Written by: Sima Cong AI Channel

I am focusing on a new dominant narrative and judging its value: the transition from the "decentralization" narrative to the "traditional centralized institutions with compliance narrative."

I am thinking about a question: "New bull market" or "a last hurrah before the reshuffle".

Don't say I didn't warn you.

Technology should be the ladder of human progress, but why is it always engulfed by greed and speculation?

From the narrative of "decentralization" to the narrative of "traditional centralized institutions with compliance", what remains unchanged is the cutting of leeks.

From the launch of the Stablecoin Act to its implementation today, you will find that the whole world is extremely crazy, and "traditional listed companies, investment institutions, and Wall Street have become the biggest contributors to this speculative craze.

The victims are no longer limited to traditional crypto speculators...the risks have spilled over to the traditional world and more people, and to traditional finance.

Since the introduction of the stablecoin bill, the victims are no longer limited to the zero-sum game between cryptocurrency speculators, but have spread to a wider range of people.

While the current crypto market remains significantly smaller than the traditional financial markets that triggered the 2008 crisis, the underlying logic is the same: high-leverage speculation lacking transparency, asset values detached from fundamentals, and the contagion of risk across various financial sectors. When a pharmaceutical company (Windtree) also begins "establishing a BNB reserve strategy," the transmission of this cross-sector risk is indeed alarming. This suggests that non-professional companies, in pursuit of short-term market trends, may allocate core assets to areas of high volatility where they are less skilled. A market reversal could harm the company's fundamentals and the interests of ordinary shareholders.

Let us face the reality: the transition from the "decentralization" narrative to the "traditional centralized institutions with compliance narrative" is an era of the strongest crypto centralization in history and also an era of the highest prices in history.

The path to mainstream crypto assets

2009–2017

Decentralized, anonymous, and censorship-resistant

2018–2023

The rise of exchanges, institutional entry, and regulatory exploration

2024–2025

Compliance, securitization, and Wall Streetization

Narrative Change: Who is Dominating the Crypto World Today?

Traditional financial institutions

(Goldman Sachs, JPMorgan Chase, BlackRock) ------------------- Promote ETFs, issue stablecoins, and package token securities

Public Company

(MicroStrategy, Windtree, Qianxun Technology) --------- Crypto assets, hype concepts, and stock price manipulation

Wall Street investment banks

(Galaxy Digital, Grayscale) ------------------- Promoting token securitization and structured products

Politicians

(Trump, CZ, Musk) -------------------------- Using crypto narratives to gain support, funding, influence

The risks of crypto assets are spilling over into the traditional financial system, and like in 2008, the impact is wider and more difficult to control.

Lessons from the 2008 financial crisis:

Ø Financial derivatives are detached from the real economy

Ø Leverage out of control, risk transmission layer by layer

Ø Regulatory lag and outbreak of systemic risks

Ø Ordinary people will ultimately bear the consequences

This is where it all starts now

In fact, Trump's "crypto-friendly" stance is a clear shift in his recent campaign strategy and a manifestation of his political savvy. During his presidency, although the Treasury Department and the Office of the Comptroller of the Currency (OCC) showed a certain openness to the crypto industry in some aspects (such as allowing banks to provide crypto custody services), Trump himself was skeptical of cryptocurrencies in the early days, even calling Bitcoin a "scam based on thin air."

His current positive attitude is more aimed at winning the support of young voters, technology voters and cryptocurrency holders, and is in sharp contrast to the Biden administration's policies (especially SEC Chairman Gary Gensler, who is regarded as "anti-crypto" by the crypto industry).

Even within the Republican Party, views on cryptocurrencies are divided, with those who actively embrace innovation and free markets and conservatives who worry about their use for illegal activities and money laundering.

During his second term (starting in 2025), Trump rapidly promoted crypto-friendly policies, including establishing a strategic Bitcoin reserve in March 2025 (based on $17 billion in confiscated Bitcoin) and signing the GENIUS Act on July 19th to regulate stablecoins. These initiatives led to the United States being considered the "global crypto capital," and the price of Bitcoin briefly rose to over $100,000.

He appointed close friends (such as Paul Atkins as SEC Chairman) and created the position of "Crypto and AI Czar" (David Sacks), promoted regulatory easing, and suspended 12 investigations into companies such as Coinbase and Binance.

