Welcome to the US Cryptocurrency Morning Briefing. We'll briefly summarize today's key cryptocurrency developments.

Prepare a cup of coffee. Famous author Robert Kiyosaki says to think twice before believing paper promises.

Today's Cryptocurrency News: Robert Kiyosaki Says ETFs Are Paper Guns... Hold Physical Assets

While most investors seek convenience, the author of 'Rich Dad Poor Dad' urges caution about the rising popularity of ETFs (Exchange-Traded Funds).

His recent message blurs the lines between financial knowledge and survivalist thinking, suggesting that pictures won't protect you during a crisis.

"Be careful with paper. I know ETFs make investing easier for the average investor. So I recommend ETFs to the average investor. But I give a word of caution. ETFs are like pictures of guns for personal defense. Sometimes it's best to have actual gold, silver, Bitcoin, and guns," Kiyosaki explained in his post.

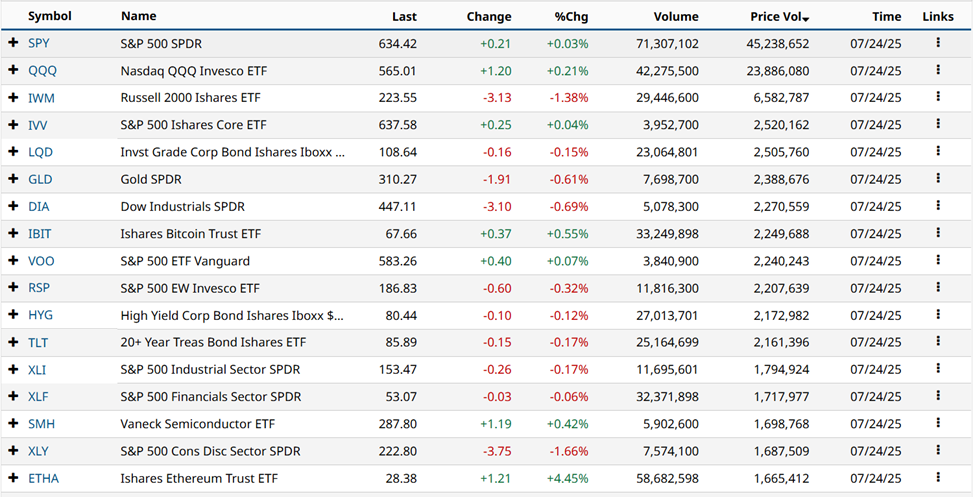

Specifically, Bitcoin ETFs provide investors an opportunity to indirectly expose themselves to BTC through regulated means. Ethereum ETF plays the same role for Ether (ETH). The regulated means factor attracts institutional investors.

These financial products are traded on traditional stock exchanges, thus regulated, providing protections like supervision, auditing, and investor disclosure.

Additionally, ETFs can be held in IRAs and retirement accounts, enabling exposure to Bitcoin and Ethereum in tax-advantaged portfolios.

However, the renowned author and investor Kiyosaki says such convenience is insufficient, adding that ETFs should not be substitutes for actually holding physical assets like gold, silver, and Bitcoin.

Despite his criticism, Kiyosaki acknowledges ETFs might be a good choice for average investors.

"I recommend gold ETFs, silver ETFs, Bitcoin ETFs for average investors. But know the difference between when to have the real thing and when to have paper. If you know the difference and how to use them, you're above average," he said.

This isn't the first time Robert Kiyosaki has advocated for Bitcoin, silver, and gold. BeInCrypto recently reported in US cryptocurrency news that the investor advocated for gold, silver, and Bitcoin, calling fiat currency 'fake money' amid economic collapse warnings.

"For years, I've recommended buying gold, silver, Bitcoin. Don't be a loser who says 'should have, could have, would have.' Owning gold, silver, Bitcoin is better than being a loser saving fake money," Kiyosaki wrote.

