The 'Kimchi Premium' in the cryptocurrency market, which gauges investment sentiment, has turned negative, sending a new signal to the market. Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), and Solana (SOL) are all trading at prices lower than global rates on domestic exchanges, an unusual phenomenon.

Kimchi Premium Reversal, Change in Investor Sentiment

Recently, Bitcoin recorded a -0.52%, Ethereum a -0.53%, Ripple a -0.42%, and Solana a -0.57% negative premium. This is a phenomenon occurring for the first time in months, indicating that Korean investors' overall buying sentiment has weakened compared to the global market. Particularly, Solana showing the largest negative premium suggests a more cautious approach to altcoins.

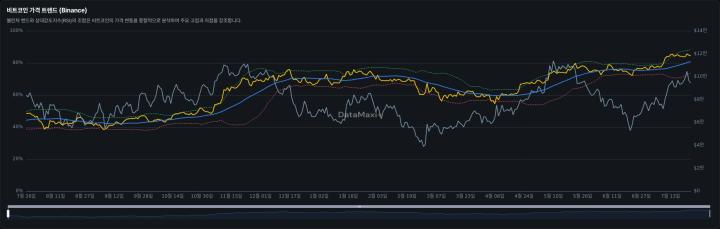

BTC, ETH, XRP, SOL Price Trends

Bitcoin is currently trading around 160 million won, showing a slight adjustment of -0.06% in the last 24 hours. Bitcoin, which had been maintaining strength during the week, is transitioning to weakness ahead of the weekend, increasing selling pressure.

Ethereum is maintaining an upward trend of 0.75% at around 5.13 million won. Despite recent upward momentum, the domestic premium recording negative values raises concerns about investment sentiment.

Ripple is trading at 4,313 won, showing a -0.82% decline. While continuing to show weakness on global charts, investment avoidance is also detected domestically.

Solana is currently trading around 256,000 won, showing a -0.57% premium reversal. This indicates that domestic investors are taking a more conservative approach to altcoins like Solana.

Preparing for Weekend Volatility

Experts analyze that the negative conversion of the Kimchi Premium is strongly associated with psychological changes in the Korean market. With the possibility of increased volatility ahead of the weekend, investor caution is required.

While uncertainty may expand in the short term, it could be a process of price readjustment with the global market in the medium to long term. There is also a possibility that trends will change depending on regulatory changes and global market trends.

Real-time news...Go to Token Post Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>