Potential attack points after the Democrats come to power

Differences between the two parties:

Democrats have traditionally been cautious about cryptocurrencies. The Biden administration (2021-2025) is pushing for regulation (such as EO 14067), and Senators such as Elizabeth Warren have warned of the money laundering risks of cryptocurrencies. In May 2025, the Democrats introduced the "End Crypto Corruption Act" to oppose Trump's policies.

The Republican Party is also divided, with 13 Republicans defecting on July 15, 2025, to oppose the GENIUS Act, showing that the policy is not partisan mainstream.

Attack possibility:

Legal Prosecution: After leaving office, Trump family businesses (such as World Liberty Financial) may face SEC investigations, particularly regarding suspected insider trading related to the $500 million in proceeds from the $TRUMP token. Richard Blumenthal launched a preliminary investigation in May 2025.

Political accusations: Democrats may use the congressional hearings to expose Trump's conflicts of interest (such as his $75 million deal with Justin Sun) and damage his reputation.

Policy reversal: If the Democrats come to power, they may withdraw Bitcoin reserves and sell $17 billion in assets, which will undermine confidence in the crypto market.

Stablecoins and bills must be viewed correctly

Early Bitcoin and Ethereum emphasized "censorship resistance," "autonomous control of assets," and "escape from traditional financial oppression," a form of anti-establishment technological utopianism.

Today, the United States is trying to accept encryption through legislation such as the Stablecoin Act, and those driving this change are no longer anonymous geeks like Satoshi Nakamoto, but Circle, BlackRock, Franklin Templeton, Fidelity, Visa, Mastercard, and even pharmaceutical companies.

For example, Hong Kong.

Hong Kong's Stablecoin Ordinance will come into effect on August 1, 2025, and the application for stablecoin licenses will be launched at the same time.

The license for stablecoin issuers will not be issued by applicants downloading forms and submitting written applications on their own, but will be arranged in a similar invitation application system.

Regarding the so-called invitation application system, a source explained that in actual operation, the Hong Kong Monetary Authority, which is responsible for supervision and licensing, will communicate in advance with interested applicants for stablecoin licenses to understand whether the other party meets the basic application qualifications. Only after basic approval is obtained in the preliminary communication will the HKMA issue the application form.

Another source revealed that application scenarios are one of the factors that regulators value most, and it can be felt that the Hong Kong Monetary Authority is very cautious about approving licenses.

In fact, Eddie Yue, Chief Executive of the Hong Kong Monetary Authority, made a similar statement at the Hong Kong Investment Funds Association Annual Meeting on June 23. He stated that stablecoin applicants must be able to provide a concrete and practical use case. "Without a use case, you won't even get an application form."

Currently, there are fifty or sixty companies interested in applying for Hong Kong stablecoin licenses, including state-owned enterprises, financial institutions and Internet giants in mainland China.

Hong Kong has very strict risk management requirements for stablecoin issuers, especially the anti-money laundering and anti-terrorist financing regulatory standards, which are almost on par with banks and e-wallets. The entry threshold is very high, and only a few licenses will be issued in the first phase.

On May 21, 2025, the Hong Kong Legislative Council officially passed the "Stablecoin Bill", and the Hong Kong stock market began to hype stablecoin concept stocks, and then expanded to the entire digital asset concept.

In addition to mainland state-owned enterprises, internet giants, and traditional financial institutions, the number of companies applying for stablecoin licenses is diversifying. On the evening of July 17th, Huajian Medical (01931.HK), a Hong Kong-listed medical company, announced plans to build a "NewCo+RWA" Web3 exchange ecosystem centered around innovative pharmaceutical high-tech assets and issue a proprietary stablecoin (IVDDollar). The company primarily engages in the research and development, production, and sales of in vitro diagnostic medical devices and consumables (IVD products). Its 2024 revenue is projected to be 3.162 billion yuan, with a net profit attributable to parent company of 274 million yuan. The company also announced on July 14th that its board of directors had resolved to pursue a dual primary listing on Nasdaq.

On July 18, 2024, while preparing to establish a stablecoin licensing regime, the Hong Kong Monetary Authority (HKMA) approved three potential issuers from over 40 applications for inclusion in its stablecoin testing sandbox. The three sandbox testers are: Yuanbi Innovation Technology Co., Ltd.; JD CoinChain Technology (Hong Kong) Co., Ltd.; and a joint venture established by Standard Chartered Bank (Hong Kong), Animoca Brands, and Hong Kong Telecom (HKT). These three issuers are currently in the sandbox's testing phase, second testing phase, and late testing phase, respectively.

