XRP's price is hovering with Bitcoin, showing signs of weakening bullish support.

Major on-chain indicators also showed a downward trend last week. This flow indicates that investor interest is cooling down.

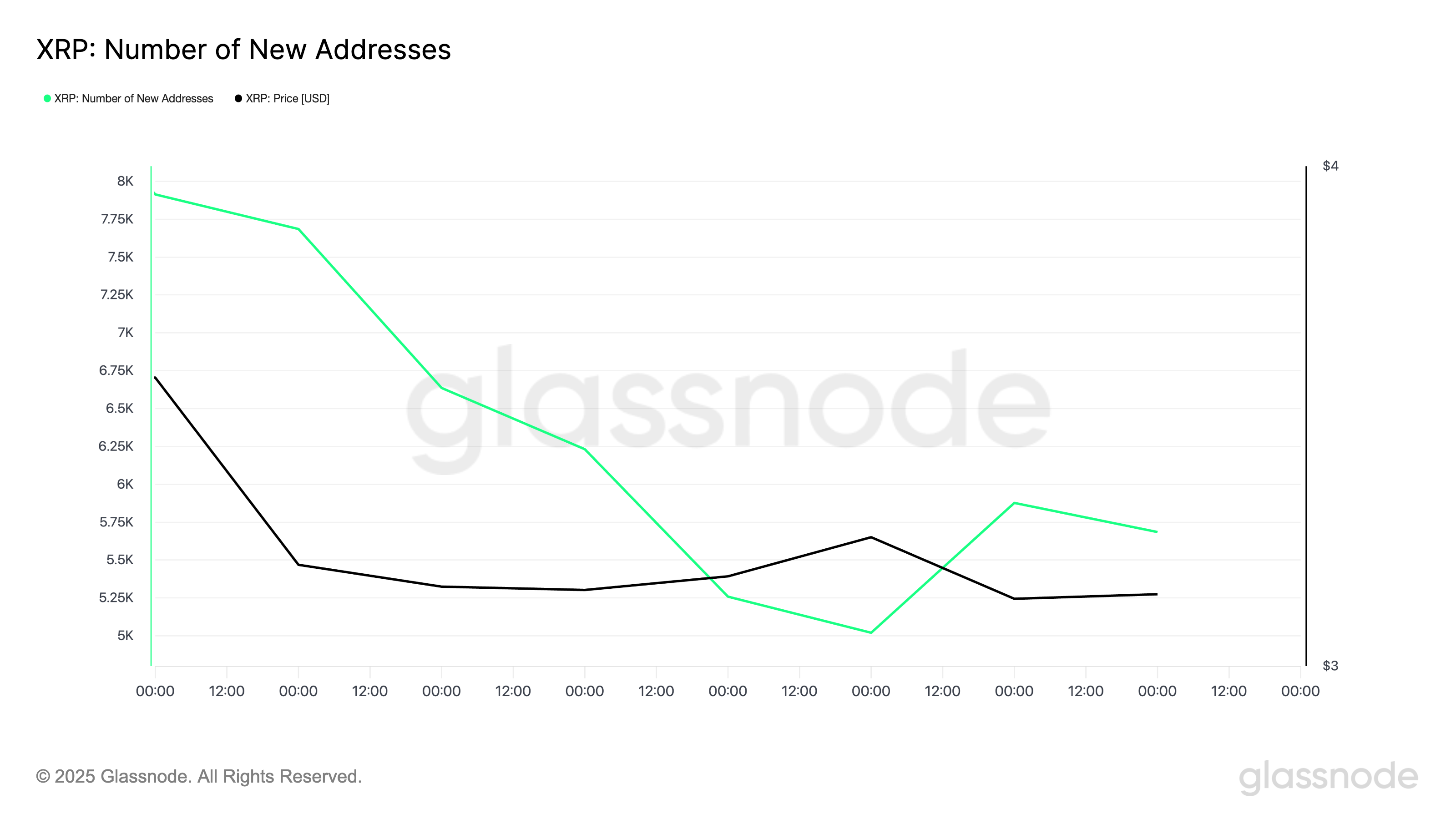

Disappearing New Wallets... Decrease in Futures Trading Volume

According to glassnode, new XRP demand sharply declined over the past 7 days. On the 29th (local time), only 5,685 new addresses traded XRP. This is a 28% decrease from 7,914 addresses recorded 7 days ago.

