Author | Mario Chow @IOSG

Introduction

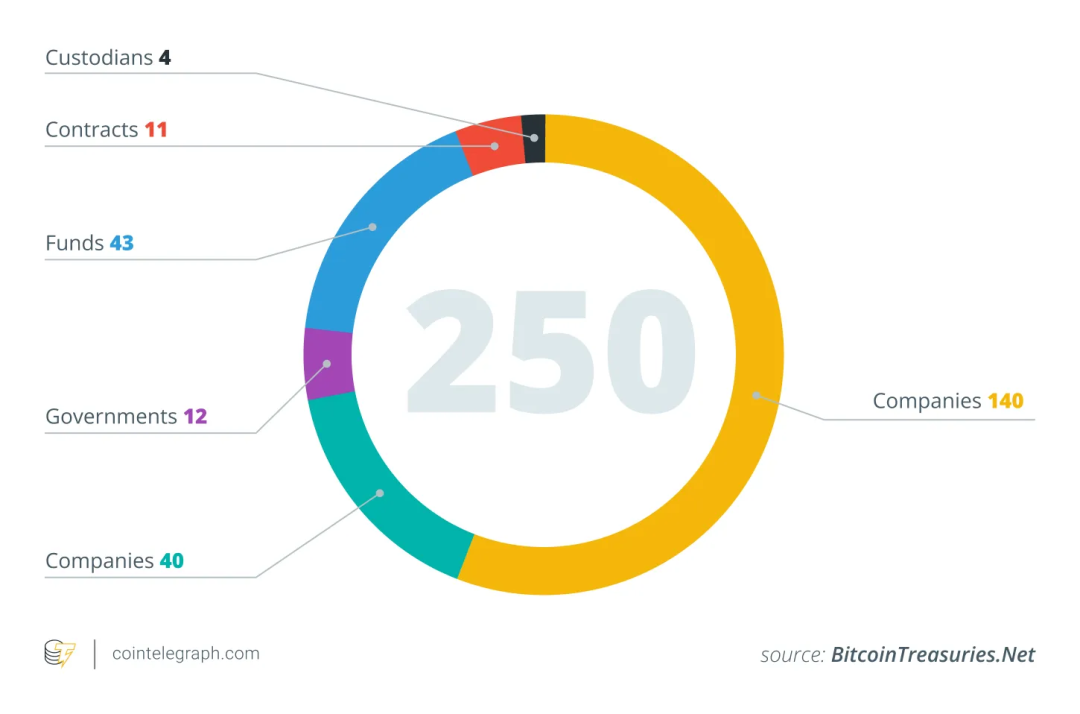

By mid-2025, an increasing number of listed companies have begun incorporating cryptocurrencies (especially Bitcoin) into their corporate treasury asset allocation, inspired by the successful case of Strategy ($MSTR). For example, according to blockchain analysis data, in June 2025 alone, 26 new companies added BTC to their balance sheets, bringing the total number of companies holding BTC globally to approximately 250.

These companies span multiple industries (technology, energy, finance, education, etc.) and different countries and regions. Many companies view Bitcoin's limited supply of 21 million as a hedge against inflation and emphasize its low correlation with traditional financial assets. This strategy is quietly becoming mainstream: as of May 2025, 64 SEC-registered companies collectively hold approximately 688,000 BTC, representing about 3-4% of Bitcoin's total supply. Analysts estimate that over 100-200 companies globally have incorporated crypto assets into their financial statements.

Crypto Asset Reserve Model

When a listed company allocates part of its balance sheet to cryptocurrencies, a core question arises: How do they finance the purchase of these assets? Unlike traditional financial institutions, most companies adopting a crypto treasury strategy do not rely on cash-rich core businesses to support this. The following analysis will primarily use $MSTR (MicroStrategy) as an example, as most other companies are essentially replicating its model.

Operating Cash Flow

While theoretically the most "healthy" and least dilutive method would be purchasing crypto assets through free cash flow generated by the company's core business, in reality, this approach is almost unfeasible. Most companies lack sufficiently stable and large-scale cash flows to accumulate substantial BTC, ETH, or SOL reserves without external financing.