Asymmetrical imaginary space

The crypto world is pushing and using all its power to promote this fantasy: the implementation of the stablecoin bill will benefit cryptocurrency speculation! ?

But the question is: After stablecoins become compliant, will they be an incremental source of new on-chain investment channels?

Is this really the reality?

The GENIUS Act specifically regulates payment-based stablecoins. First, the Act imposes strict market access controls on stablecoin issuers, prohibiting them from offering interest on their issued stablecoins. Stablecoin issuers must meet bank-level regulatory compliance requirements. Stablecoin issuers established or registered outside the United States must register with the Office of the Comptroller of the Currency (OCC) if conducting business in the United States. They must also hold sufficient reserve assets at U.S. financial institutions to meet the liquidity needs of their U.S. customers.

The bill also makes special provisions for non-financial public companies. If a public company is not primarily engaged in financial activities, its wholly-owned or majority-owned subsidiaries and affiliates are not allowed to issue payment stablecoins.

Second, the bill imposes strict requirements on the issuer's reserve assets to ensure the redemption ability of stablecoins, which is also the core clause of the bill.

The bill provides for numerous supporting measures: First, it strictly prohibits the rehypothecation of reserve assets, explicitly prohibiting issuers from using reserve assets for collateralized financing, lending, or other speculative transactions. Second, it requires the public disclosure of monthly reserve fund reports, including information on the total number of outstanding stablecoins, the amount and composition of reserves, the average maturity of each type of reserve instrument, and the geographic location of custody. These reports must be signed and confirmed by the company's Chief Executive Officer (CEO) and Chief Financial Officer (CFO). Issuers with a combined total issuance exceeding $50 billion must also publicly disclose annual financial statements, including any related-party transactions.

Third, strengthen anti-money laundering rules. The bill requires issuers to establish an anti-money laundering and customer identification system covering the entire business process, such as properly retaining payment stablecoin transaction records, monitoring and reporting suspicious transactions, and blocking, freezing, and rejecting illegal transactions. By combining technical means with institutional processes, it prevents the risk of illicit capital flows and terrorist financing.

Foreign stablecoin issuers are also subject to the additional requirements of reciprocal arrangements established and implemented by the U.S. Treasury with other jurisdictions. Otherwise, they may not offer or sell their overseas-issued stablecoins in the United States. The U.S. Treasury may establish and implement reciprocal arrangements with other jurisdictions if their regulatory regimes for stablecoins are comparable to the one established by the U.S. GENIUS Act.

Therefore, the GENIUS Act is intended to address the "trust" and "risk" issues of payment stablecoins, rather than to directly stimulate people to invest in crypto assets.

Does the operating principle that the stablecoin bill is good for crypto hold true?

The question is: What do unspecified individuals or institutions do after getting stablecoins?

Stablecoins and RWAs are inseparable from the characteristics of the underlying blockchain architecture. Stablecoins are anchored by fiat currencies/government bonds, etc., and rely on blockchain smart contracts to achieve 1:1 asset mapping, becoming a value bridge connecting traditional finance and Web3.0.

Domestic third-party payment platforms (WeChat Pay MAU exceeds 1.1 billion, and Alipay MAU reaches 900 million) are essentially "stablecoin-like" mechanisms anchored to the RMB, relying on legal reserves to ensure currency stability. Domestic fees are as low as a few thousandths (for example, WeChat's online payment commission is 0.6%), far superior to the few percent of overseas platforms (such as PayPal).

Internet companies related to cross-border payments (with cross-border goods/service transactions) are more actively deploying stablecoins, such as JD.com and Ant Financial.

Advantages: 1) User scenarios: Companies like Amazon have hundreds of millions of users and mature payment scenarios (such as cross-border e-commerce), which can quickly promote the application of stablecoins; 2) Technical capabilities: Internet companies have technical research and development capabilities; 3) Ecosystem synergy: The closed loop of B-end (supply chain) + C-end (retail payment) can strengthen the network effect of stablecoins.

The GENIUS Act (implemented on July 19, 2025) explicitly limits the scope of regulation to "payment stablecoins," which are defined as digital assets used for payment, transfer, or settlement that must be backed by 1:1 fiat currency and meet bank-level compliance (such as OCC registration).

