BNB price reached a new all-time high (ATH) on Sunday, surpassing the previous high of $793.86 recorded in early December.

This surge led to approximately $180 million in total positions being liquidated, with short positions driving the liquidations.

BNB Approaches All-Time High of $830

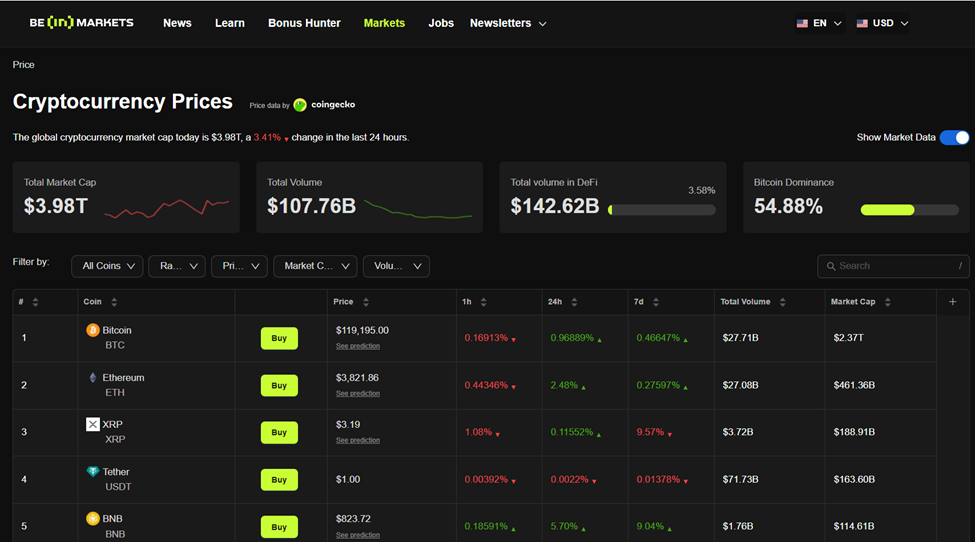

According to TradingView data, BNB's price reached a new ATH of $827.25 on Sunday, July 27. According to the BeInCrypto Price Index, BNB is showing the largest increase among the top 20 cryptocurrencies. Currently, BNB is trading at $822.05, showing a slight correction.

BNB's price broke through a two-year resistance level during the weekend and maintained strength above it, entering an expansion phase.

Analysts attribute the surge to increased BNB Chain network activity and corporate interest in BNB Treasury. BeInCrypto reported two cases including WindTree Therapeutics and Nano Labs, with more companies likely to join this trend.

"BNB Chain network activity is increasing, and Binance remains the top exchange. Companies are purchasing BNB for treasury. This demand will push BNB to over $1,000 by Q4 and up to $1,800-2,000 at the cycle peak." – wrote one analyst.

Binance founder and former CEO Changpeng Zhao (CZ) recently praised the community and ecosystem support for the network.

Build and Build. $BNB

— CZ 🔶 BNB (@cz_binance) July 23, 2025

Appreciations to all the ecosystem players, BTC maxis, ETH holders, meme traders, ETF applicants, treasury pub cos, good regulators, and utility builders. 🙏 pic.twitter.com/5YreSKU7xQ

BNB is now the fourth largest altcoin excluding stablecoins, with a market capitalization of $114.61 billion.

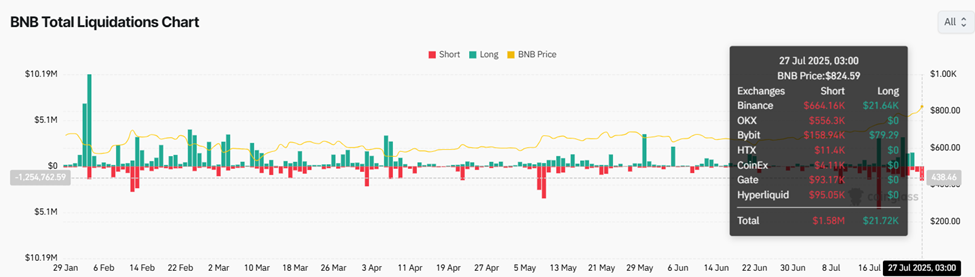

With BNB's new ATH, total cryptocurrency liquidations reached $178.04 million, with 77,874 traders liquidated in the past 24 hours according to Coinglass data. Notably, the largest single liquidation order occurred on the Bybit exchange.

Meanwhile, as BNB price reached a new ATH, $1.58 million in short positions were liquidated, while long positions were limited to $21,720.

BNB's ATH breakthrough is supported by strong market activity. The funding rate continues to turn positive, suggesting aggressive long positioning.

Open interest has exceeded $1.3 billion, indicating increasing trader confidence.

Meanwhile, daily trading volume has surpassed $5 billion, the highest level in months, confirming real momentum rather than speculative noise.