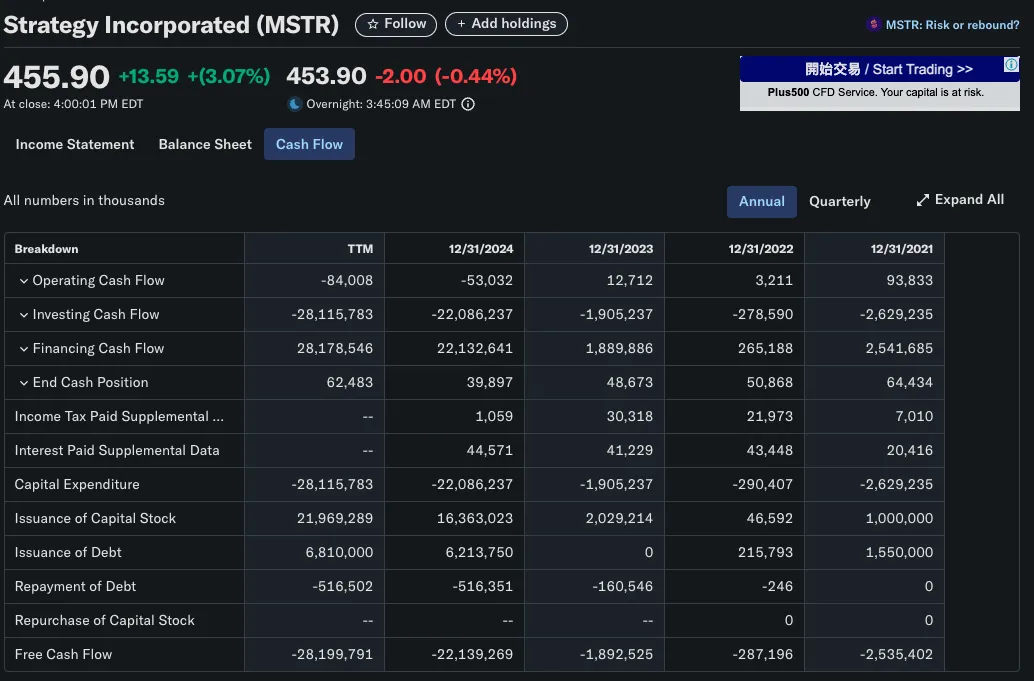

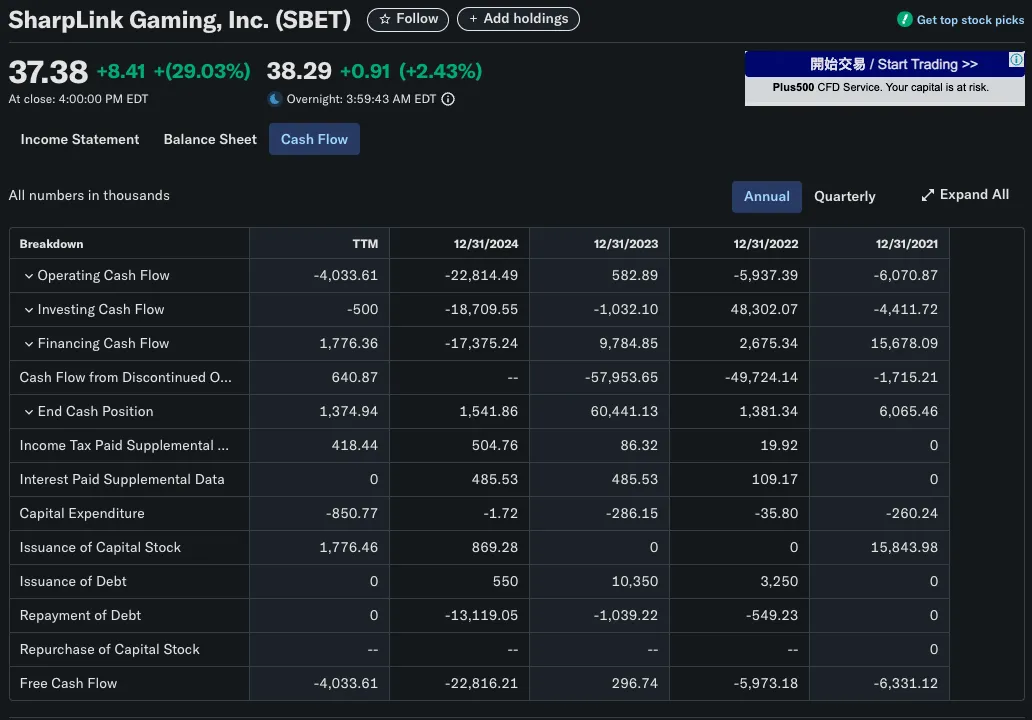

Taking MicroStrategy (MSTR) as a typical example: Founded in 1989, it was originally a software enterprise focused on business intelligence, with products including HyperIntelligence and AI analysis dashboards, but these products still generate only limited revenue. In fact, MSTR's annual operating cash flow is negative, far from the billions invested in Bitcoin. This shows that MSTR's crypto treasury strategy was never based on internal profitability but relied on external capital operations.

