Welcome to the US Crypto News Morning Briefing. We will briefly summarize today's key cryptocurrency news.

The United States is promoting the expanded use of stablecoins to guide the weak dollar. Crypto expert Max Keiser believes that Bitcoin will perform a very different role in the future.

Max Keiser: "Bitcoin Will Perform a Core Role in Traditional Systems"

Interest rate cuts remain a hot potato in the United States. Jerome Powell, the Federal Reserve Chairman, is standing up to political pressure from President Trump.

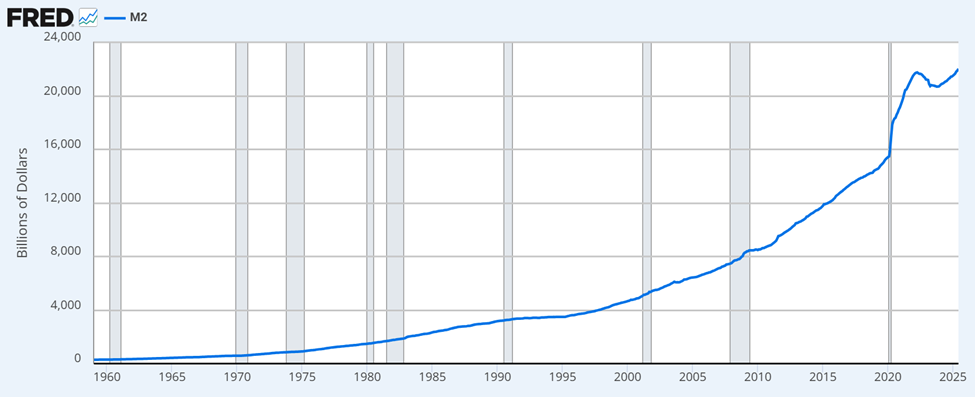

While Powell resists pressure from the US administration to lower interest rates, global M2 money supply is increasing. However, not as quickly as many would like.

Bitcoin expert Max Keiser recently said that if M2 money supply increases quickly enough, it could devalue the dollar. This could satisfy Trump's export hopes.

According to Keiser, Trump wants to double the M2 money supply by utilizing stablecoins.

"Your dollar purchasing power will be cut in half."

Max Keiser recently said this on X (formerly Twitter).

Keiser also mentioned that stablecoin issuers are purchasing BTC at a rapid pace.

In this context, BeInCrypto contacted Max Keiser to get more information. He emphasized that BTC is no longer just a speculative asset. Rather, he said it will become a growing hedge against national defaults and legal tender failures.

"BTC is always equivalent to a CDS for the $400 trillion global legal tender Ponzi scheme. This is now collapsing as demand for securities like US Treasuries has dramatically decreased."

Max Keiser

Today's Chart

Notable US Cryptocurrency News

Here are notable cryptocurrency news in the United States.

- BitMine estimates Ethereum's intrinsic value at $60,000.

- 4 institutions that could trigger BTC selling in August

- CryptoPunks floor price rises 8% amid high interest in Non-Fungible Token revival.

- Coinbase's roadmap update triggered price increases for two altcoins.

- BTC whales are still silent. Why hasn't the rally started yet?

- XRP price risks falling below $3.

- Conflux 3.0 upgrade surged CFX coin price by 12%.

- BTC dominance has sharply decreased. Has the altcoin season finally arrived?

- Why did Ray Dalio suggest allocating 15% of portfolio to BTC or gold?

- Ethereum, Solana, and PYUSD are gaining attention after PayPal's global cryptocurrency launch.

Cryptocurrency Stock Pre-Market Overview

| Company | July 28 Closing Price | Pre-Market Overview |

| Strategy (MSTR) | $403.80 | $408.50 (+1.16%) |

| Coinbase Global (COIN) | $379.49 | $381.40 (+0.505%) |

| Galaxy Digital Holdings (GLXY) | $29.60 | $30.05 (+1.52%) |

| Marathon Holdings (MARA) | $17.16 | $17.34 (+1.05%) |

| Riot Platforms (RIOT) | $14.51 | $14.57 (+0.41%) |

| Core Scientific (CORZ) | $13.75 | $13.75 (+0.036%) |