Token TA and Market Update: Want more of these token insights? Subscribe to the daily crypto newsletter here.

The decrease in new demand indicates that new capital and market participants' interest are weakening. This is essential for maintaining the asset's upward momentum. For XRP, the lack of new capital makes the asset more vulnerable to bearish pressure, which could break out of its narrow price range in the near term.

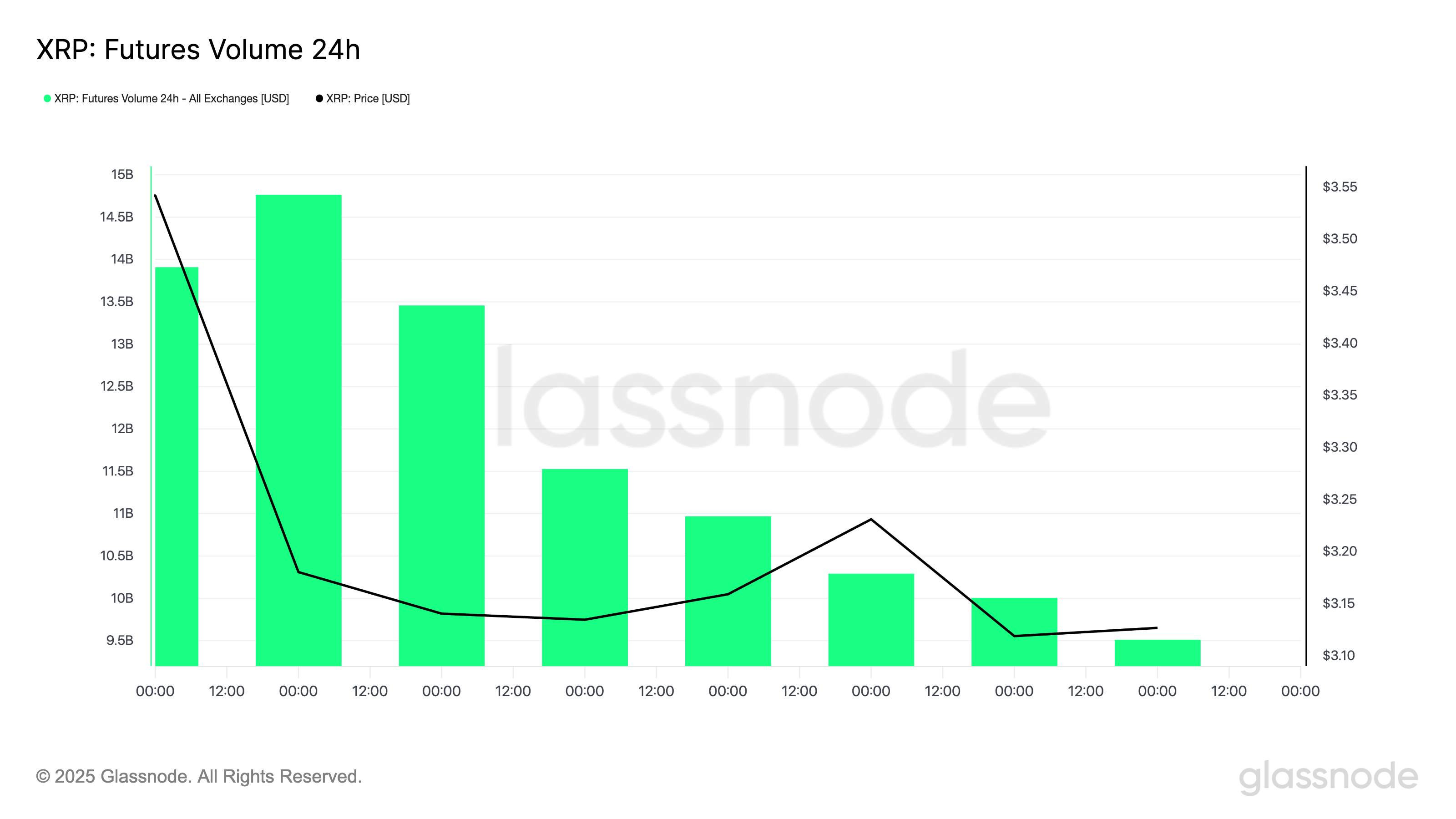

Additionally, futures market activity has noticeably decreased, further suggesting momentum loss. According to glassnode, the total daily trading volume of XRP futures contracts, measured by a 7-day moving average, dropped by over 30% last week.

This suggests that leveraged investors are restraining their trading. When futures trading volume decreases and spot prices hover, it indicates market uncertainty and lack of direction.