The bill does not directly mention "investment and financing stablecoins", but by prohibiting issuers from providing interest and re-hypothecation (Article 2 reserve asset requirements), it indirectly restricts the investment and financing functions of similar income-generating stablecoins (such as DAI).

The bill requires that reserve assets be used only for redemption and not for pledge, lending, or speculation (Section 2, Section 1). This means that stablecoins issued by issuers (such as USDC) are designed to support only payment purposes. In July 2025, Circle's CEO explicitly stated that USDC would focus on cross-border payments, with average daily trading volume increasing to $1.2 billion.

Those with obvious investment and financing characteristics (such as algorithmic stablecoins, yield-based stablecoins, or stablecoins whose value growth depends on the active investment efforts of the issuer) are likely not to fall within the direct regulatory scope of the GENIUS Act, but will be subject to existing securities laws (regulated by the SEC) or other more stringent financial product regulations.

Therefore, there is a regulatory "gray area" hidden here: investment and financing stablecoins are not included in formal supervision, nor are they explicitly prohibited, which means "neither encouraged nor suppressed", but they still survive in a legal vacuum.

The bill prohibits issuers from providing interest → suppressing the financial attributes of the issuer.

However, users are not prohibited from using stablecoins for DeFi staking and RWA investment → the financial attributes of the user side are retained.

The answer is in another bill

Stablecoins were initially approved for issuance based on the “payment narrative”, but were subsequently used in a wide range of speculative scenarios, including secondary market investment, mortgage and pledge, and institutional position building.

This is the underlying logic behind why the stablecoin bill is beneficial to the so-called crypto world.

This is one of the biggest risks in the current crypto market:

In a structure where payments are in name only and investments are in reality, regulators want to regulate payments, but the market uses this as a detour for speculation.

Ø Due to issuers' compliance and investors' freedom, the regulatory chain is not closed, and risks eventually spill over into traditional finance;

This could potentially repeat the systemic risks of 2008, characterized by widespread circulation of AAA-rated securities, liquidity mismatch, and a lack of regulatory oversight.

The Clarity Act clarifies the respective regulatory responsibilities of the two major US regulatory bodies—the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC)—in the digital asset market. Under the bill, the SEC will be primarily responsible for regulating stablecoin trading and combating fraud in stablecoins and digital commodities, while the CFTC will be responsible for registration and trading supervision in the digital asset market.

The Clarity Act defines digital assets as "digital representations of value recorded on a distributed ledger through encryption." It also explicitly stipulates that securities, securities derivatives, stablecoins, bank deposits, commodities such as agricultural products, commodity derivatives, artworks, asset pools, and other investment products, even if in digital form, are not considered "digital commodities" and will therefore continue to be regulated under current rules.

The Clarity Act requires digital asset exchanges, brokers, and dealers to temporarily register with the CFTC within 180 days of its enactment until the SEC and CFTC release a formal registration process.

In addition, the CFTC regulates the trading of digital commodities and is also responsible for supervising contracts involving "permitted payment stablecoins" by registered entities, but it has no authority to issue rules for permitted payment stablecoins or make requirements on related entities or stablecoin issuers.

The Clarity Act also further clarifies that investment contract assets recorded on the blockchain, capable of being exclusively held and directly transferred peer-to-peer without the need for intermediaries can be considered digital assets and should be subject to the provisions of the Clarity Act.

Under the Clarity Act, investment contract digital assets that meet certain requirements do not need to be registered with the SEC as required by the Securities Act. For example, if "the issuer operates the digital asset on a mature blockchain or intends to do so within four years," or "the amount does not exceed US$75 million in a single year," these investment contract assets will be registered with the CFTC.

Under the Clarity Act, the SEC is responsible for regulating transactions by permitted payment stablecoin issuers on dealers, brokers, exchanges, or other trading systems. Furthermore, digital commodity trading activities registered with the SEC but exempt from CFTC regulation are also subject to SEC oversight.

In addition, the Clarity Act also stipulates that the rules and judicial precedents prohibiting fraud, manipulation, or insider trading under the Securities Act apply to approved payment stablecoins and digital commodity transactions to the same extent as securities transactions, and this part of the regulatory responsibility remains the responsibility of the SEC.

mean:

Ø Although these payment stablecoins themselves are not securities;

Ø However, as long as they are circulated and traded on trading platforms, brokers, etc., the SEC's trading supervision mechanism will take effect.

