ZORA's price performance turned bearish over the past 24 hours, moving further away from its new all-time high of $0.105.

This downturn signals the beginning of a profit-taking cycle, following a decrease in whale activity and a slight increase in exchange inflows.

ZORA Whales Exit Near Token Peak… Correction Incoming?

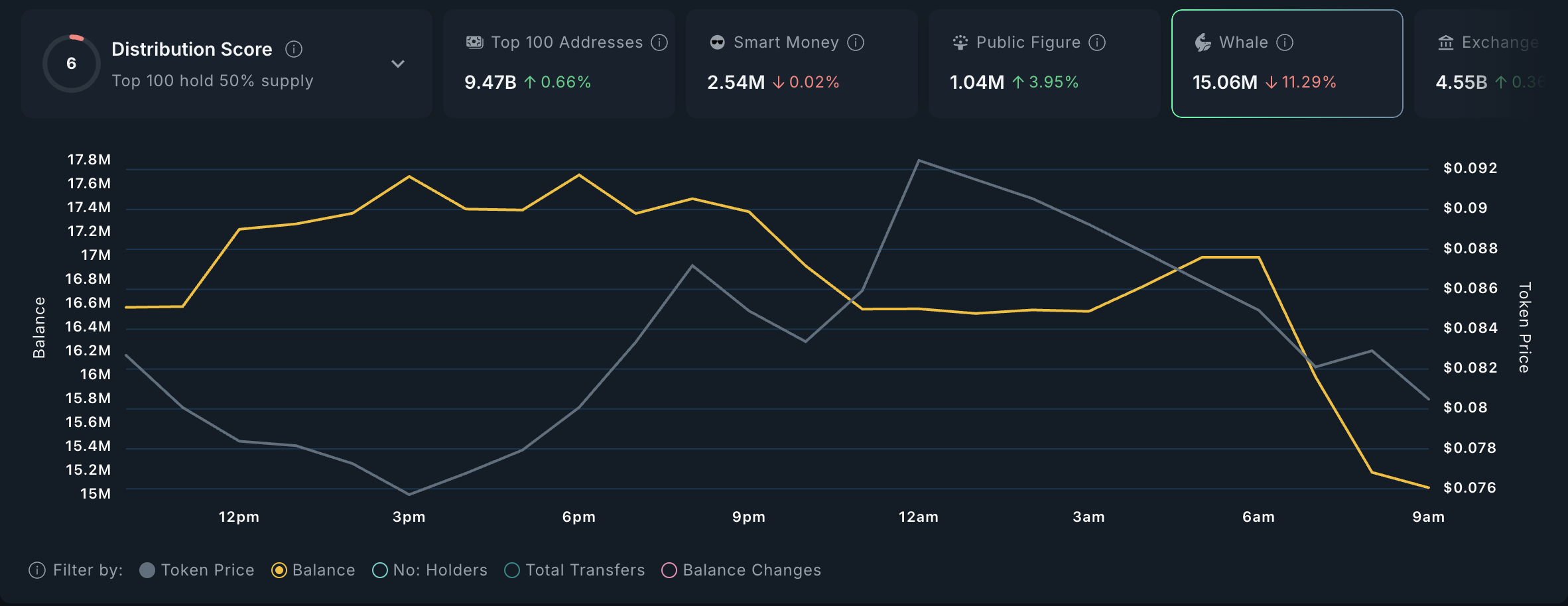

According to Nansen's data, ZORA's large holder activity has sharply decreased over the past 24 hours.

The on-chain data provider indicates that the balance of high-value wallets holding over $1 million in ZORA has decreased by almost 11% in just one day, signaling a notable change among major stakeholders.

Token TA and Market Update: Want more such token insights? Subscribe to the daily crypto newsletter here.

A sudden retreat occurred after ZORA's rise to its all-time high of $0.105. As market volatility and uncertainty increase, whales appear to be reducing their held positions while keeping the token's price at a high level.