A similar situation occurred with SharpLink Gaming (SBET). The company transformed into an Ethereum treasury vehicle in 2025, purchasing over 280,706 ETH (approximately $840 million). Clearly, this could not be achieved through its B2B gaming business revenue. SBET's capital formation strategy primarily relied on PIPE financing and direct stock issuance, rather than operating income.

Capital Market Financing

Among companies adopting crypto treasury strategies, the most common and scalable method is through public market financing, issuing stocks or bonds to raise funds for purchasing crypto assets like Bitcoin. This model allows companies to build large-scale crypto treasuries without using retained earnings, fully leveraging traditional capital market financial engineering methods.

Stock Issuance: Traditional Dilutive Financing Case

In most cases, issuing new stocks comes with costs. When companies raise funds by issuing new stocks, two things typically occur:

Ownership dilution: Existing shareholders' percentage of company ownership decreases.

Earnings per share (EPS) decline: With unchanged net profit, increased total shares lead to lower EPS.

These effects typically cause stock price drops, mainly for two reasons:

Valuation logic: If price-to-earnings (P/E) remains constant while EPS declines, stock price will also fall.

Market psychology: Investors often interpret financing as indicating the company lacks funds or is in distress, especially when raised funds are for unverified growth plans. Additionally, market supply pressure from new stock influx can lower market prices.

