In the past 24 hours, approximately $188.44 million (about 275.3 billion won) worth of leverage positions were liquidated in the cryptocurrency market.

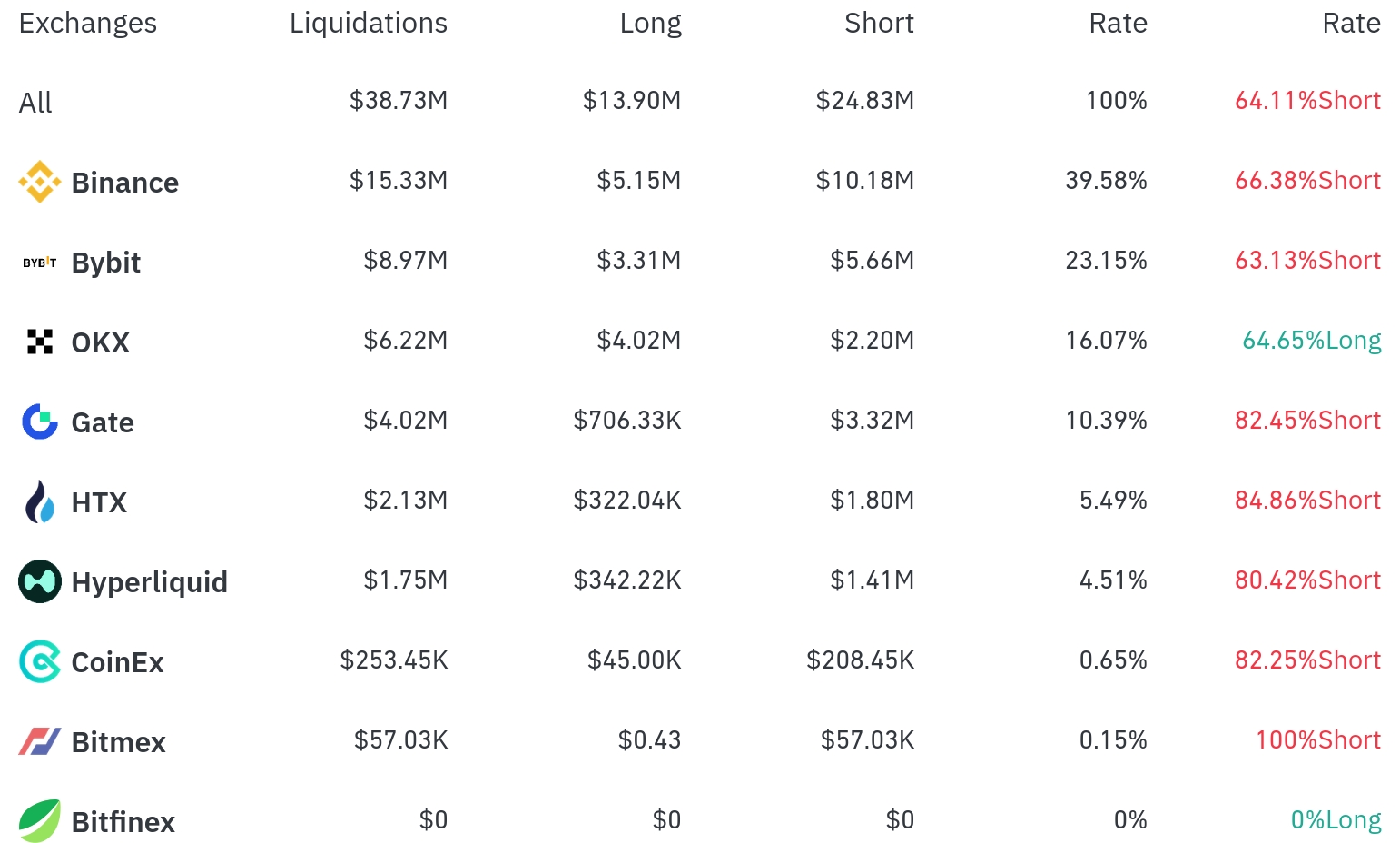

According to the currently aggregated data, a unique phenomenon was observed where short positions were predominantly liquidated. On a 4-hour basis, major exchanges showed a prevalence of short position liquidations, with HTX and Gate recording over 80% short position liquidation rates.

Binance recorded the highest position liquidations over the past 4 hours, with a total of $15.33 million liquidated (39.58% of the total). Among these, short positions accounted for $10.18 million, or 66.38%.

Bybit was the second-highest exchange, with $8.97 million (23.15%) of positions liquidated, of which short positions comprised $5.66 million (63.13%).

OKX saw approximately $6.22 million (16.07%) in liquidations, and unlike other major exchanges, had a higher long position liquidation rate of 64.65%.

By coin, Ethereum (ETH) recorded the most liquidations. Approximately $72.27 million in Ethereum positions were liquidated within 24 hours, which occurred despite a market rise (+2.95%). On a 4-hour basis, $11.83 million was liquidated from long positions and $16.19 million from short positions.

Bitcoin (BTC) had approximately $43.73 million in positions liquidated over 24 hours, showing a slight increase of 0.84%. On a 4-hour basis, $3.90 million was liquidated from long positions and $2.93 million from short positions.

Doge (DOGE) experienced significant liquidations of $9.67 million in 24 hours, with $4.50 million in short position liquidations on a 4-hour basis, despite a 1.39% rise.

Solana (SOL) had about $8.41 million liquidated in 24 hours, with a price increase of 3.09% and a prevalence of short position liquidations.

Notably, the ENA Token recorded a significant 12.06% rise, causing substantial short position liquidations ($1.14 million), and meme tokens like PENGU and FARTCO also saw considerable short position liquidations.

Despite the overall market uptrend, this large-scale short position liquidation appears to be a result of market participants anticipating a downturn, but experiencing a rebound instead. Particularly, Ethereum's strong rise (+2.95%) caused significant losses for many short position traders.

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>