The wave of whale profit-taking could trigger a domino effect among retail traders. As short-term trend confidence weakens, smaller holders might follow suit, potentially exacerbating downward pressure on ZORA's price.

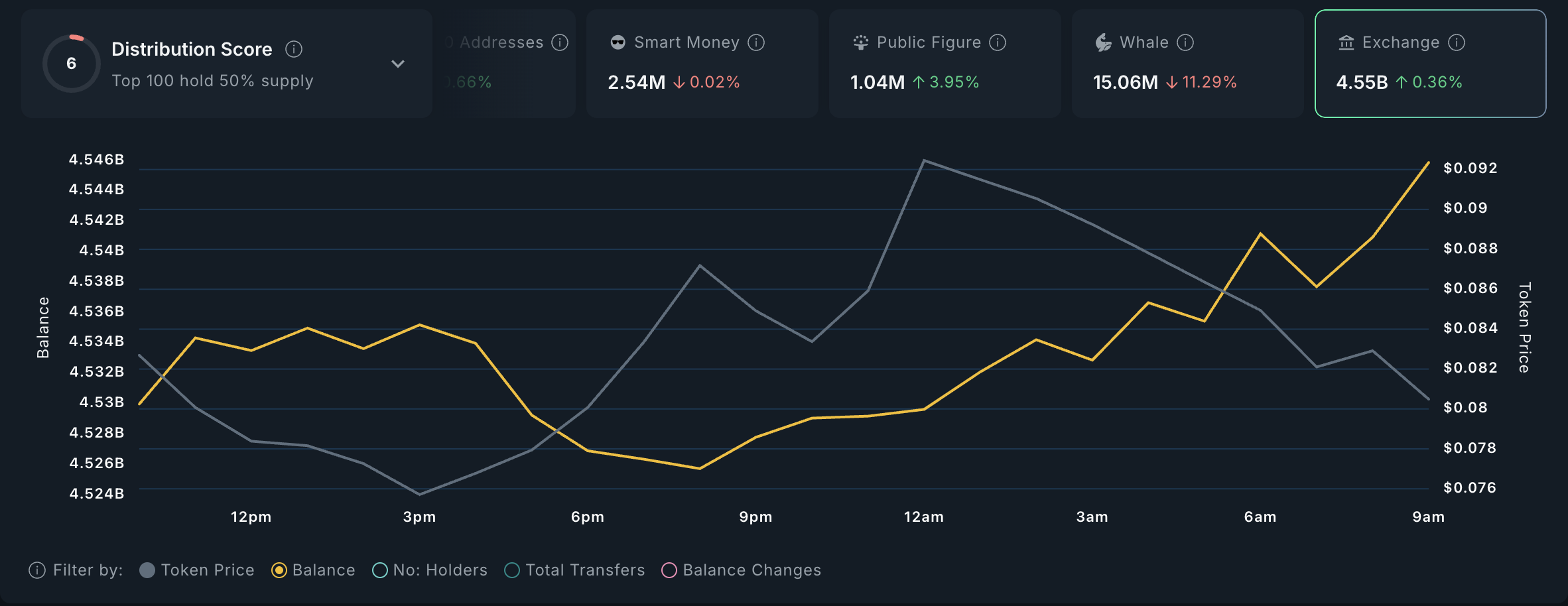

Moreover, ZORA has seen a slight 0.36% increase in exchange holdings over the past day, suggesting an increased number of tokens transferred to trading platforms since reaching its all-time high.

ZORA Exchange Activity. Source: Nansen

A surge in asset exchange inflows can signal that holders are preparing to sell. The combination of increased inflows, decreased whale activity, and reduced buy-side momentum intensifies downward pressure, increasing the likelihood of a short-term ZORA price correction.