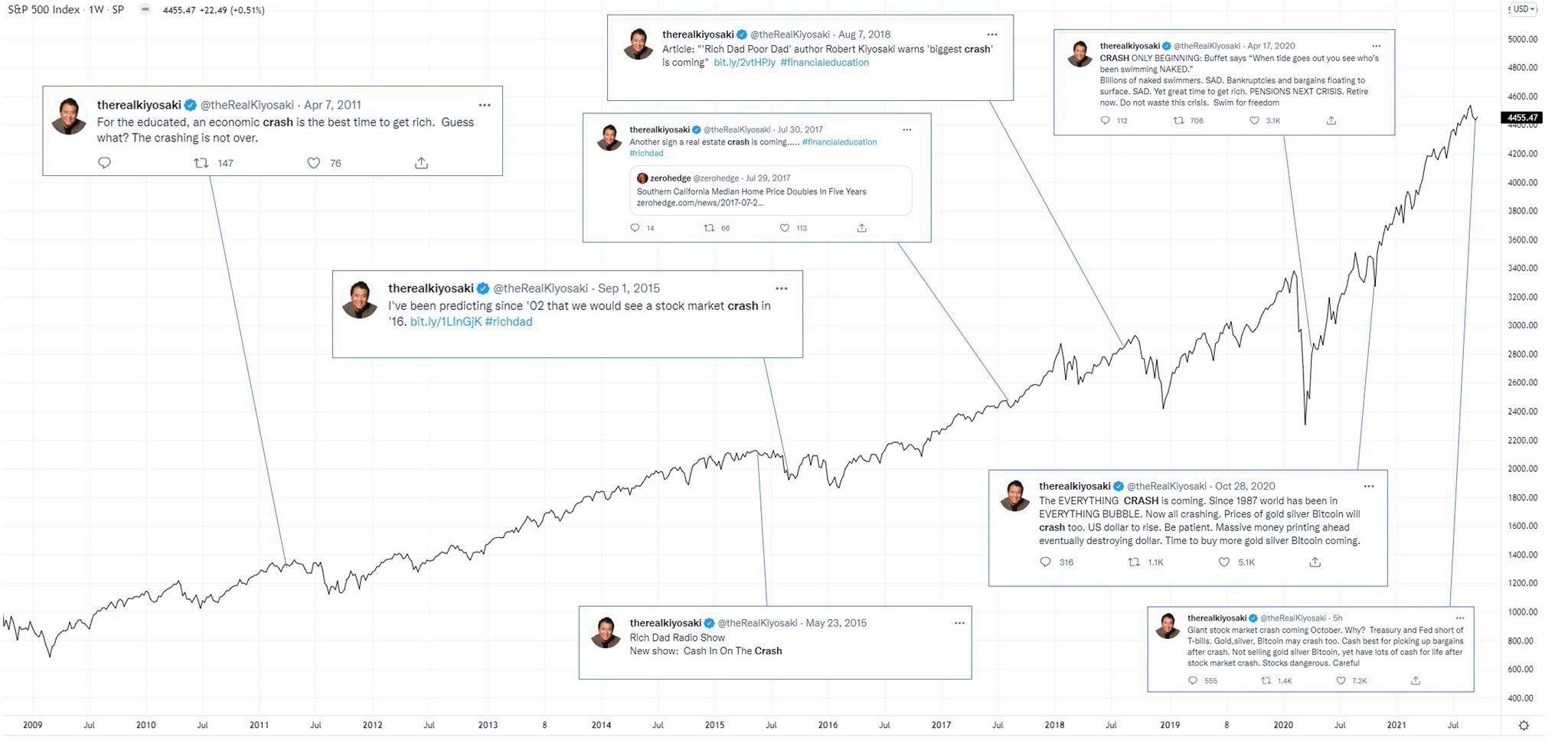

Kiyosaki's advocacy for these financial products comes amid expectations of a stock market collapse. In early June, US cryptocurrency news reported that Kiyosaki claimed stocks, bonds, and real estate markets would collapse.

He said this would hit traditional investors, especially Baby Boomers, hard. However, caution accompanies Kiyosaki's predictions. While he accurately predicted the 2008 collapse, most of his subsequent predictions have not materialized.

Gold, Bitcoin, Silver... ETF Demand Surges

Meanwhile, during a year marked by economic uncertainty and geopolitical tensions, gold and Bitcoin rose 28% in 2025, suggesting an unusual alignment indicating deep investor demand for alternative assets.

ETFs have become the primary means to gain exposure to these products, offering convenience, liquidity, and regulatory safety without direct custody.

ETFs now command over $170 billion in assets, with Bitcoin ETFs recording historic inflows from institutional and individual investors in just about 1.5 years. Analysts say BlackRock's IBIT ETF could reach $10 billion this month.

Meanwhile, silver has quietly outperformed them all. With ETFs like UTI Silver ETF recording over 32% returns, silver has increased its appeal as a safe asset amid physical supply shortages, increasing industrial demand, and global trade tensions.

Ethereum ETFs are now leveraging Bitcoin's success to join the momentum, deepening the role of tokenized products in mainstream portfolios. For investors seeking investments beyond stocks and bonds, 2025 will be a breakthrough for asset-based ETFs.

"Despite recent market declines and short-term volatility, ETH continues to attract strong institutional demand, even during a period when Bitcoin ETFs recorded over $280 million in outflows for three consecutive days. This week alone, ETH ETFs recorded over $1.3 billion in inflows, and over $4.3 billion this month," Ray Youssef, CEO of NoOnes, stated to BeInCrypto.

Corporate treasuries and institutional wallets are also continuously accumulating Ether, as mentioned in previous US cryptocurrency news.

They have purchased over $3 billion in Ether in 2025 alone. Some companies have set goals to secure 5% of Ether's circulating supply.

Appreciate this @cosmo_jiang 😍😍😍

— Thomas (Tom) Lee (not drummer) FSInsight.com (@fundstrat) July 24, 2025

Pantera has been a great partner @PanteraCapital

Bitmine $BMNR is committed to rapidly growing ETH value per share

And the stated goal is eventually 5% of ETH https://t.co/IbCHfQxikU

| Company | Closing on July 24 | Pre-Market Overview |

| MicroStrategy (MSTR) | $414.92 | $403.00 (-2.87%) |

| Coinbase Global (COIN) | $396.70 | $388.78 (-2.00%) |

| Galaxy Digital Holdings (GLXY) | $31.89 | $30.55 (-4.20%) |

| Marathon Holdings (MARA) | $17.26 | $16.67 (-3.48%) |

| Riot Platform (RIOT) | $14.69 | $14.30 (-2.65%) |

| Core Scientific (CORZ) | $13.69 | $13.59 (-0.73%) |