BTC has been struggling to maintain its upward momentum since recording a new all-time high of $122,054 on July 14th. At the current moment, the major cryptocurrency is trading around $113,000, having declined approximately 7.4% over the past 19 days.

This decline indicates a decrease in the profit ratio of BTC supply, weakening investor confidence. As the new trading month progresses, this trend could be a precursor to a larger price correction.

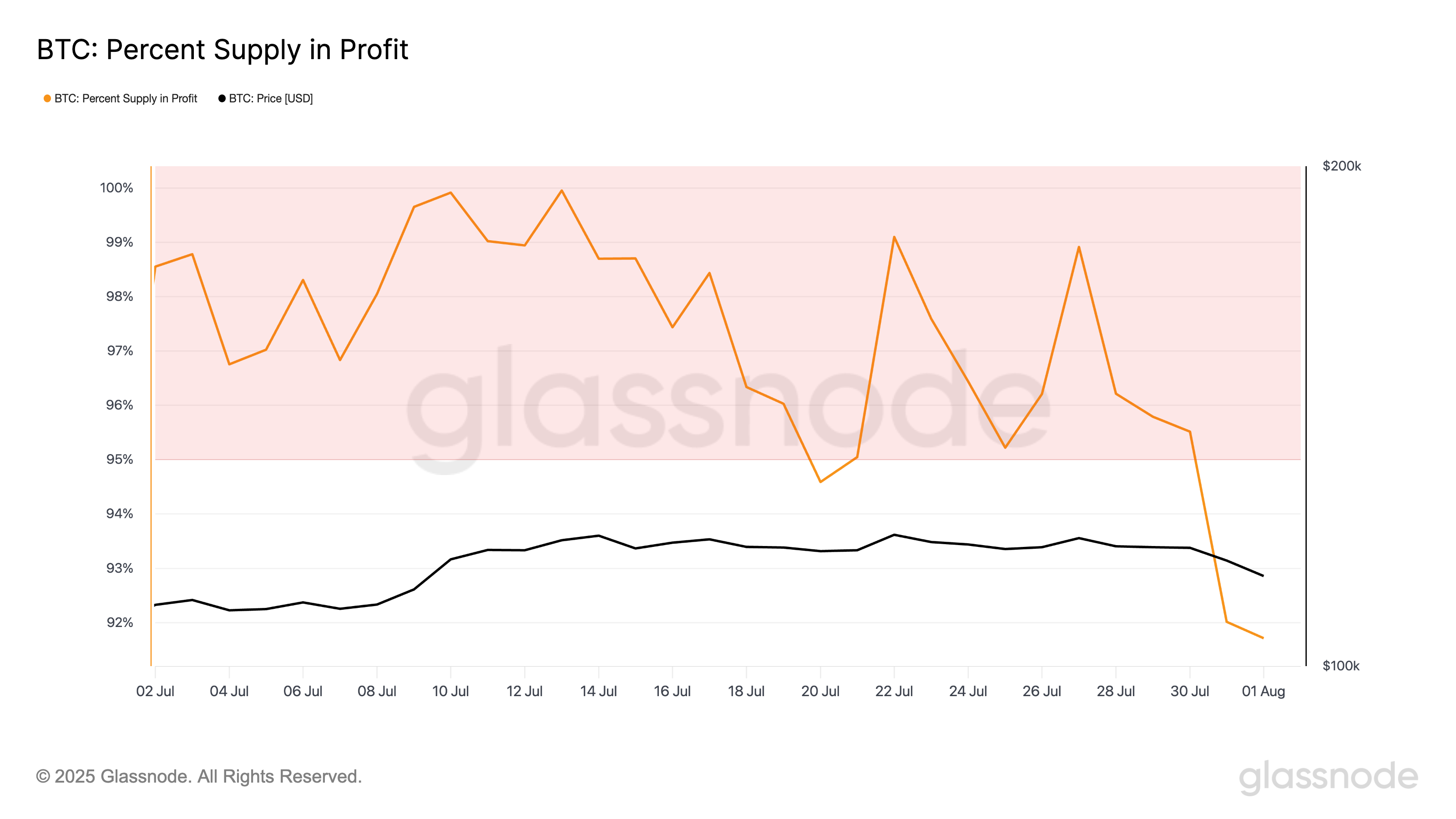

BTC Profitability at 41-Day Low

According to glassnode, the BTC profit supply ratio dropped to a 41-day low of 91.71% on August 1st. This indicator measures the proportion of BTC circulating supply currently in profit, reflecting market sentiment that often peaks during euphoric rallies and declines as investor confidence weakens.

