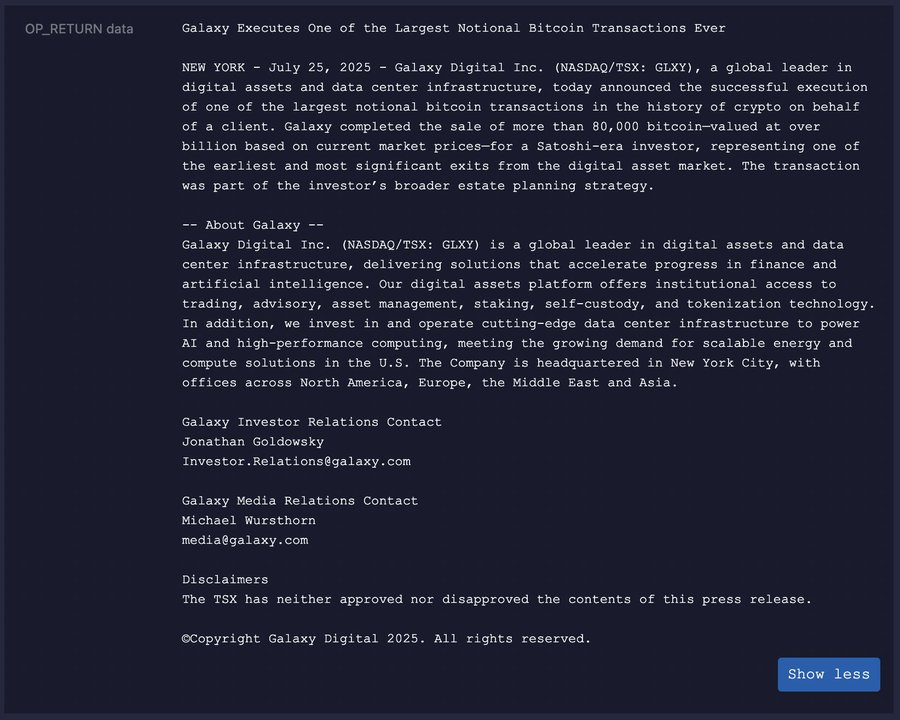

Galaxy Digital revealed that it sold over 80,000 Bitcoins on behalf of long-term investors. This represents a value of over $9 billion.

This transaction, disclosed on July 25th, is one of the largest in Bitcoin history.

Analysts Track Galaxy's $9 Billion BTC Sale…Early MyBitcoin Era Wallet

According to Galaxy, these Bitcoins belonged to an anonymous customer acquired during Bitcoin's early days and had been held for over 10 years.

The company described this move as part of the customer's estate planning, implying a strategic decision to realize profits after a long holding period.

Specifically, Galaxy announced the transaction on-chain by using the op_return field to insert a message into the transaction metadata.

The transaction sent 1 satoshi, the smallest unit of Bitcoin, to each receiving address. This symbolic act caught the attention of blockchain analysts.

"If there's no press release on-chain, did it really happen? This transaction is funded from a Galaxy Digital address with 80,000 satoshis and pays 1 satoshi of dust to each address related to the 80,000 BTC sale." – Anonymous Bitcoin analyst Mononaunt stated.

After the disclosure, blockchain investigators traced the coins to addresses linked to MyBitcoin, one of the early Bitcoin wallet services. This platform closed down in 2011 after a notorious hack, with many coins remaining unrecovered.

Crypto Quant CEO Ki Young Ju noted that the wallet had been inactive since April 2011, sparking speculation about the seller's identity.

"Most likely belonging to a hacker or Tom Williams, the anonymous founder. Galaxy Digital might have bought the Bitcoins from them, but it's unclear if they conducted forensics." – He added.

Meanwhile, market analysts questioned the strategy of selling such a large amount at once.

Bloomberg's Eric Balchunas suggested that the Bitcoin sale likely caused significant slippage. He added that the urgency of the move raises important questions about the seller's motives.

"Did they lose so much trust that they want to pull out so much money so quickly? It's strange and even worrying if they don't have plans to buy the LA Lakers with cash." – Balchunas questioned.

However, Eliezer Ndinga from 21Shares suggested that if Galaxy mediated the transaction, they likely went through strict Know Your Customer (KYC) procedures, reducing the likelihood of an unidentified malicious actor.

"Looks like hacker-like behavior, but if processed by Galaxy, I assume they went through strict KYC procedures to allow the transaction to proceed." – Ndinga said.

Other market observers praised Bitcoin's quick recovery after the sale. They noted that the rebound reflects maturity as an independent asset class.

At the time of reporting, BTC was trading above $117,000, a remarkable turnaround from dropping below $115,000 during the sale.