As long as its currency is used on an exchange/broker venue, the SEC has regulatory authority.

The SEC’s regulatory authority is not limited to the issuers of payment stablecoins and their reserve management (the core of the GENIUS Act), but also extends to the trading of these stablecoins in the secondary market.

Confirming the formation of a "regulatory closed loop": Combining the GENIUS Act (regulating the issuance and reserves of stablecoins) and the CLARITY Act (clarifying the nature of tokens and giving the SEC broad regulatory powers over trading practices and market integrity), the United States is indeed building a comprehensive, clearly divided, yet mutually complementary digital asset regulatory closed loop.

This information completely shatters the simplistic understanding that commodities are not regulated by the SEC. Even for digital commodities, if their trading methods or market behavior reveal fraud, manipulation, or other issues, the SEC can intervene. The SEC's authority permeates every corner of the digital asset market, ensuring fairness and integrity in market behavior.

DeFi will face a "compliance screening", and some projects may exit the market due to lack of transparency, liquidity or compliance paths.

If an Altcoin is interpreted by the market as "compliant" simply because it meets the "registration requirements" of a regulatory agency (such as registration with the CFTC), triggering speculation, this is itself a dangerous illusion. Registration does not equate to fundamental value.

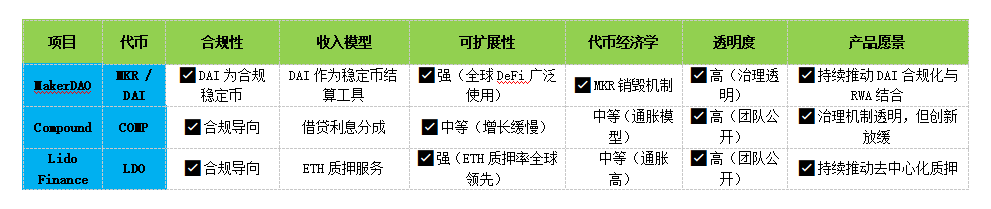

My methodology: looking for valuable projects, especially within new narratives

1. Revenue sustainability and scalability

Does the project generate revenue? If yes, does it provide the required services? If yes again, then the next step is to look at scalability.

How do highways make money? Every car that passes through a toll booth pays a fee. However, the number of cars that can pass through a highway simultaneously is not infinite. To increase revenue, once a highway approaches congestion, the operator has two options: expand it by building new lanes and/or increase tolls.

If a project grows its revenue as traffic increases, then it meets the scalability requirement. The best projects are those that can grow their revenue exponentially because their cost structure grows at a much slower rate.

2. Healthy Token Economics

If a project is able to regularly buy back and burn their tokens, then by definition, the economic interest represented by each remaining token in circulation will be higher. This is not much different from how companies in traditional finance do stock buybacks, where earnings per share (EPS) increase as the number of shares outstanding decreases, even if profits don't. Projects that increase profits while reducing the circulating supply of their tokens benefit from this.

3. Transparency

Every piece of information running on it can be accessed and verified.

4. Compliance

The fact that there are already general laws and regulations in the world that do not (yet) explicitly include the term "blockchain," or even if some do, they are not consistently enforced, is not an excuse not to comply with them. Of course, there are exceptions, such as the fully decentralized Bitcoin blockchain.

Does it comply with the Clarity Act and the GENIUS Act? Is it considered a security by the SEC?

5. Clear product/service vision and continuous innovation

The most successful projects are always those that have never significantly changed their product and vision since the beginning. If a project needs to "reinvent themselves," I see it as a red flag, meaning that anything they invested money in building before then is almost worthless. Another red flag is a project that needs to change its name.

If a project continues to develop its product and expand its service suite along the same lines, this is always a strong sign of success and healthy demand. Conversely, if a project at some point "branchs off" into something different from their core vision and product, this is usually a sign that they believe the potential demand for them is limited.

6. Substitutability and absorbability

Core factors such as technology and competitors need to be considered.

Background reiteration: What does the implementation of the stablecoin bill mean?