If speculative interest does not push the price higher, XRP risks falling below its current range, especially if selling pressure increases.

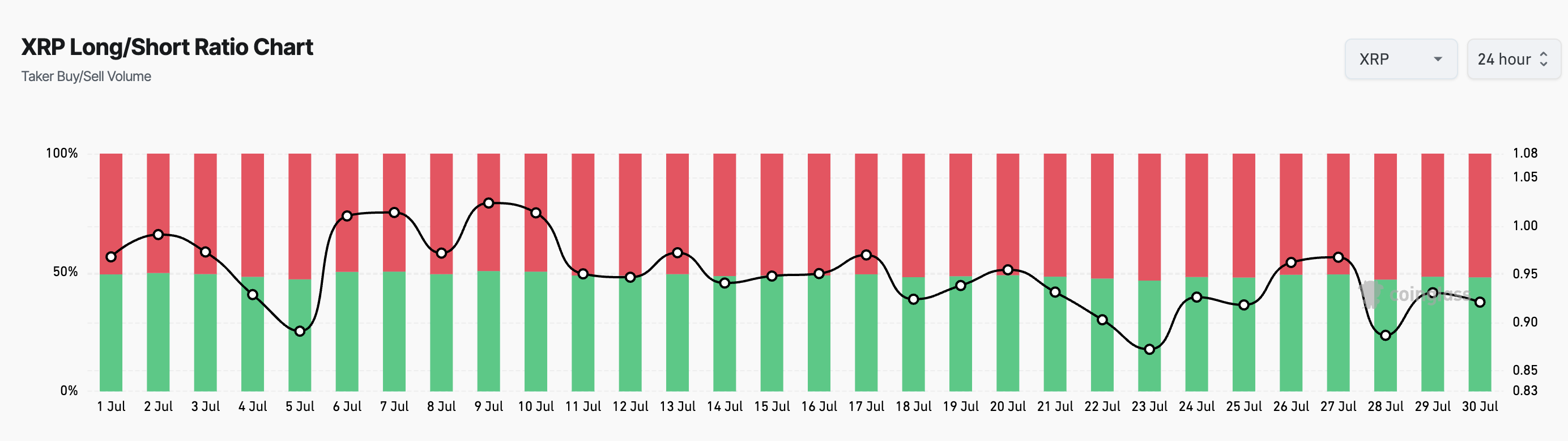

XRP Futures Sentiment Turns Bearish

Unfortunately, the desire to push XRP higher is not the dominant sentiment in the futures market. This is reflected in the current Longing/Short ratio of 0.92.

The Longing/Short indicator measures the ratio of Longing positions to Short positions in the asset's futures market. A ratio above 1 indicates more Longing positions than Short positions. This suggests most traders expect the asset's value to rise.

Conversely, a Longing/Short ratio below 1 means more traders are betting on the asset's price falling.

Therefore, XRP's current Longing/Short ratio suggests most traders anticipate a decline, confirming the bearish outlook in the spot market.

