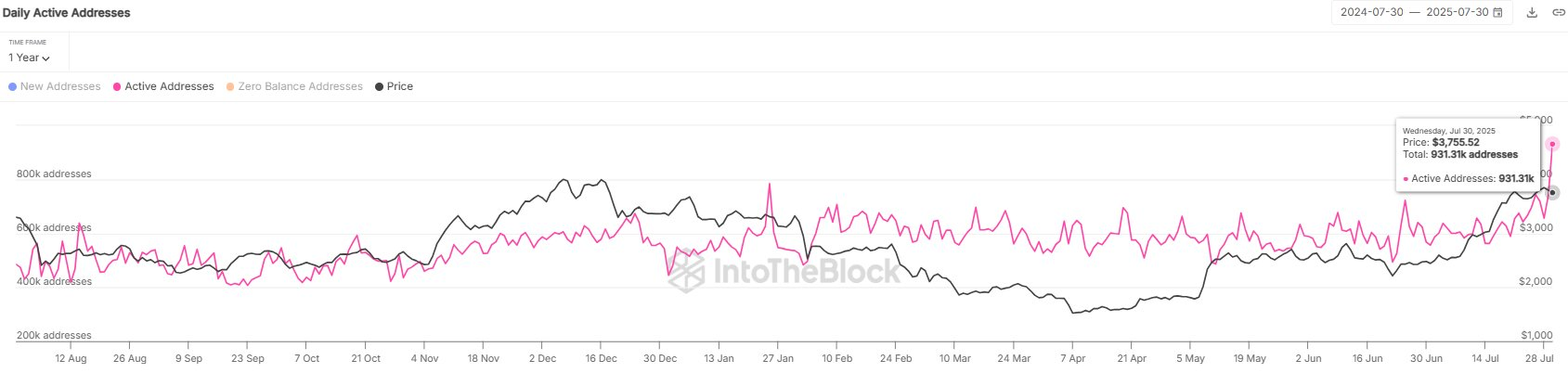

Sentora (formerly IntoTheBlock) recently reported that Ethereum recorded 931,000 active addresses in a day, the highest in almost two years, highlighting increased user engagement and interest across the network.

Moreover, regulatory trends could further strengthen Ethereum's prospects, as U.S. authorities are prepared to lead the blockchain-based era.

Thomas Lee, a famous venture capitalist from Fundstrat, suggested that if Ethereum continues to dominate as the preferred smart contract platform for Wall Street firms, its value could significantly increase, potentially reaching $60,000.