An Exception: MicroStrategy's Non-Dilutive Equity Model

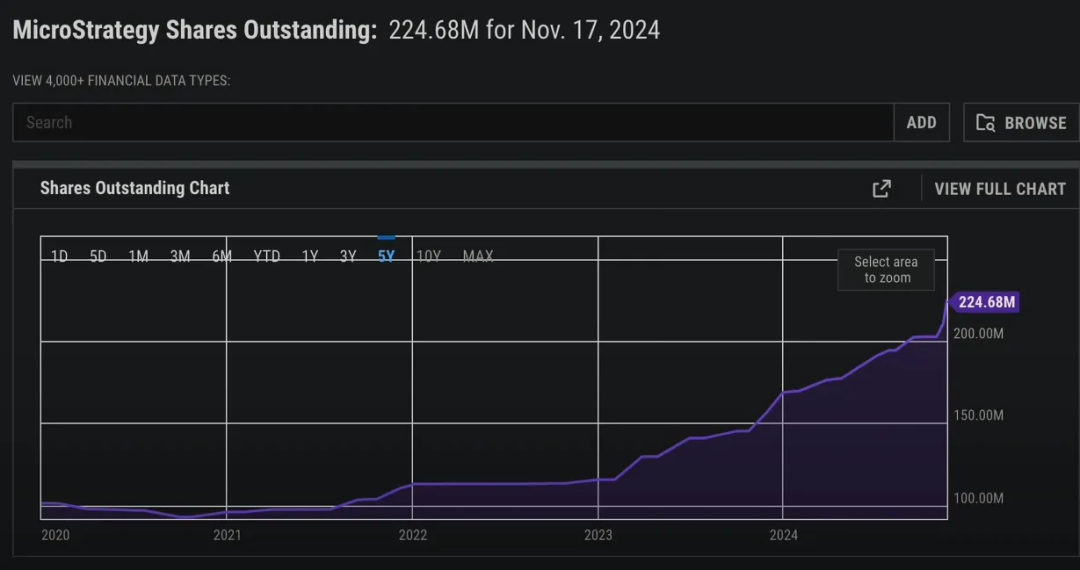

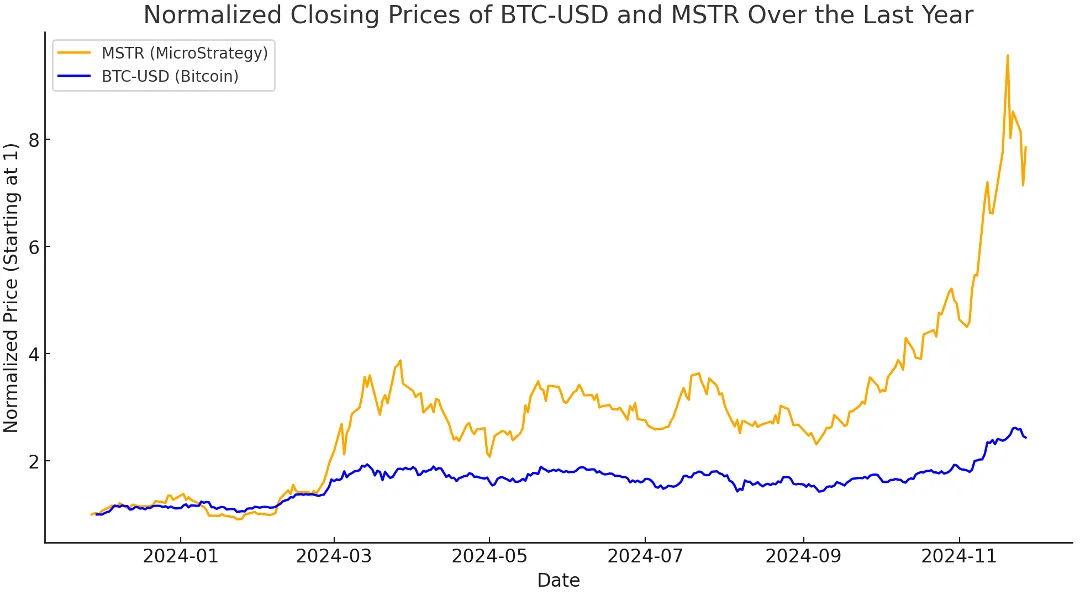

MicroStrategy (MSTR) is a typical counterexample to the traditional narrative of "equity dilution = shareholder loss". Since 2020, MSTR has actively used equity financing to purchase Bitcoin, with total circulating shares growing from under 100 million to over 224 million by the end of 2024.

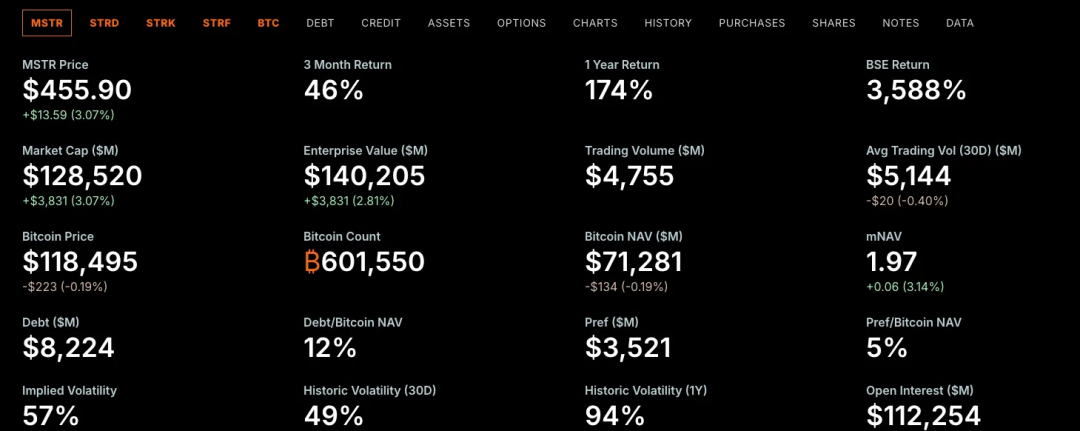

Despite share dilution, MSTR's performance often outperforms Bitcoin itself. Why? Because MicroStrategy has long been in a state where its market value exceeds its Bitcoin net value, or what we call mNAV > 1.

Understanding Premium: What is mNAV?

When mNAV > 1, the market values MSTR higher than its Bitcoin's fair market value.

In other words, when investors obtain Bitcoin exposure through MSTR, they pay a price per unit higher than directly buying BTC. This premium reflects market confidence in Michael Saylor's capital strategy and may represent market perception of MSTR providing leveraged, actively managed BTC exposure.

Traditional Financial Logic Support

Although mNAV is a crypto-native valuation indicator, the concept of "trading price exceeding underlying asset value" has long been common in traditional finance.

Companies often trade at prices higher than book value or net assets for several reasons:

#Discounted Cash Flow (DCF) Valuation Method

Investors focus on the present value of the company's future cash flows, not just its current assets.

This valuation method often leads to companies trading far above their book value, especially in the following scenarios:

Expected revenue and profit margin growth

Company possesses pricing power or technological/business moats