In essence, the implementation of the Stablecoin Act does not directly benefit crypto speculative assets, but rather:

Strengthening the positioning of "stablecoin = financial infrastructure" (the bill regulates the issuance mechanism, reserve ratio, and the issuance authority of banks and non-banks)

Ø It is conducive to the legal and compliant access of traditional financial institutions to the on-chain world (such as securities companies, banks, and payment platforms)

Ø Make regulated platforms more willing to connect with on-chain projects, thereby expanding the actual application scenarios of some high-quality crypto assets

The conclusion is:

This bill benefits protocol projects that have revenue models + compliance capabilities + financial service attributes, and does not constitute a fundamental benefit to purely speculative Memecoin or Layer1 speculative assets.

Detailed analysis:

Ø Coinbase is a robust Web3 infrastructure platform. It's not a Web3 hype stock, but it's a "Buffett-like company" in the crypto space and deserves attention in the medium and long term.

Ø Circle is the issuer of the stablecoin USDC and will benefit positively from the stablecoin bill.

Ø Coinbase is a leading compliant exchange in the United States and also directly holds shares in Circle, making it an indirect beneficiary.

Ø Ethereum is one of the carriers of the "on-chain US dollar system". The stablecoin policy is beneficial to its infrastructure role, but it may not immediately increase in volume in the short term.

SOL has a speculative advantage, but its valuation premium should gradually converge amidst the current clarification of compliance policies. Regulatory risks remain. The SEC has attempted to classify it as a security, leaving it in a regulatory gray area, with high inflation and incomplete deflation.

LINK is one of the few protocols that has clear revenue and service support in both bull and bear cycles, making it a worthy long-term investment target.

UNI (Uniswap) is a high-risk, high-return project. If it introduces a fee-sharing system and successfully resists regulation, its value may be revalued. Inflation is high, and the value of governance rights remains limited. The SEC has drafted a lawsuit, and the degree of decentralization has not yet mitigated the risks. If Uniswap is designated as an "exchange" by the SEC, it may face legal action.

Ø AAVE has a stable revenue model and robust product logic, but compliance barriers are the core issue that limits further valuation increases.

Pendle: The niche but specialized interest rate derivatives market is highly speculative, limited by market size and unclear regulation. It also involves high levels of financial engineering complexity, making compliance extremely challenging.

Ø ONDO is one of the most direct beneficiaries of the implementation of the stablecoin bill. It is a high-quality bridge connecting real-world assets (RWA) with the chain, and its prospects are extremely promising.

Ø Pyth Network (PYTH) is another important on-chain oracle infrastructure with long-term potential.

Ø Aptos (APT) has the potential to gradually become the second main chain besides Ethereum and is worthy of attention.

Ø Celestia (TIA) Web3 underlying modular development is worth planning in advance.

Ø BUIDL (BlackRock Tokenized Fund) BUIDL represents the trend of institutional entry, with short-term stability and long-term benefits from traditional financial integration.

Ø TRAC (OriginTrail) RAC combines real-world applications with the potential of DeFi, with minimal regulatory impact and promising long-term growth.

Underlying Technology: High fungibility. From a purely technical perspective, the underlying tokenization standards (such as ERC-20) and smart contract programming are widely used and open source. Any team with blockchain development capabilities can implement similar basic tokenization functionality.

Non-technical barriers (high). ONDO's true barriers lie in its compliance framework, legal structure, business integration with traditional financial institutions (such as custodians and asset issuers), and experience in obtaining regulatory approvals. This is a complex system engineering project involving financial law, regulatory technology, and traditional financial operational processes. Academically, this can be considered a form of "institutional technology" or a manifestation of "compliance as a competitive advantage." This "technology" is not the code itself, but the ability to translate complex legal and financial processes into executable blockchain protocols, which is extremely difficult to replicate non-technically.

Chainlink is a decentralized oracle network for blockchains, serving as a critical middleware connecting on-chain smart contracts with off-chain real-world data. It addresses the core issues of blockchain data silos and trust deficits.

The fundamental concept of oracle as a service model is replicable by other teams or protocols. Other oracle projects exist in the market (e.g., Band Protocol, Pyth Network, etc.).

Chainlink’s true moat lies in its powerful network effects and the unparalleled trust it has built in the industry.

From a purely technical code perspective, its substitutability is moderate. However, from a deeper perspective, regarding network effects and trust accumulation, Chainlink's barriers to entry are extremely high, and its "ecosystem technology substitutability" is extremely low.

Whether it is a large technology company (such as cloud computing service providers, which need to introduce off-chain data into the blockchain) or a traditional financial data service provider (such as Bloomberg, which needs to expand into the on-chain data market), they may want to control or deeply participate in the data entrance of the blockchain.