ZORA Driven by Selling Pressure

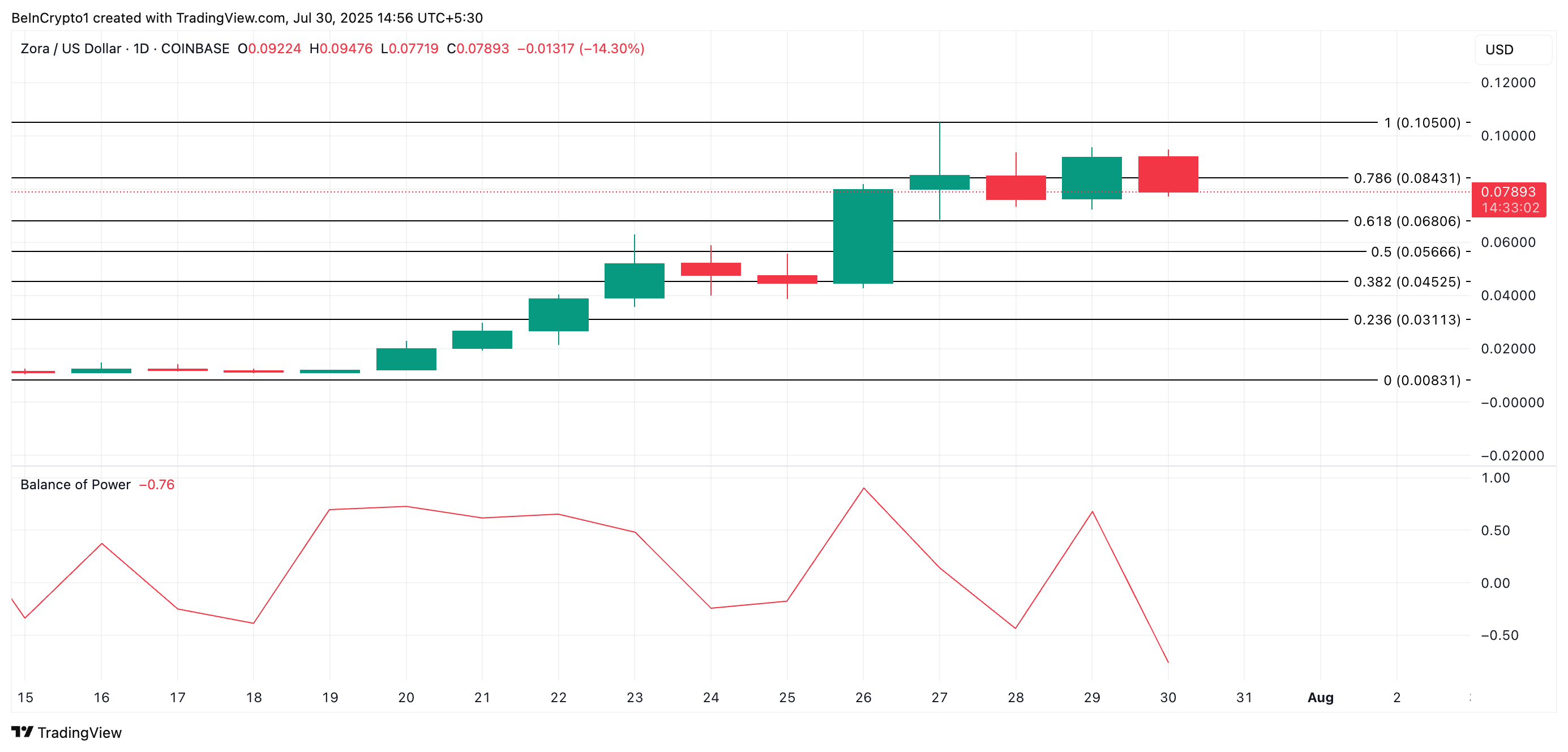

From a technical perspective, ZORA's Balance of Power (BoP) indicator is currently negative, emphasizing a clear decrease in buying pressure. The momentum indicator measuring buy and sell pressure at the current point is -0.76.

This suggests that buyers are losing control and sellers are beginning to dominate market direction.

If this situation continues, ZORA's price could plummet to $0.068.

Conversely, if buy-side strength increases, it could break through the $0.084 resistance and rise again to $0.105.