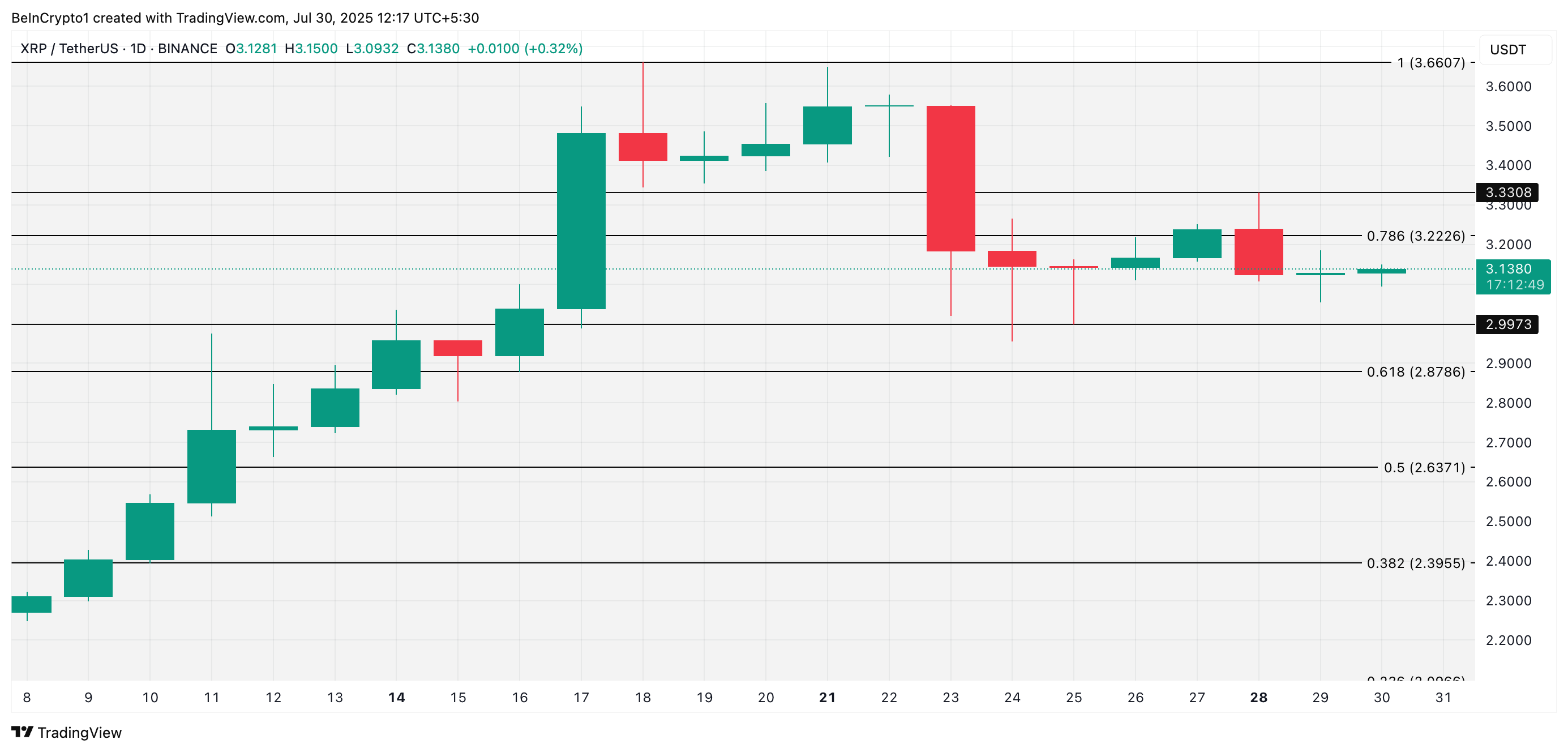

XRP, Weakening Buying Pressure... Will It Maintain $3?

Currently, XRP is trading at $3.13, with strong resistance acting below $3.22. If selling pressure intensifies and the token breaks out of its sideways trend, the price could drop below $3 to reach $2.99.

Conversely, if new demand re-enters the market, it could trigger a rally beyond $3.22 to $3.33.