Want more token insights? Subscribe to editor Harshi Notariya's daily crypto newsletter here.

When this indicator declines, more holders are reaching their break-even point or recording losses. Historically, such market conditions coincide with market corrections or potential price adjustments.

The recent drop to 91.71% suggests the market is cooling after weeks of price increases. This reflects a change in sentiment as the number of profitable holders decreases.

This could weaken short-term buying pressure and expose BTC to additional downside risk in the next trading session.

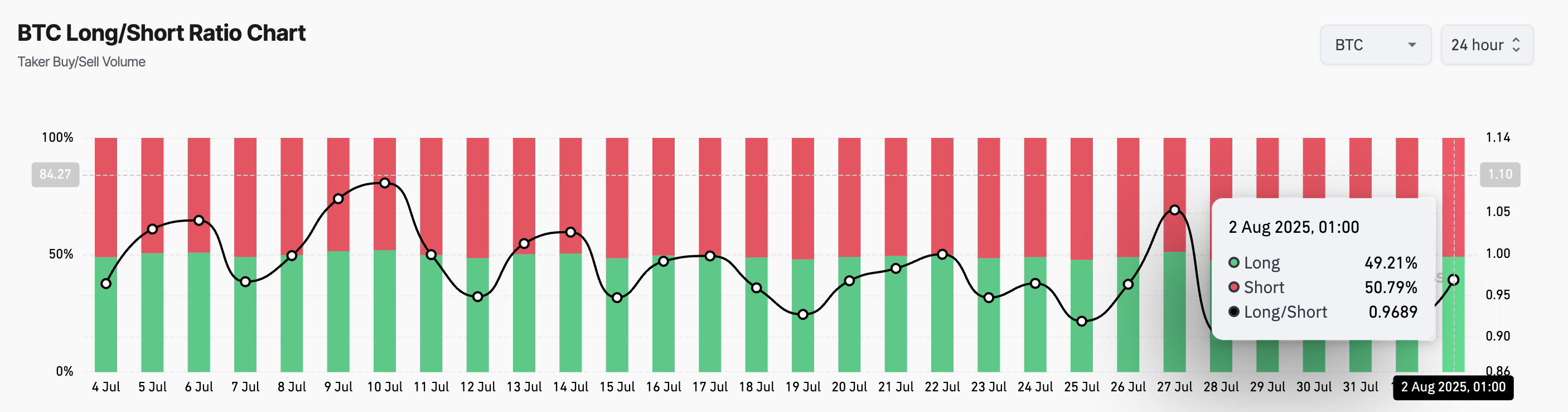

BTC Futures Traders Turning Bearish… Facing Critical Test

The BTC Longing/Short ratio has tilted towards the bearish zone, confirming that bullish confidence among leveraged traders is disappearing. Currently, this ratio is 0.96, below 1.

The Longing/Short indicator measures the ratio of Longing and Short bets in the futures market for an asset. A ratio above 1 indicates more Longing positions than Short positions, suggesting most traders expect the asset's value to rise.

Conversely, a Longing/Short ratio below 1 means more traders are betting on the asset's price decline than those expecting an increase.

With fewer traders aggressively betting on continued growth, BTC may struggle to recover momentum unless a new catalyst emerges.

BTC's Next Move: Potential Drop to $111,855… Breaking $120,000?

BTC's daily trading volume has decreased from July's peak, indicating reduced market participation. If profit-taking intensifies, BTC could fall to $111,855.

However, if new demand enters the market, the coin's price could recover strength and rise to $116,952. Breaking this resistance could be the key to BTC rising again above $120,000.